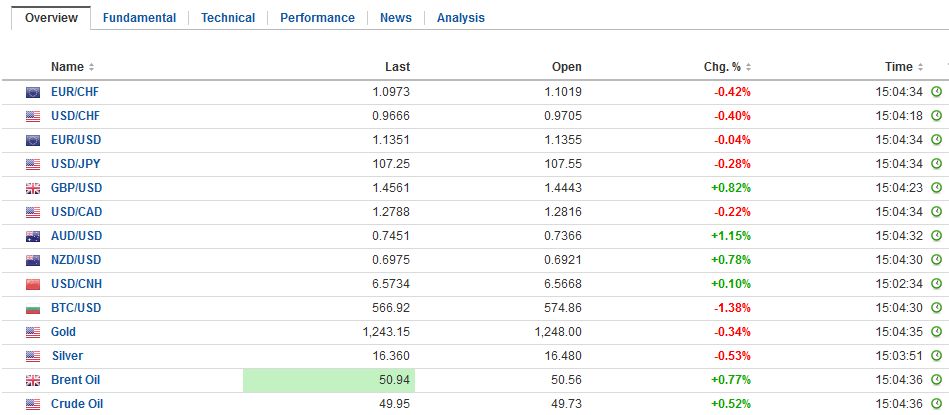

Swiss Franc Once again both EUR and USD broke down against the franc. The adverse effect of the Friday US jobs reports is visible again.Moreover, CHF appreciated with the Asian block, with AUD and NZD and with the oil price. Swiss sales are pretty high to Asian countries. We also know that rising oil prices usually lead to a stronger CHF. Japan The Japanese yen is the major currency not to be gaining against the US dollar. Emerging market currencies, save the Chinese yuan, are also advancing against the greenback today. The yen rose 3.5% against the dollar last week, and rising equities and commodities are weighing on the yen. The dollar rose to almost JPY108 in Asian trading is consolidating in the European morning. The JPY108.30 area is the first retracement objective, which is a little above the five-day moving average (~JPY108.05). USD/JPY – click to enlarge. Asian equities gained today, with the Thai market only exception. The MSCI Asia Pacific Index gained 1% and extended its advancing streak to a third session. It has risen in eight of the last 10 sessions. European shares are also advancing, with the Dow Jones Stoxx up 1.25%, after gapping higher at the open.

Topics:

Marc Chandler considers the following as important: AUD, Barack Obama, Donald Trump, Featured, FX Daily, FX Trends, GBP, Hillary Clinton, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancOnce again both EUR and USD broke down against the franc. The adverse effect of the Friday US jobs reports is visible again. |

|

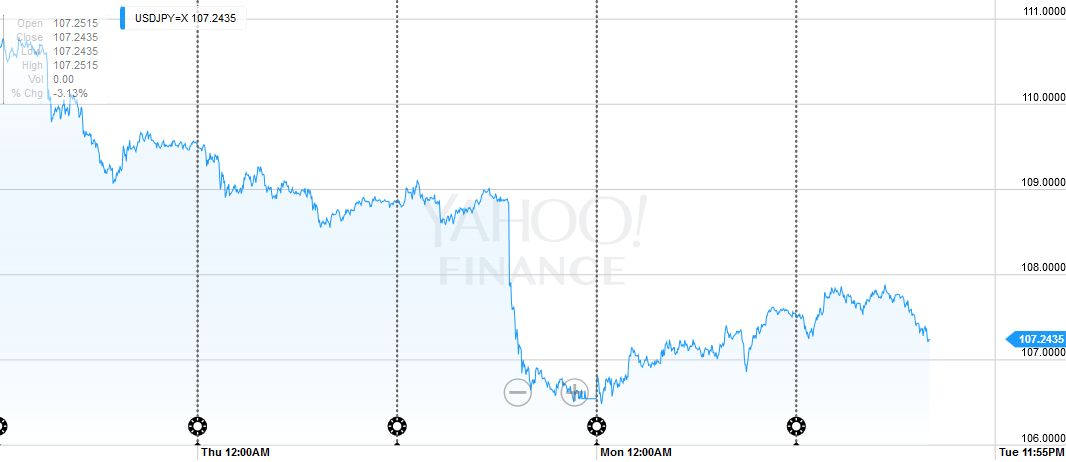

JapanThe Japanese yen is the major currency not to be gaining against the US dollar. Emerging market currencies, save the Chinese yuan, are also advancing against the greenback today.

The yen rose 3.5% against the dollar last week, and rising equities and commodities are weighing on the yen. The dollar rose to almost JPY108 in Asian trading is consolidating in the European morning. The JPY108.30 area is the first retracement objective, which is a little above the five-day moving average (~JPY108.05).

|

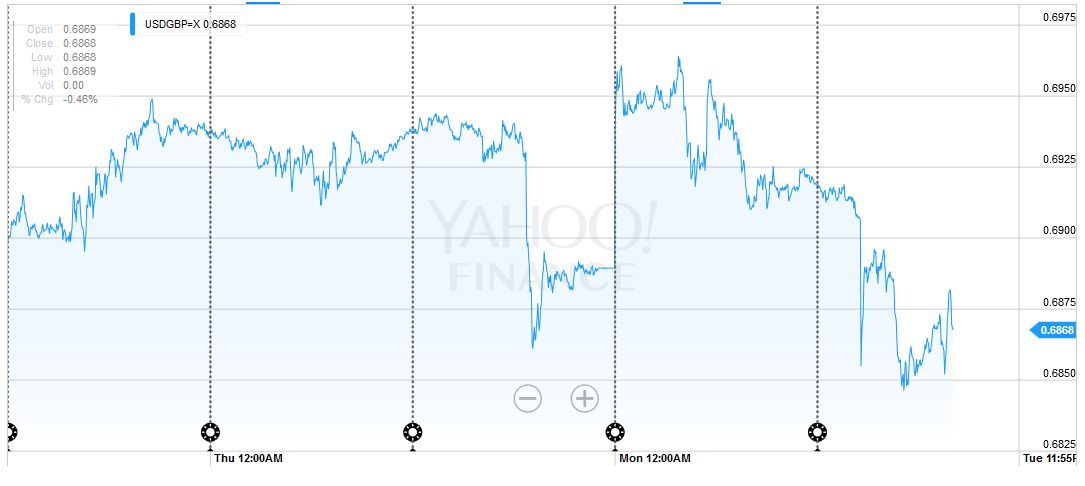

United KingdomThe third development today is sterling’s strength. Sterling inexplicably shot up almost two cents in a matter of minutes in Asia (~$1.4475 to $1.4660). It quickly came off amid talk of a trading error. However, on the push back, it found support near $1.4500 and managed to trade back above $1.4600 in the European morning. One-month implied volatility is making new highs today above 22% (it was near 16.6% on May 27) and the put-call skew is at a new record extreme (~6.9%). UK stocks are underperforming, but the FTSE is the best performingG7 equity market over the past week. UK gilts are also underperforming, with 10-year yields three bp higher near 1.30%, while most eurozone benchmark yields are lower.

|

|

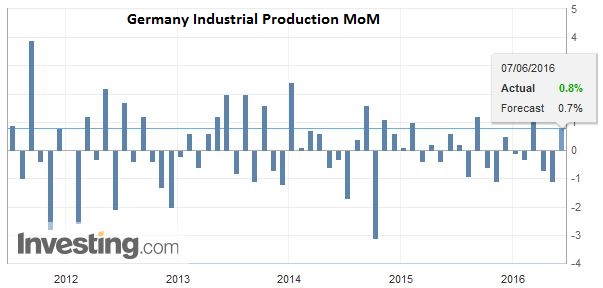

Euro zoneFourth, yesterday’s unexpectedly poor German factory orders (-2.0% vs. expectations for a 0.5% fall) left investors ill-prepared for the stronger than expected industrial production report today. The 0.8% gain follows a revised 1.1% decline in March (initially -1.3%) and February (-0.7%). Going back to through the second quarter last year, German industrial output has risen only one month every quarter. The weak orders data warn that although output began Q2 on a firm note, there may not be much follow-through.

|

Economic Events June 07, 2016 |

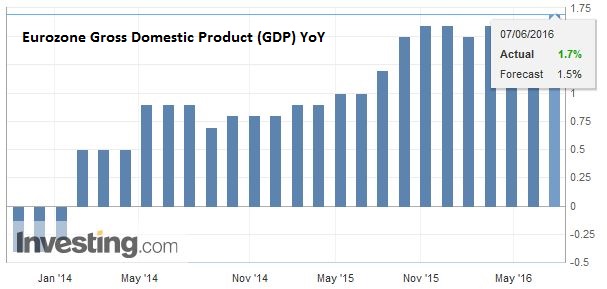

| If, as we have argued, the euro is correcting the slide from May 3 (~$1.1615) to May 30 (~$1.11), then at its current level (~$1.1370) is has retraced 50% of the move. The next retracement is found near $1.1420. |

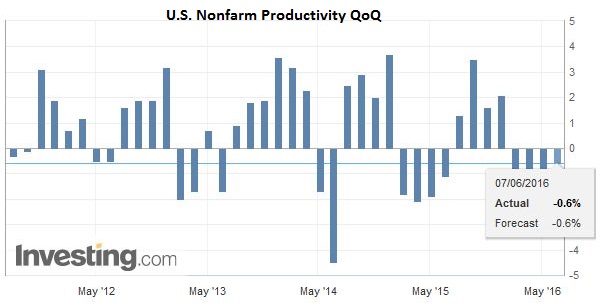

United StatesThe US economic data today is not the kind that moves the markets. Non-farm productivity is likely to be revised up following the upward revision to Q1 growth. However, it will likely remain negative, and the weak productivity growth remains an important economic puzzle. Unit labor costs may edge lower from the 4.1% initial estimate. Consumer credit is due out late in the session. After a record level (~$29.7 bln ) in March, a return to trend (six-month average is ~$18.4 bln) is expected. Canada reports the IVEY PMI. A softer number from April’s 53.1 reading is anticipated. The US dollar is approaching the CAD1.2740 area, which is the retracement of May’s run-up.

|

|

| Unit labor costs may edge lower from the 4.1% initial estimate. Consumer credit is due out late in the session. After a record level (~$29.7 bln ) in March, a return to trend (six-month average is ~$18.4 bln) is expected. Canada reports the IVEY PMI. A softer number from April’s 53.1 reading is anticipated. The US dollar is approaching the CAD1.2740 area, which is the retracement of May’s run-up. |

Graphs and additional information on Swiss Franc by the snbchf team