The Omicron variant may be less fatal than the earlier versions, but it is disrupting economies. The surge in the Delta variant well into Q4 in the US and Europe was already slowing the recoveries. Investors will likely take the high-frequency real sector data with the proverbial pinch of salt until January data available beginning later this month. While the tribalist approach, exemplified by “team transition” and “team permanent” debates about inflation, the recovery is precarious. Last week’s data confirmed that the aggregate composite PMI in the eurozone fell in December for the fourth time in five months. At 53.3, it finished the year at its lowest level since March. The average in Q4 22 was 54.3, down from 58.5 in Q3 and 56.8 in Q2. The US composite PMI

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, EU, Featured, Federal Reserve, inflation, newsletter, PBOC, Russia, Ukraine

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Omicron variant may be less fatal than the earlier versions, but it is disrupting economies. The surge in the Delta variant well into Q4 in the US and Europe was already slowing the recoveries. Investors will likely take the high-frequency real sector data with the proverbial pinch of salt until January data available beginning later this month.

While the tribalist approach, exemplified by “team transition” and “team permanent” debates about inflation, the recovery is precarious. Last week’s data confirmed that the aggregate composite PMI in the eurozone fell in December for the fourth time in five months. At 53.3, it finished the year at its lowest level since March. The average in Q4 22 was 54.3, down from 58.5 in Q3 and 56.8 in Q2.

The US composite PMI peaked in May at 68.7. It has been trending lower since, and in the last seven months of 2021, it rose once (October). It finished the year at 57.0. It averaged 57.3 in Q4, up slightly from 56.8 in Q3, though down from the Q2 average of 65.3. The US economy lost some momentum as the quarter progressed and the risk may be on the downside in retail sales and industrial production reports due on January 14. Although subject to statistically significant revisions, Q4 non-farm payroll growth slowed to 365k, almost half (43%) of the Q3 average.

Retail sales may have stagnated or worse in December after averaging 1% gains over the previous four months. We learned last week that December auto sales disappointed. They were expected to have increased by nearly 2% (seasonally adjusted annual rate) but instead fell by nearly 3.5% to end the year with back-to-back monthly declines.

The components of retail sales that are used in many GDP models exclude the sales of autos, gas stations, building materials, and food services. It fell by 0.1% in November, after rising an average of 1.6% in the previous three months. Despite the Santa Claus rally in US stocks in the days before Christmas, maybe Scrooge stole Xmas after all.

Industrial production may have also downshifted. Recall that output fell by almost 1.2% in August and September before bouncing back by nearly 1.7% in October. It rose by 0.5% in November, helped by a 0.7% rise in manufacturing output. The rig count increased by 48 in Oct-Nov after increasing by 36k in the previous two months. The anecdotal easing of some supply chain disruptions may have hit fresh ones. China’s zero-Covid strategy has led to dramatic lockdowns, which may adversely impact supply chains and new price pressures.

Of note, the number of people on the non-farm payrolls, is still more than three million fewer than at the end of 2019. At the current pace, it will take the first half to reach it. On the other hand, the industrial capacity utilization rate has surpassed the 76.6 average of Q4 2019 in November. The median forecast (Bloomberg survey) is for the utilization rate to rise above 77%. Also note that the manufacturing inventory rebuilding is well underway and is likely to no longer be the significant tail wind it has been. The six-month average through October was the strongest in a decade.

Of the slate of US economic reports, the December CPI is the most impactful for market psychology and business sentiment. It has peaked yet. Economists (Bloomberg survey) look for a 0.4% rise in the headline and a 0.5% rise in the core measure. Given the base effect, the year-over-year pace may increase from 6.8% to 7.0%. In December 2020, the core rate was unchanged, and the zero drops out of the 12-month comparison, it may accelerate to 5.4% from 4.9%. Separately, the producer price inflation also likely accelerated closer to 10% (9.6% in November).

The new inflation prints will need to be understood in the context of two considerations. First, the market has already nearly priced in 75 bp in hikes this year, which matches the median view of Fed officials (voting and non-voting members). There are several moving pieces here.

The apparent hawkishness of the December FOMC minutes encouraged the market to boost the changes of a March hike. It has risen from about a 66% chance at the end of last year to over 80%. Expectations can shift in favor of a fourth hike this year, one a quarter. At the end of 2022, the market, following the Fed’s dot plot, priced in nearly three hikes this year. However, after the FOMC minutes, the market priced in better than a 1-in-3 chance of a fourth hike. Shifting views on the timing of the roll-off, when the Fed allows the balance sheet to shrink by slowing the recycling of maturing issues, are more difficult to quantify, but there is talk that it may begin around midyear.

The second consideration is that the amplitude of inflation says very little about its duration. Economists expect price pressures to gradually ease this year. The Blomberg survey found a median expectation for CPI to moderate over the next five quarters, finishing this year at 2.8% and 2.5% at the end of Q1 23. The projection for the PCE deflator, which the Fed targets, follows a similar pattern falling to 2.5% at the end of the year and 2.4% at the end of Q1 23.

This is very much in line with the Fed’s Summary of Economic Projections, which the median PCE deflator forecast is 2.6% at the end of this year and 2.3% at the end of 2023. For the record, IMF is less sanguine. It sees US CPI at 3.5% at the end of 2022 and at 2.7% at the end of next year. The OECD forecasts the PCE deflator at 4.4% at the end of this year and 2.5% at the end 2023.

The Fed’s Beige Book headline at midweek may draw some attention. Few appear to really read the largely anecdotal survey, but in light of the uncertainty surrounding the economic impact of the Omicron variant, it may attract more interest. Yet, Powell and Brainard’s confirmation hearings scrutinized for insight into how the Fed is thinking about its balance sheet.

The Bank of England indicated that it would stop recycling maturing proceeds when the base rate reaches 50 bp, which could be as early as February. The Federal Reserve has been more or less transparent on the topic, but it is moving higher on the talking points in the market. Some economists see the Fed allowing the run-off to begin in the second half or after two rate hikes have been delivered.

China reports its December CPI and PPI early on January 12 in Beijing. Even though the US CPI is driven primarily by energy, housing, medical care, and recently used cars, some observers have tried linking American inflation to China often via the PPI. China’s PPI appears to have peaked in October and is expected to have eased for the second consecutive month in December.

China’s CPI jumped in October (0.7%) and November (0.4%). This lifted the headline rate to 2.3% year-over-year in November, the highest since August 2020. However, the base effect, the soft demand spurred by the rolling lockdowns, may see China’s CPI soften in December and into early readings this year. In December 2020, China’s monthly CPI rose by 0.7%, after falling in previous two months. It rose 1% in January 2021 and 0.6% in February before falling again in the March through June period last year.

After cutting required reserve ratios and shaving the one-year loan prime rate (to 3.8% from 3.85%, the PBOC is understood to have an easing bias and the moderating price pressures. This is also consistent with other signals from Chinese officials of supportive policy. The first move this year could take place before the end of the month ahead of the week-long Lunar New Year celebration (year of the tiger), which starts January 31. Another 50 bp cut in required reserve ratio seems like the most likely step, but the PBOC may also cut the one -year medium lending facility rate, which has stood at 2.95% since April 2020.

Lastly, we turn to geopolitics. There are a series of meetings set to ostensibly diffuse the situation in Eastern Europe. Unfortunately, we are not particularly optimistic, and suspect these meetings are important formalities. This is to say that Russia’s demands cannot be met. Putin seeks to be given back the sphere of influence that the Soviet Union had. It is difficult to imagine NATO freezing its membership on command. It has made gestures to Ukraine and Georgia, but has not been anxious to follow-through, but there are also scenarios under which Sweden and Finland would join. Moreover, Putin’s demand that the US have nuclear weapon bases abroad cut to the heart of the US commitment to NATO.

The US and European response will likely be trying to asphyxiate Russia financially, but they are unlikely to raise the cost of an invasion to prohibitive levels. Any suffering will be blamed on the West. The moves could range from banning trading and investing in Russian government bonds, ejecting it from SWIFT, to sanctioning the large state-owned banks, restricting imports of Russian goods/commodities, and (finally) canceling the all-ready build Nord-Stream 2 pipeline.

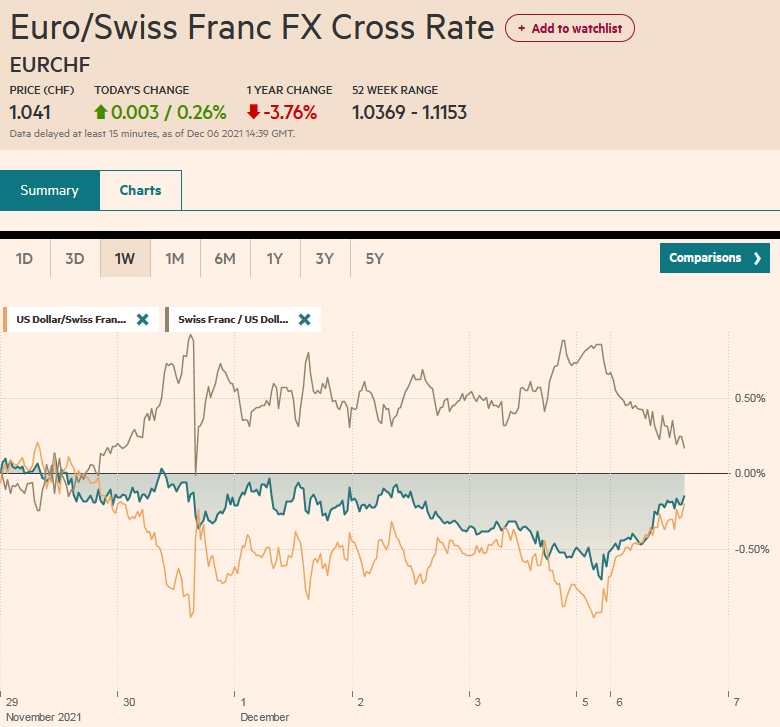

In the fog of war, the euro would likely come under pressure, and we suspect the Swiss franc, which is already trading near its best levels against the euro since 2015, would appreciate further. The post-crash (when SNB removed the floor of the cross) low made a was near CHF1.0235 and a break of it would threat parity. It could elicit a response by the Swiss National Bank. Similarly, the euro hovering at its lowest level against sterling since March 2020, confirming the break of GBP0.8400. The next important chart area is around GBP0.8275. That said, in the futures market, speculators are more short sterling than the Swiss franc, and they have a larger short franc than euro position.

Energy prices would likely spike. Europe still gets around two-thirds of natural gas from Russia. The Ukraine pipeline would likely be an early casualty. US and some Asian cargoes were diverted to Europe late last month. Several more US ships are reportedly headed toward Europe now, but Asian demand has picked up recently. Risk may come off more broadly, until Russia’s intentions are clear. Some strategists suspect Putin will be content with the eastern part of the country, while intimidating the western part. A war unleashes many unknowns, and its use of cyber warfare and other tactics will be closely watched. A Russian military action against Ukraine could also influence the elections in Europe, favoring nationalistic expressions.

Tags: EU,Featured,federal-reserve,inflation,newsletter,PBOC,Russia,Ukraine