Many observers misunderstood US President Trump’s “American First” rhetoric. Trump’s earlier writings show that this is not a reference to the 1940s effort to keep the US out of WWII, with its isolationist tint. Rather, Trump’s use goes back to the original use by President Harding in the 1920s. It was a rejection of the Wilsonian multilateralism (e.g. League of Nations) and a robust defense of unilateralism. That...

Read More »FX Weekly Review, April 10-14: Swiss Franc loses against the Yen, but wins against Dollar

Swiss Franc Currency Index Last week the Swiss Franc improved against both euro and dollar, but – compared to its safe-haven counterpart Japanese Yen – it had a bad performance. We expect strong SNB interventions, that reflect the demand for CHF safe-haven. Trade-weighted index Swiss Franc, April 14(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3...

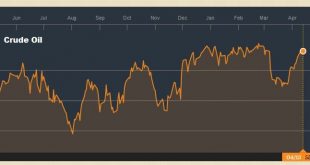

Read More »Decoupling of Oil and US Interest Rates

Summary: US yields have trended lower as oil prices have trended higher. The correlation between the 10-year breakeven and oil has also weakened considerably. Technicals readings are getting stretched, but no compelling sign of a top. Rising oil prices traditionally boost inflation expectations and US interest rates. The May futures contract for light sweet crude oil is up today for the sixth consecutive...

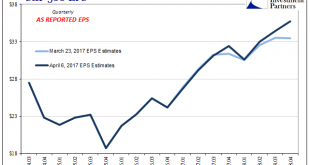

Read More »Earnings per Share: Is It Other Than Madness?

As earnings season begins for Q1 2017 reports, there isn’t much change in analysts’ estimates for S&P 500 companies for that quarter. The latest figures from S&P shows expected earnings (as reported) of $26.70 in Q1, as compared to $26.87 two weeks ago. That is down only $1 from October, which is actually pretty steady particularly when compared to Q4 2016 estimates that over the same time plummeted from $29.04...

Read More »Perth Mint Silver Bullion Sales Rise 43 percent In March

– Perth Mint’s silver bullion sales rise 43% in March.– Perth Mint’s monthly gold coin, bars sales fall 12%.– Gold silver ratio of 32 – 32 times more silver ounces sold.– Gold: 22,232 oz and Silver: 716,283 oz – bullion coins and minted bars sold. – Gold is 2.6% higher and silver surged 3.1% in the shortened week with markets closed for Good Friday tomorrow. Australian Kangaroo 2017, 1 oz 9999 Silver The Perth Mint’s...

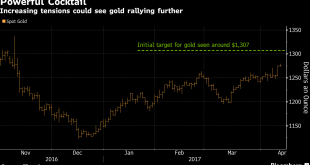

Read More »Gold Price Surges Above Key 200 Day Moving Average $1270 Level

– Gold price breaks above key 200-day moving average– Gold hits 5-month high on back of investor nervousness– Safe haven has 10% gains in 2017 after 9% gains in 2016– Gold options signal more gains as ETF buying increases– Geopolitical uncertainty over North Korea & Middle East– Tensions high -World awaits US move & Russia response– Russia says chemical attack was terrorist “false flag”– Poor March jobs report...

Read More »Gold Price Surges Above Key 200 Day Moving Average $1270 Level

– Gold price breaks above key 200-day moving average– Gold hits 5-month high on back of investor nervousness– Safe haven has 10% gains in 2017 after 9% gains in 2016– Gold options signal more gains as ETF buying increases– Geopolitical uncertainty over North Korea & Middle East– Tensions high -World awaits US move & Russia response– Russia says chemical attack was terrorist “false flag”– Poor March jobs report...

Read More »Euro’s Record Losing Streak Against the Yen

Summary: The euro has fallen for 11 consecutive sessions against the yen. Interest rates, US and German in particular, seem to be the main driver. Technicals are stretched, but have not signaled a reversal yet. Looking for a trend in the foreign exchange market? The euro is weaker against the yen for the 11th consecutive session today, which is the longest streak in the euro’s natural life. Since March 17, the...

Read More »Cool Video: Making Sense of the New Administration

Marc Chandler In Bloomberg I was on Bloomberg TV earlier today, chatting with David Gura about how to try to make sense of new Trump Administration. I suggest that the decision-making style and practical concerns have created two wing to the Administration. There is a populist-nationalist wing that is home to America First ideas. The other wing is much more rooted in American political tradition. Many things, for...

Read More »Cool Video: Making Sense of the New Administration

Marc Chandler In Bloomberg I was on Bloomberg TV earlier today, chatting with David Gura about how to try to make sense of new Trump Administration. I suggest that the decision-making style and practical concerns have created two wing to the Administration. There is a populist-nationalist wing that is home to America First ideas. The other wing is much more rooted in American political tradition. Many things, for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org