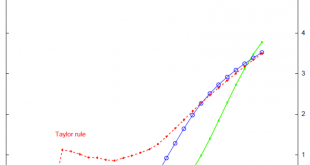

In June 2012, Janet Yellen, then the Vice Chairman of the Federal Reserve, addressed an audience in Boston with what for the time seemed like a radical departure. It was the latest in a string of them, for conditions throughout the “recovery” period never did quite seem to hit the recovery stride. Because of that, there was constant stream of trial balloons suggesting how the Federal Reserve might try to overcome this...

Read More »Swiss federal tribunal refuses to help French tax authorities

© Steeve Baillon – Dreamstime.com Tribune de Genève. The French tax authorities will not get Swiss help to investigate tax payers identified in data taken by Hervé Falciani from HSBC private bank in Geneva. HSBC, owner of the private bank in Geneva, which became part of HSBC in 1999 when it was acquired from Republic National Bank, a group run by Lebanese-born financier Edmond Safra, described the data taken from the...

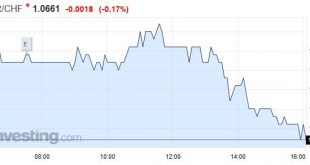

Read More »FX Daily, April 14: Holiday Markets Remain on Edge

Swiss Franc EUR/CHF - Euro Swiss Franc, April 14(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge FX Rates The holiday-induced calm in the capital markets conceals a high degree of anxiety. The investment climate has been challenged by heightened geopolitical risk and unusual complaints about the US dollar’s strength from the sitting US President. While sending an “armada” toward the Korean...

Read More »Bank of England Rigging LIBOR – Gold Market Too?

– Bank of England implicated in LIBOR scandal by BBC – “We’ve had some very serious pressure from the UK government and the Bank of England about pushing our Libors lower.” – “This goes much much higher than me” -UBS’ Tom Hayes – Libor distraction as all markets are manipulated today – Central bank’s “rigging” bond markets and likely gold – Risks of bank ‘holidays’, capital controls and of course bail-ins remains Bank...

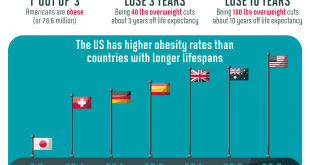

Read More »Life Expectancy Indicates A Nation’s Overall Well Being – So Why Is America’s Dropping?

‘Exceptional’ America is seriously lagging behind in global life expectancy… Via: MesoTreatmentCenters.org Some additional details… Life Expectancy Indicates a Country’s Overall Well Being—So Why Is Ours Dropping? The last time U.S. life expectancy declined at birth 1992-1993: 75.8 to 75.5 years Resulting from high death rates from AIDS, flu epidemic, homicide, and accidental deaths After years of life expectancy...

Read More »Life Expectancy Indicates A Nation’s Overall Well Being – So Why Is America’s Dropping?

‘Exceptional’ America is seriously lagging behind in global life expectancy… Via: MesoTreatmentCenters.org Some additional details… Life Expectancy Indicates a Country’s Overall Well Being—So Why Is Ours Dropping? The last time U.S. life expectancy declined at birth 1992-1993: 75.8 to 75.5 years Resulting from high death rates from AIDS, flu epidemic, homicide, and accidental deaths After years of life expectancy...

Read More »Trade Notes: China and Prospects for a New Executive Order

Summary: China’s trade concessions seem modest, but little discussion of US concessions. Reports suggest Trump is set to sign a new executive order to investigate trade practices in steel, aluminum, and maybe household appliances. Trade imbalances and floating currencies are not mutually exclusive. Last week’s meeting between the US and China’s Presidents did not produce much fireworks or headlines. The...

Read More »Millennials Are Abandoning the Postwar Engines of Growth: Suburbs and Autos

Where’s the growth going to come from as the dominant generation makes less, borrows less, spends less, saves more and turns away from long commutes, malls and suburban living and abandons the worship of private vehicles? If anything defined the postwar economy between 1946 and 1999, it was the exodus of the middle class from cities to suburbs and the glorification of what Jim Kunstler calls Happy Motoring: freeways,...

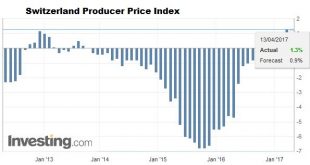

Read More »FX Daily, April 13: Greenback Stabilizes After Trump Induced Slide

Swiss Franc Switzerland Producer Price Index (PPI) YoY March 2017(see more posts on Switzerland Producer Price Index, ) Source: investing.com - Click to enlarge FX Rates The US dollar slid after US President Trump complained about its strength. The sell-off extended into early Asian activity, before stabilizing. It is mixed in late morning European turnover, which is already lightening up due to the extended...

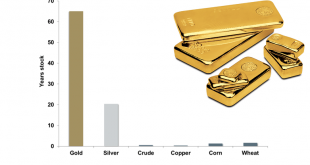

Read More »Gold – An Overview of Macroeconomic Price Drivers

Fundamental Analysis of Gold As we often point out in these pages, even though gold is currently not the generally used medium of exchange, its monetary characteristics continue to be the main basis for its valuation. Thus, analysis of the gold market requires a different approach from that employed in the analysis of industrial commodities (or more generally, goods that are primarily bought and sold for their use...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org