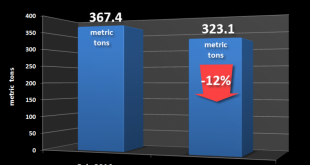

– Silver production sees “huge decline” in Peru – Production -12% in one month in 2nd largest producer – Silver decline is due to ‘exhaustion of reserves’ in Peru – GFMS recognise that ‘Peak Silver’ was reached in 2015 – Global silver market had large net supply deficit in 2016 – Silver rallied 13.5% in Q1 in 2017 – Base metal production accounts for 56% of silver mining – Base metal demand under threat from global...

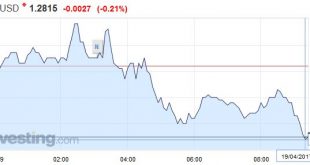

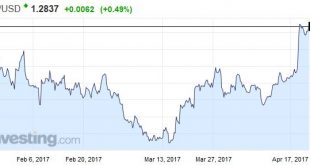

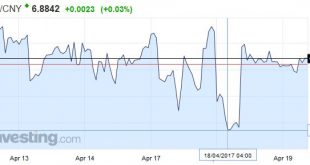

Read More »May’s Early Election Bid Sends Sterling on Roller Coaster

Summary: May calls snap election for June 8. Tories running 20 percent point lead over Labour. Next election would be in 2022, after the Brexit negotiations conclude. UK Prime Minister May surprised investors by calling for a snap election on June 8. The Tory Party is ahead of Labour by over 20 percentage points. It currently enjoys a 17-seat majority in the House of Commons. The early election would put the...

Read More »May’s Early Election Bid Sends Sterling on Roller Coaster

Summary: May calls snap election for June 8. Tories running 20 percent point lead over Labour. Next election would be in 2022, after the Brexit negotiations conclude. UK Prime Minister May surprised investors by calling for a snap election on June 8. The Tory Party is ahead of Labour by over 20 percentage points. It currently enjoys a 17-seat majority in the House of Commons. The early election would put the...

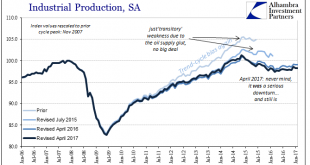

Read More »Now You Tell Us

As we move further into 2017, economic statistics will be subject to their annual benchmark revisions. High frequency data such as any accounts published on or about a single month is estimated using incomplete data. It’s just the nature of the process. Over time, more comprehensive survey results as well as upgrades to statistical processes make it necessary for these kinds of revisions. There is, obviously, great...

Read More »Fall in Swiss property prices accelerates

Over the year ending 31 March 2017, apartment prices across Switzerland dropped by 6.8%, according to a property price report published by the Zurich-based research and consulting firm Fahrländer Partner FPRE. Close to half of the decline (-3.2%) occurred in the first quarter of 2017.Across the year, the price of mid-range apartments fell most (-9.4%), followed by high-end ones (-6.3%) and smaller lower cost...

Read More »French Election – Bad Dream Intrusion

The “Nightmare Option” The French presidential election was temporarily relegated to the back-pages following the US strike on Syria, but a few days ago, the Economist Magazine returned to the topic, noting that a potential “nightmare option” has suddenly come into view. In recent months certainty had increased that once the election moved into its second round, it would be plain sailing for whichever establishment...

Read More »More Thinking about Trade as Pence and Ross Head to Tokyo

Summary: Pence and Ross may “feel out” Abe for interest in a bilateral trade agreement. The US enjoys a small trade surplus with countries it has free-trade agreements. Ownership-based framework of the current account and value-added trade suggest the US trade imbalance is not a significant problem. US Vice President Pence and Commerce Secretary Ross will go to Japan this week. In addition to regional...

Read More »The Left’s Descent to Fascism

The Left is morally and fiscally bankrupt, devoid of coherent solutions, and corrupted by its embrace of the Corporatocracy. History often surprises us with unexpected ironies. For the past century, the slide to fascism could be found on the Right (conservative, populist, nationalist political parties). But now it’s the Left that’s descending into fascism, and few seem to even notice this remarkable development. By Left...

Read More »Gold-Silver Divergence – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. A Force Like Gravity This was a holiday-shorted week, due to Good Friday, and we are posting this Monday evening due to today being a holiday in much of the world. Gold and silver went up the dollar went down, +$33 and +$0.53 -64mg gold and -.05g silver. The prices of the metals in dollar terms are readily available, and...

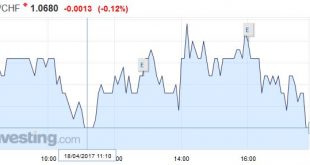

Read More »FX Daily, April 18: US Dollar Consolidates Yesterday’s Gains

Swiss Franc EUR/CHF - Euro Swiss Franc, April 18(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is consolidating the gains scored late in the US session yesterday in response to a Financial Times interview with US Treasury Secretary Mnuchin who seemed to play down the strategic importance of Trump’s recent complaint about the greenback’s strength. Mnuchin spun Trump’s comments to be...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org