Swiss Franc The Euro has fallen by 0.23% to 1.1944 CHF. EUR/CHF and USD/CHF, April 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge GBP/CHF The pound to Swiss Franc rate has traded in a fairly tight range this week as a lack of any new fresh information to drive financial markets so far. A major driver for the Franc has been risk-sentiment as investors attitudes to risk shape...

Read More »Great Graphic: Aussie Tests Trendline

It is not that the Australian dollar is the weakest currency this month. Its 0.4% decline puts it among the better performers against the US dollar. However, it has fallen to a new low for the year today. The losses have carried to a trendline drawn off of the early 2016 low near $0.6800. The trendline has been drawn on this Great Graphic composed on Bloomberg. It is found today near $0.7625 and rises by about seven...

Read More »Emerging Market Preview: Week Ahead

Stock Markets EM FX came under renewed pressure last week as US yields rose to new highs for the cycle. RUB and TRY were the top performers last week, while MXN and COP were the worst. There are no Fed speakers this week due to the embargo ahead of the May 2 FOMC meeting. While we see little chance of a hike then, markets are likely to remain nervous. Stock Markets Emerging Markets, April 18 - Click to enlarge...

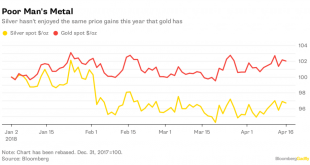

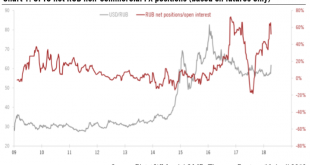

Read More »Silver Bullion Remains Good Value On Positive Supply And Demand Factors

– Silver bullion remains good value on positive supply and demand factors– Industrial demand set to continue to climb from 2017, into 2018 and beyond– Speculators are bearish on silver as net short positions in silver futures reach record– Investment demand sees silver ETF holdings at eight-month high of 665.4 million ozs– 2017 saw fifth consecutive annual physical deficit in scrap silver, of 26 moz– Global silver mine...

Read More »FX Daily, April 23: Rising Rates Help Extend Dollar Gains

Swiss Franc The Euro has fallen by 0.23% to 1.1944 CHF. EUR/CHF and USD/CHF, April 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The new week has begun much like last week ended, with rising rates helping to extend the dollar’s recent gains. The US 10-year yield is flirting with the 3.0% threshold. The two-year yield is firmer, and, like in the second half of last...

Read More »New All Time Record Highs For Gold In 2019

– New all time record highs for gold in 2019– ‘Powerful bull market’ will likely send gold to $5,000 to $10,000– If USD & Treasuries keep falling, stocks may decline at ‘moment’s notice’– Traditional portfolio of stocks and bonds will not protect investors– “Gold will replace bonds as the go-to hedge” by Brian Delaney of Secure Investments Gold is gaining momentum after a 5-year consolidation and is set to...

Read More »The future of cities

The digital revolution has launched a wave of innovation in the world’s cities, says MIT’s Carlo Ratti, providing opportunities to improve urban mobility and create better workspaces for the changing nature of work. These are exciting times for cities, according to Carlo Ratti, Director of MIT’s Senseable City Lab and co-founder of Carlo Ratti Associati architecture studio. Although they occupy just 2 per cent of the...

Read More »Russian rouble: significantly undervalued but quite risky

On 6 April, the Trump Administration announced additional and more severe sanctions against Russia “in response to the totality of the Russian government’s ongoing and increasingly brazen pattern of malign activity around the world”. US sanctions target seven Russian oligarchs, 12 companies controlled by them, and 17 high-ranking government officials. The measures freeze any US assets held by those targeted and cut them...

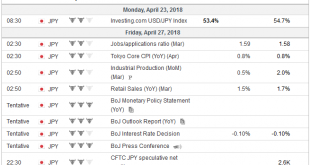

Read More »FX Weekly Preview: Markets and Macro

Worries about a trade war appear to have eased, at least for the moment, but that does not make investors worry-free. The concerns have shifted toward rising US interest rates, perhaps more than anything else, but general anxiety seems elevated. The unpredictableness of Trump Administration is not helpful, and even though oil prices recovered, they did react quickly, losing a dollar a barrel in response to his tweet....

Read More »Emerging Markets: What Changed

Summary The Reserve Bank of India is tilting more hawkish. Tensions on the Korean peninsula are easing. The Trump administration reversed course on Russia sanctions. Turkey is heading for early elections. Raul Castro stepped down as president of Cuba. Mexico polls show continued gains for Andres Manuel Lopez Obrador. Stock Markets In the EM equity space as measured by MSCI, Qatar (+4.8%), Russia (+3.3%), and Singapore...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org