Swiss Franc The Euro has fallen by 0.23% to 1.1944 CHF. EUR/CHF and USD/CHF, April 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The new week has begun much like last week ended, with rising rates helping to extend the dollar’s recent gains. The US 10-year yield is flirting with the 3.0% threshold. The two-year yield is firmer, and, like in the second half of last week, the US curve is becoming a little less flat. The market, as we had anticipated, was not so impressed with North Korea’s measures, and Korea’s Kospi edged lowed, and the region-leading KOSDAQ fell a little more than 1% (still up 10% year-to-date). Foreign investors sold 0 mln of Korean shares

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, EUR, EUR/CHF, Eurozone Manufacturing PMI, Eurozone Markit Composite PMI, Eurozone Services PMI, Featured, GBP, Japan Manufacturing PMI, JPY, newslettersent, SPY, TLT, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

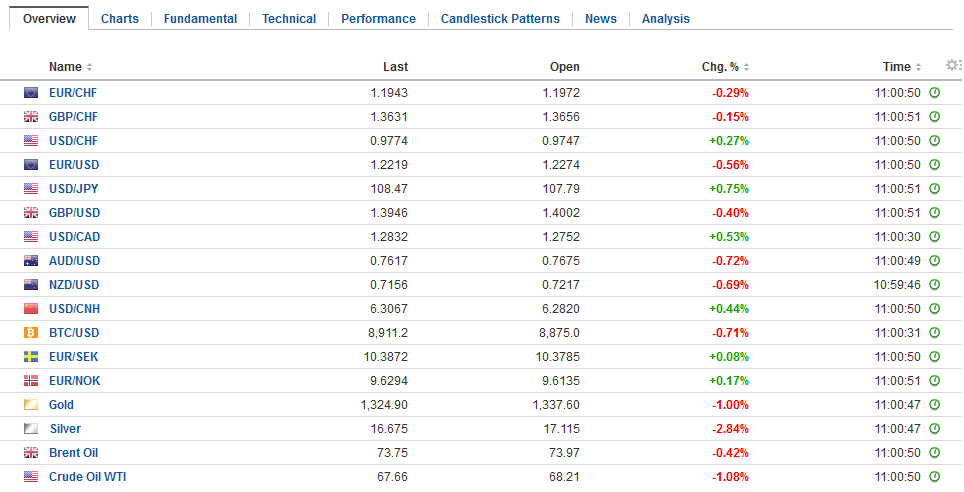

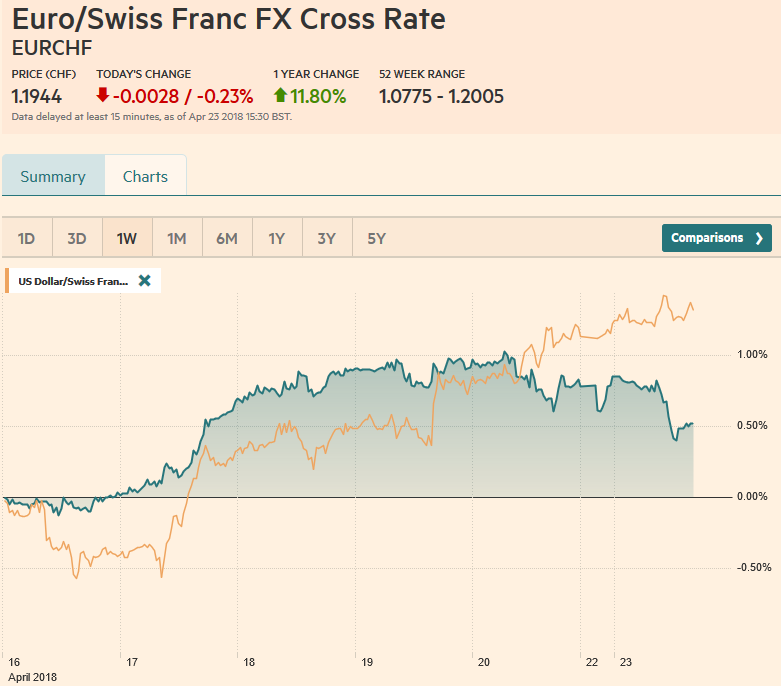

Swiss FrancThe Euro has fallen by 0.23% to 1.1944 CHF. |

EUR/CHF and USD/CHF, April 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe new week has begun much like last week ended, with rising rates helping to extend the dollar’s recent gains. The US 10-year yield is flirting with the 3.0% threshold. The two-year yield is firmer, and, like in the second half of last week, the US curve is becoming a little less flat. The market, as we had anticipated, was not so impressed with North Korea’s measures, and Korea’s Kospi edged lowed, and the region-leading KOSDAQ fell a little more than 1% (still up 10% year-to-date). Foreign investors sold $400 mln of Korean shares today. The amount is large in this context, and foreign investors had only sold $100 mln this month coming before today and $1.1 bln year-to-date. |

FX Daily Rates, April 23 |

| The MSCI Asia Pacific Index fell 0.5%, extending the pre-weekend nearly 1% decline to slip below the 20-day moving average. European markets are mostly heavier too. The Dow Jones Stoxx 600 is off 0.2%, lead by utilities (rate sensitive), real estate and consumer staples. This is a big week for bank earnings, and the financial component of the index is flat-to-firmer. US shares are trading fractionally weaker.

The dollar is near session highs as American participants return. The Dollar Index is at its best level since March 1. We suspect that the top of the range three-month range near 91.00 is too far today, given the stretched intraday technical readings. But if it does, a breakout may be at hand. |

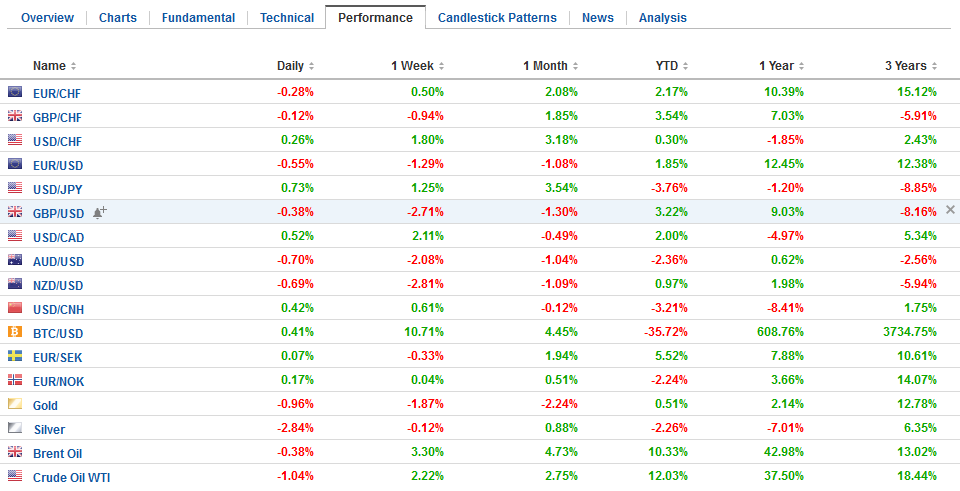

FX Performance, April 23 |

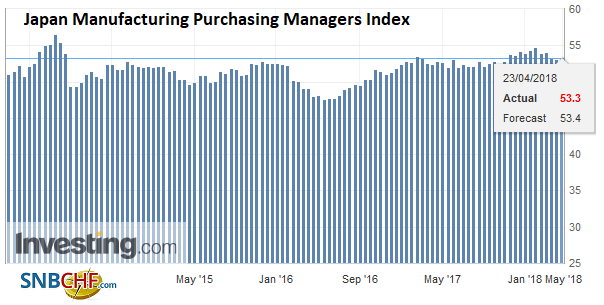

JapanThe main economic news has come in the form of the flash PMI readings. Japan’s April manufacturing April PMI edged higher to 53.3 from 53.1 in March. It is the first increase since January. |

Japan Manufacturing Purchasing Managers Index (PMI), Apr 2013 - 2018(see more posts on Japan Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

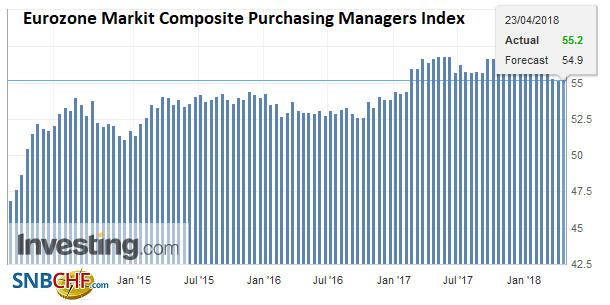

EurozoneThe eurozone flash composite was unchanged at 55.2, reflecting a small increase in services offsetting a somewhat larger decline in manufacturing. |

Eurozone Markit Composite Purchasing Managers Index (PMI), May 2013 - Apr 2018(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

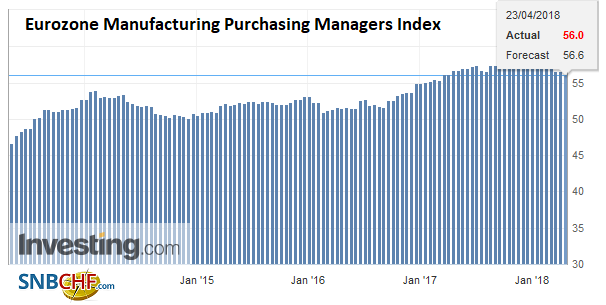

| The flash manufacturing PMI fell to 56.0 from 56.6. |

Eurozone Manufacturing Purchasing Managers Index (PMI), May 2013 - Apr 2018(see more posts on Eurozone Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

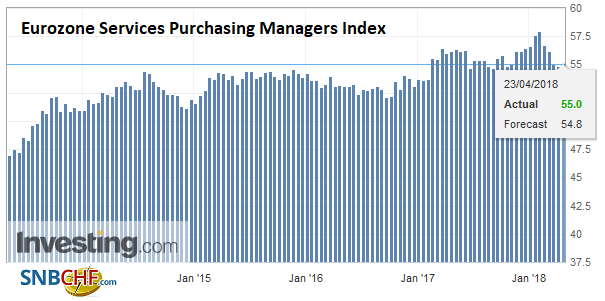

| The services PMI is at 55.0 rather than 54.9. |

Eurozone Services Purchasing Managers Index (PMI), May 2013 - Apr 2018(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

We suspect three forces are at work behind the apparently stalled momentum in the eurozone this year. First, Q4 likely overstated the growth, so call this reversion to mean. Second, the poor weather dampened activity in Q1, so this should fade. Third, the eurozone economy is entering the latter part of the expansion cycle. The first two forces may be more evident than the third.

The North American session calendar is light. Canada reports a wholesale trade, after soft CPI and retail sales reports before the weekend. The US dollar is extending last week’s recovery against the Canadian dollar and is testing the CAD1.28 level, which was the neckline of the technical pattern that had informed our near-term view. A move above CAD1.2830 could spur a move to the CAD1.29 congestion area.

The US sees Markit’s flash US PMI, which may not spur more than a flutter around the headlines and existing home sales for March. They are expected to have edged higher for the second consecutive month, and remain near cyclical highs. The two highlights come at the end of the week, the first estimate of Q1 GDP and the Employment Cost Index.

Having closed just below $1.23 last week, the euro has approached $1.22, the lowest end of its range, though it did spike to $1.2155 on March 1. The intraday technicals are extended. On the other hand, the greenback is pushing above JPY108.00 for the first time since mid-February. Although the dollar was firmer in Asia, it has been gaining in the European time zone that has driven the gains. The bottoming pattern we have been monitoring projects toward JPY110.00.

Sterling has been sold to a marginal new low for the month near $1.3965. A break of this area could signal another near-term, even if not today, cent decline. The Brexit debate became more complicated last week as the House of Lords endorsed remaining in the customs union by a wide margin. A poor Tory showing in next month’s local elections and defeat in the House of Commons could spur a leadership challenge. Separately, after the recent soft data and comments from Governor Carney last week, the odds of a BOE rate hike were downgraded from nearly a done deal (87.5% on April 13) to a strong maybe (49%) before the weekend. The odds are slightly higher today.

The Australian dollar is making new lows for the year today, as it is sold through last month’s lows. Recall the Aussie posted a key reversal on April 19 and saw strong follow-through selling ahead of the weekend. After pushing through $0.78, it finished last week near $0.7670 and is approaching $0.7600, where a 2.5-year trendline is found.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Manufacturing PMI,Eurozone Markit Composite PMI,Eurozone Services PMI,Featured,Japan Manufacturing PMI,newslettersent,SPY,USD/CHF