It was supposed to be a quiet week. The economic data and event calendar was light. There were three features, and none would likely disrupt the markets much. Eurozone The first two are in Europe. The eurozone flash PMI for July, the first insight into how Q3 has begun. The PMI is expected to paint a mostly steady economic activity. The June composite PMI rose for the first time since January, and it is forecast to be...

Read More »Emerging Markets: Week Ahead Preview

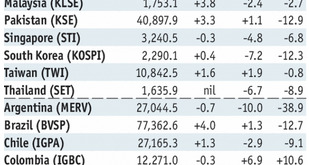

Stock Markets EM FX saw some violent swings last week, due in large part to some unhelpful official comments Friday. BRL and TRY were the best performers last week, while RUB and CLP were the worst. When all is said and done, however, we think Fed policy remains unaffected and so we remain negative on EM FX. Also, global trade tensions remain high after Trump threatened tariffs on all Chinese imports entering the US....

Read More »Solutions without Historical Templates: Cryptocurrencies and Blockchains

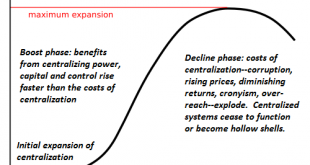

Crypto-blockchain technologies are leveraging the potential of computers and the web for direct political-social innovation. We’re accustomed to three basic templates for system-wide solutions or improvements: 1. an individual “builds a better mousetrap” and starts a company to exploit this competitive advantage; 2. a company invents something that spawns a new industry (the photocopier, the web browser, for example)...

Read More »Rothschild bank sanctioned for role in 1MDB scandal

The 1MDB scandal has seen billions disappear from the sovereign wealth fund. The Swiss financial regulator has concluded its investigations into the Malaysian 1MDB scandal by finding Rothschild Bank AG and one of its subsidiaries in serious breach of anti-money laundering regulations. The Swiss Financial Market Supervisory Authority (FINMA) said on Friday that it has appointed an auditor to make sure the bank and its...

Read More »Getting Their Pound of Flesh – Precious Metals Supply and Demand

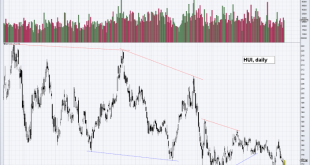

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Regulated to Death The price of gold fell $13, and that of silver $0.23. Perspective: if you’re waiting for the right moment to buy, the market now offers you a better than it did last week. If you wanted to sell, this wasn’t a good week to wait. Which is your intention, and why? Obviously, last week the sellers were more...

Read More »Euro, Yen, and Equities: Reviewed

US equities and the dollar appear to be moving higher together. The greenback is near its best level this year against most of the major and emerging market currencies. The Chinese yuan is not an exception to this generalization. At the same time, the S&P 500 is at its best levels since the downdraft February, and the NASDAQ set a new record high earlier in the week. Many investors and observers speculate about the...

Read More »FX Daily, July 20: Dollar Consolidates after Trump Wades In

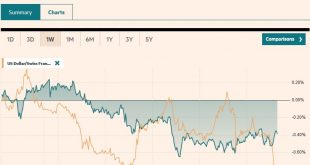

Swiss Franc The Euro has risen by 0.19% to 1.1651 CHF. EUR/CHF and USD/CHF, July 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is little changed but mostly softer as the week draws to a close. The market is digesting the implications of yesterday’s comments by President Trump about interest rates and foreign exchange, and without fresh economic data, are...

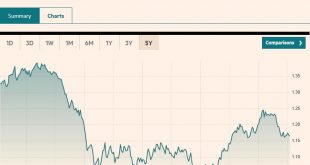

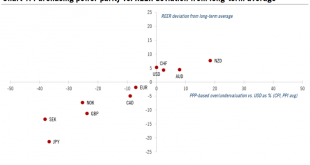

Read More »Swiss franc’s defensive features likely to come back into fashion

Despite heightened trade tensions, the Swiss franc has been relatively weak against the US dollar of late. The defensive features of the franc seem to be outweighed by an unsupported interest rate differential. But the continuing threat of escalation in trade disputes and extreme short speculative positioning on the franc mean the latter has upside potential. Capital outflows are unlikely to weigh significantly on...

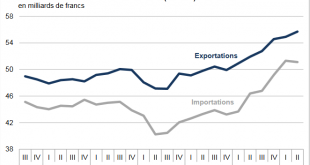

Read More »Swiss Trade Balance June 2018: Fifth consecutive record of exports

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »Bi-Weekly Economic Review

This will be a fairly quick update as I just posted a Mid-Year Review yesterday that covers a lot of the same ground. There were, as you’ll see below, some fairly positive reports since the last update but the markets are not responding to the better data. Markets seem to be more focused on the trade wars and the potential fallout. I would also note that at least some of the recent strength in the data is related to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org