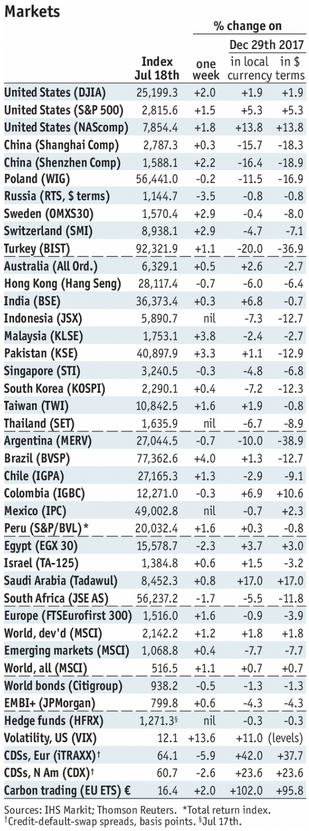

Stock Markets EM FX saw some violent swings last week, due in large part to some unhelpful official comments Friday. BRL and TRY were the best performers last week, while RUB and CLP were the worst. When all is said and done, however, we think Fed policy remains unaffected and so we remain negative on EM FX. Also, global trade tensions remain high after Trump threatened tariffs on all Chinese imports entering the US. Stock Markets Emerging Markets, July 18 - Click to enlarge Korea Korea reports trade data for the first 20 days of July on Monday. It reports Q2 GDP Thursday, which is expected to grow 2.9% y/y vs. 2.8% in Q1. The economy remains sluggish and faces headwinds from global trade tensions. Next BOK

Topics:

Win Thin considers the following as important: 5) Global Macro, Brazil, Chile, Colombia, emerging markets, Featured, Hungary, Korea. Singapore, Mexico, newsletter, Russia, Taiwan, Turkey

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX saw some violent swings last week, due in large part to some unhelpful official comments Friday. BRL and TRY were the best performers last week, while RUB and CLP were the worst. When all is said and done, however, we think Fed policy remains unaffected and so we remain negative on EM FX. Also, global trade tensions remain high after Trump threatened tariffs on all Chinese imports entering the US. |

Stock Markets Emerging Markets, July 18 |

KoreaKorea reports trade data for the first 20 days of July on Monday. It reports Q2 GDP Thursday, which is expected to grow 2.9% y/y vs. 2.8% in Q1. The economy remains sluggish and faces headwinds from global trade tensions. Next BOK policy meeting is August 31, we see steady rates then. SingaporeSingapore reports June CPI Monday, and is expected to rise 0.6% y/y vs. 0.4% in May. June IP will be reported Thursday, which is expected to rise 3.0% y/y vs. 11.1% in May. MAS does not have an explicit inflation target, but low price pressures should allow it to remain on hold at the next policy meeting in October. TaiwanTaiwan reports June IP Monday, and is expected to rise 4.75% y/y vs. 7.05% in May. June exports orders came in much weaker than expected at -0.1% y/y vs. +7.4% consensus. This suggests some slowing in H2. This is impact due to both China slowing and the consequences of tariffs, neither of which are good for EM exporters. TurkeyThe Central Bank of Turkey meets Tuesday and is expected to hike rates 100 bp to 18.75%. However, the market is split. Of the 21 analysts polled by Bloomberg, 4 see no hike, 1 sees a 50 bp hike, 1 sees a 75 bp hike, 9 see a 100 bp hike, 5 see a 125 bp hike, and 1 sees a 150 bp hike. With inflation spiking to 15.4% y/y in June, we think anything short of a 100 bp hike would be a mistake. HungaryThe National Bank of Hungary meets Tuesday and is expected to keep policy steady. Recent weakness in the forint forced some officials to take a less dovish approach. We have long argued that a rate hike is justified given tight labor markets and inflation running above target at 3.1% y/y. MexicoMexico reports mid-July CPI Tuesday, which is expected to rise 4.79% y/y vs. 4.54% in mid-June. If so, it would be the highest since March and further above the 2-4% target range. Next Banxico meeting is August 2. If the peso remains firm, it would give the bank leeway to keep rates steady at 7.75%. June trade will be reported Friday. ChileChile’s central bank meets Tuesday and is expected to keep rates at 2.5%. CPI rose 2.5% y/y in June, which is in the bottom half of the 2-4% target range. However, inflation is the highest since May 2017 and has accelerated three straight months. With the economy picking up, the bank has signaled a rate hike by year-end, which will most likely be in Q4. BrazilBrazil reports June current account, FDI, and central government budget data Thursday. While the external accounts are in good shape, the budget outlook remains poor. Markets are pricing in slight odds of a rate hike at the August 1 meeting instead putting more weight on a potential 25 bp hike at the next meeting September 19. We believe chances of a hawkish surprise in August are significant, though much will depend on BRL and external conditions. RussiaThe Central Bank of Russia meets Friday and is expected to keep rates at 7.25%. CPI rose 2.3% y/y in June, which is well below the 4% target. However, the ruble remains vulnerable and so we think that the easing cycle is over for now. ColombiaThe Colombia central bank meets Friday and is expected to keep rates at 4.25%. CPI rose 3.2% y/y in June, which has risen two straight months and is in the top half of the 2-4% target range. In addition, the peso remains vulnerable and so we think that the easing cycle is over for now. |

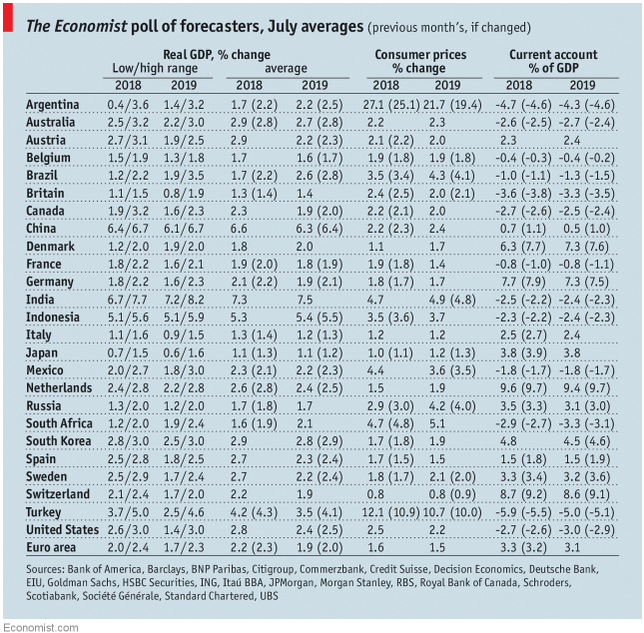

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, July 2018 Source: economist.com - Click to enlarge |

Tags: Brazil,Chile,Colombia,Emerging Markets,Featured,Hungary,Korea. Singapore,Mexico,newsletter,Russia,Taiwan,Turkey