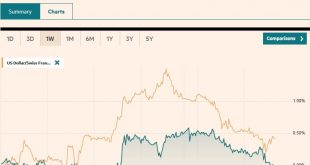

Swiss Franc The Euro has fallen by 0.21% to 1.1645 CHF. EUR/CHF and USD/CHF, July 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar eased in Asia session and the European morning. The greenback had appeared technically vulnerable, and the economic news stream is light. Sterling, unlike most of the other major currencies, remains within yesterday’s range....

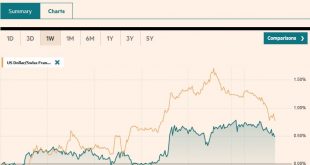

Read More »Great Graphic: Two-year Rate Differentials

Given that some of the retail sales that were expected in June were actually booked in May is unlikely to lead to a large revision of expectations for Q2 US GDP, the first estimate of which is due in 11 days. Before the data, the Atlanta Fed’s GDP Now projects the world’s biggest economy expanded at an annualized pace of 3.9% in Q2. If true, it would be the strongest quarterly expansion since Q3 14, when the economy...

Read More »The Great Gold Upgrade, Report 15 July 2018

In part I the Great Reset, we said that a reset is a terrible thing. The closest example is the fall of Rome in 476AD, in which more than 90% of the population of the city fled or died. No one should wish for this to happen, but we are unfortunate to live under a failing monetary system. Debt is growing exponentially. A way must be found to transition to the use of gold. We covered a few ways that won’t work. The Fed...

Read More »FX Daily, July 16: Dollar Softens a Little as Market Awaits Developments

Swiss Franc The Euro has fallen by 0.05% to 1.1683 CHF. EUR/CHF and USD/CHF, July 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is slightly softer against most of the major currencies but is in narrow ranges ahead of today’s key events, which include US retail sales and the debate in the UK parliament over Brexit. The yen is the main exception. The local...

Read More »FX Weekly Preview: For the Millionth Time: Investors Exaggerate Trade Tensions at Their Own Peril

You would never have guessed it reading many of the op-eds and pundits pronouncing the end to globalization or the West, or liberalism. Global equities have rallied. Of course, stock prices are not the end all and be all, but it stands in stark contrast to the cries that the sky is falling. The MSCI World Index of developed markets advanced for the second consecutive week adding 2.2%. The US S&P 500 moved above...

Read More »Uber plans softer Swiss expansion drive

Taxi drivers and trade unions have both opposed Uber in Switzerland. The ride sharing service Uber plans to expand further in Switzerland, but not as aggressively as in the past, Swiss head Steve Salom says in a newspaper interview. Uber is present in Zurich, Basel, Geneva and Lausanne with 300,000 regular customers and some 2,600 drivers in Switzerland, Salom told SonntagsBlick. But it has also run into some...

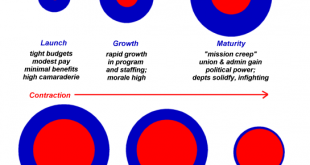

Read More »Our Institutions Are Failing

Our institutional failure reminds me of the phantom legions of Rome’s final days. The mainstream media and its well-paid army of “authorities” / pundits would have us believe the decline in our collective trust in our institutions is the result of fake news, i.e. false narratives and data presented as factual. If only we could rid ourselves of fake news, all would be well, as our institutions are working just fine....

Read More »The large tax differences between Swiss cantons

In Switzerland, tax is largely determined by the canton of residence. The range of tax rates is wide. In 2017, a single person earning CHF 100,000 paid only CHF 7,592 in the canton of Zug but CHF 19,233 in the canton of Neuchâtel, more than 2.5 times as much. Someone married with children earning the same amount paid CHF 920 in Zug and CHF 9,249 in Neuchâtel, more than 10 times as much. ...

Read More »Great Graphic: Two Stories for Two Trend Lines

The Dollar Index made a marginal new high for the year at the end of June a touch below 95.55. It fell through the start of this week when it reached nearly 93.70. With the earlier gains, the Dollar Index briefly traded above the 61.8% retracement of the pullback (~94.85). A move now below 94.20 would be disappointing. The Dollar Index is not a trade-weighted. It is too concentrated in Europe and does not include two...

Read More »EU migration into Switzerland down significantly in 2017

© Arturo Osorno | Dreamstime.com Net migration into Switzerland from the EU was down by 11% last year, according to the State Secretariat for Economic Affairs (SECO). In 2017, a net 31,250 people from the EU and EFTA moved to Switzerland. And, with a 4% decline in the number arriving over the five months to May 2018, the fall looks set to continue. For some nationalities the net flow went into reverse. In 2017, more...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org