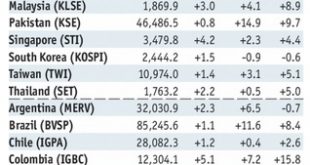

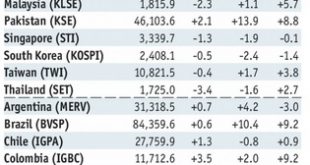

Stock Markets EM FX came under intense selling pressures last week. The worst performers were ARS, TRY, and MXN while the best were PHP, KRW, and TWD. US rates are likely to remain the key driver for EM FX, and so PPI and CPI data will be closely watched this week. We believe EM FX will remain under pressure. Stock Markets Emerging Markets, May 08 - Click to enlarge Indonesia Indonesia reports Q1 GDP Monday,...

Read More »Emerging Markets: What Changed

Summary Bank Indonesia is taking measures to stabilize the local bond market. The Philippine central bank is tilting more hawkish. Czech National Bank cut its inflation forecasts. The Turkish government is loosening fiscal policy to drum up popular support. S&P downgraded Turkey to BB- with stable outlook. Argentina officials are taking significant measures to support the peso. Brazil central bank made a subtle...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX ended Friday on a firm note, capping off a generally softer week overall. TRY and PHP were the best performers last week, while CLP and ZAR were the worst. US core PCE, ISM manufacturing, FOMC meeting, and jobs data all pose risks to EM this week. We remain a bit defensive on risk assets in general now. Stock Markets Emerging Markets, April 25 - Click to enlarge Korea Korea reports March IP...

Read More »Emerging Market Preview: Week Ahead

Stock Markets EM FX came under renewed pressure last week as US yields rose to new highs for the cycle. RUB and TRY were the top performers last week, while MXN and COP were the worst. There are no Fed speakers this week due to the embargo ahead of the May 2 FOMC meeting. While we see little chance of a hike then, markets are likely to remain nervous. Stock Markets Emerging Markets, April 18 - Click to enlarge...

Read More »Emerging Markets: What Changed

Summary The Reserve Bank of India is tilting more hawkish. Tensions on the Korean peninsula are easing. The Trump administration reversed course on Russia sanctions. Turkey is heading for early elections. Raul Castro stepped down as president of Cuba. Mexico polls show continued gains for Andres Manuel Lopez Obrador. Stock Markets In the EM equity space as measured by MSCI, Qatar (+4.8%), Russia (+3.3%), and Singapore...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX was mixed Friday, capping a mixed week as a whole. COP, CLP, and MXN were the best performers last week, while RUB, BRL, and TRY were the worst. While concerns about trade wars and Syrian missile strikes have ebbed, risks to EM remain elevated. US retail sales Monday and Fed Beige Book Wednesday are the economic highlights this week. Stock Markets Emerging Markets, April 11 Source:...

Read More »Emerging Markets: What Changed

Summary Hong Kong Monetary Authority intervened to defend the HKD peg. Moody’s upgraded Indonesia by a notch to Baa2 with a stable outlook. MAS tightened policy by adjusting the slope of its S$NEER trading band up “slightly.” Hungary Prime Minister Orban won a fourth term for his Fidesz party. Poland central bank Governor said it’s possible that the next move will be a rate cut. Russia outlined a range of potential...

Read More »Emerging Markets: What Changed

Summary Reserve Bank of India cut its inflation forecast for the first half of FY2018/19 to 4.7-5.1%. Former South Korean President Park was sentenced to 24 years in prison. Malaysia Prime Minister Razak has called for early elections. Bahrain discovered its biggest oil field since it started producing crude in 1932. Local press reports Turkey’s Deputy Prime Minister Simsek tendered his resignation. Brazilian Supreme...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX was mostly stronger last week, despite the dollar’s firm tone against the majors. Best EM performers on the week were MXN, KRW, and COP while the worst were ZAR, INR, and PEN. US jobs data poses the biggest risk to EM this week, as US yields have been falling ahead of the data. Indeed, the current US 10-year yield of 2.74% is the lowest since February 6. We remain cautious on EM FX, and do not think...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM ended Friday under renewed selling pressures, and capped off a mostly softer week. COP, THB, and TWD were the best performers last week, while TRY, RUB, and ZAR were the worst. Despite a widely expected 25 bp hike, this week’s FOMC meeting still has potential to weigh on EM. Stock Markets Emerging Markets, March 14 Source: economist.com - Click to enlarge Poland Poland reports February...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org