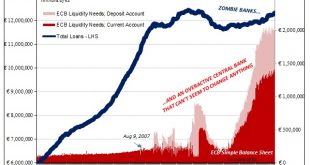

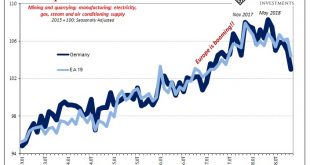

Mario Draghi’s term at the helm of the ECB is winding down. He will step down in October. It has not been an easy job. The light at the end of the tunnel in 2017 turned out to be another train in 2018. The eurozone enjoyed 0.7% quarterly growth every quarter in 2017. The ECB was able to outline an exit from its asset purchases. The debate began over sequencing and when the first rate hike could be delivered. But alas,...

Read More »FX Weekly Preview: Drivers, While Marking Time

The main issues for investors have not changed. There are three dominant ones: Trade, growth, and Brexit. Unfortunately, there won’t be any closure in the week ahead, and that may make short-term participants reluctant to turn more aggressive. United States The US reported exceptionally poor December retail sales and January industrial output figures. Growth forecasts were adjusted. The St. Louis Fed’s GDP Now tracker,...

Read More »It’s Not That There Might Be One, It’s That There Might Be Another One

It was a tense exchange. When even politicians can sense that there’s trouble brewing, there really is trouble brewing. Typically the last to figure these things out, if parliamentarians are up in arms it already isn’t good, to put it mildly. Well, not quite the last to know, there are always central bankers faithfully pulling up the rear of recognizing disappointing reality. At the end of November, Mario Draghi went...

Read More »FX Weekly Preview: Divergence Reinvigorated

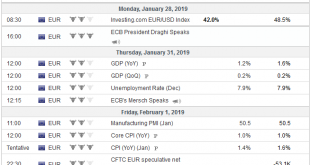

Eurozone Last week the focus was on Europe. Prospects of a delay in Brexit helped extend sterling’s gains to 11-week highs. Disappointing flash PMI for the eurozone and a dovish Draghi pushed the euro below $1.13 for the first time since mid-December. Speculation that the Reserve Bank of Australia would be forced to cut interest rates saw the Australian dollar punch through $0.7100. For its part, the yen was...

Read More »ECB Preview: Worries Increase but Not Quite Ready to Act

The ECB meets Thursday, and it may be best conceived as a transition meeting. It will lay the rhetorical groundwork for two things: a likely downgrade to the staff’s growth forecasts and moving toward a new round of long-term loans (targeted long-term refinance operations). Draghi’s speech last week to the European Parliament anticipated the themes he can be expected to develop in his press conference on Thursday. The...

Read More »European Central Bank likely to stick to script

The ECB is comfortable with current market expectations for rate hikes. At its latest meeting in December, the ECB turned more cautious, lowering its growth forecasts but showing no sign of panic regarding the loss in euro area economic momentum. Risks were considered as “broadly balanced”, but moving to the downside. Since the December monetary policy meeting, data (PMI and national surveys, industrial production) have...

Read More »That’s A Big Minus

Goods require money to finance both their production as well as their movements. They need oil and energy for the same reasons. If oil and money markets were drastically awful for a few months before December, and then purely chaotic during December, Mario Draghi of all people should’ve been paying attention. China put up some bad trade numbers for last month, but Europe’s goods downturn came first. According to...

Read More »European Central Bank likely to stick to script

The ECB is comfortable with current market expectations for rate hikes.At its latest meeting in December, the ECB turned more cautious, lowering its growth forecasts but showing no sign of panic regarding the loss in euro area economic momentum. Risks were considered as “broadly balanced”, but moving to the downside. Since the December monetary policy meeting, data (PMI and national surveys, industrial production) have deteriorated further, notably in France and Germany. While risks have...

Read More »Two Takeaways from ECB Record

The record of the ECB’s December meeting was released, and there are two takeaways. The first is that officials may have been more concerned with the deteriorating situation than they let on at the time. Apparently, paring near-term growth forecasts was seen as a sufficient signal that risks were increasing. This allowed Draghi to maintain the “broadly balanced” risk assessment. Although Draghi did acknowledge that the...

Read More »Technical Musings about the Euro and Dollar Anchored by Macro

The $1.1475-$1.1550 is an important area for the euro. Many bulls see a rounded bottom being carved and a break above it would be embraced as a confirmation. The lower-end corresponds to the 100-day moving average. Such a bottom pattern, if confirmed, would project toward $1.1800 the high in H2 18. On the downside, the low from H2 18 was near $1.1200. This is just above a key (61.8%) retracement of the January...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org