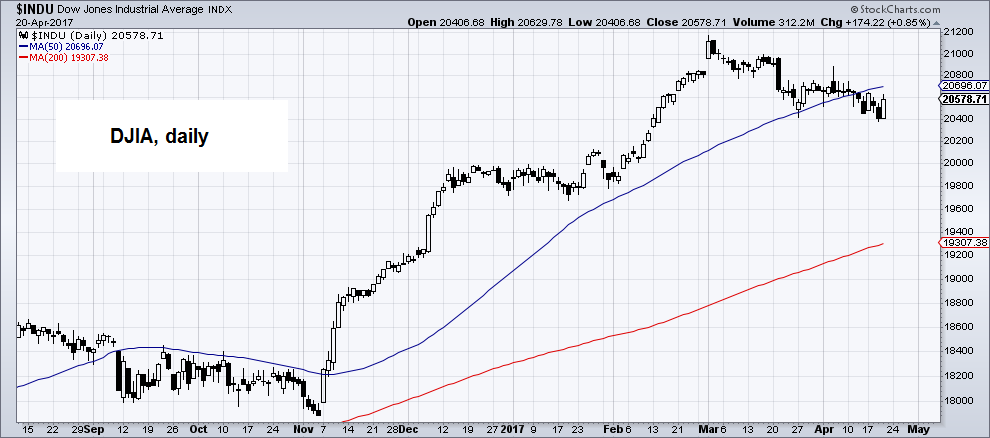

Paycheck to Paycheck GUALFIN, ARGENTINA – The Dow was down 118 points on Wednesday. It should have been down a lot more. Of course, markets know more than we do. And maybe this market knows something that makes sense of these high prices. What we see are reasons to sell, not reasons to buy. Nearly half of all American families live “paycheck to paycheck,” say researchers. Without borrowing, 46% couldn’t raise 0 to cover an emergency. This is at least part of the reason why retail sales dropped for the second month in a row in March. Despite seven years of economic “recovery,” millions of Americans don’t have much money. According to Census Bureau figures, 110 million Americans receive benefits from means-tested federal programs – food stamps, disability, and the like. And according to the Bureau of Labor Statistics, about 125 million Americans have full-time work (with another roughly 112 million without jobs). Dow Jones Industrial Average Index, September 2016 - May 2017(see more posts on Dow Jones Industrial Average, ) - Click to enlarge That means there are only 125 million people in full-time jobs supporting the whole kit and caboodle of the U.S. economy, with a total population of 323 million. At that rate, each full-time worker supports about 2.

Topics:

Bill Bonner considers the following as important: Debt and the Fallacies of Paper Money, Featured, newslettersent, On Economy, On Politics

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Paycheck to PaycheckGUALFIN, ARGENTINA – The Dow was down 118 points on Wednesday. It should have been down a lot more. Of course, markets know more than we do. And maybe this market knows something that makes sense of these high prices. What we see are reasons to sell, not reasons to buy. Nearly half of all American families live “paycheck to paycheck,” say researchers. Without borrowing, 46% couldn’t raise $400 to cover an emergency. This is at least part of the reason why retail sales dropped for the second month in a row in March. Despite seven years of economic “recovery,” millions of Americans don’t have much money. According to Census Bureau figures, 110 million Americans receive benefits from means-tested federal programs – food stamps, disability, and the like. And according to the Bureau of Labor Statistics, about 125 million Americans have full-time work (with another roughly 112 million without jobs). |

Dow Jones Industrial Average Index, September 2016 - May 2017(see more posts on Dow Jones Industrial Average, ) |

| That means there are only 125 million people in full-time jobs supporting the whole kit and caboodle of the U.S. economy, with a total population of 323 million. At that rate, each full-time worker supports about 2.6 people… including almost one person receiving money from the feds.

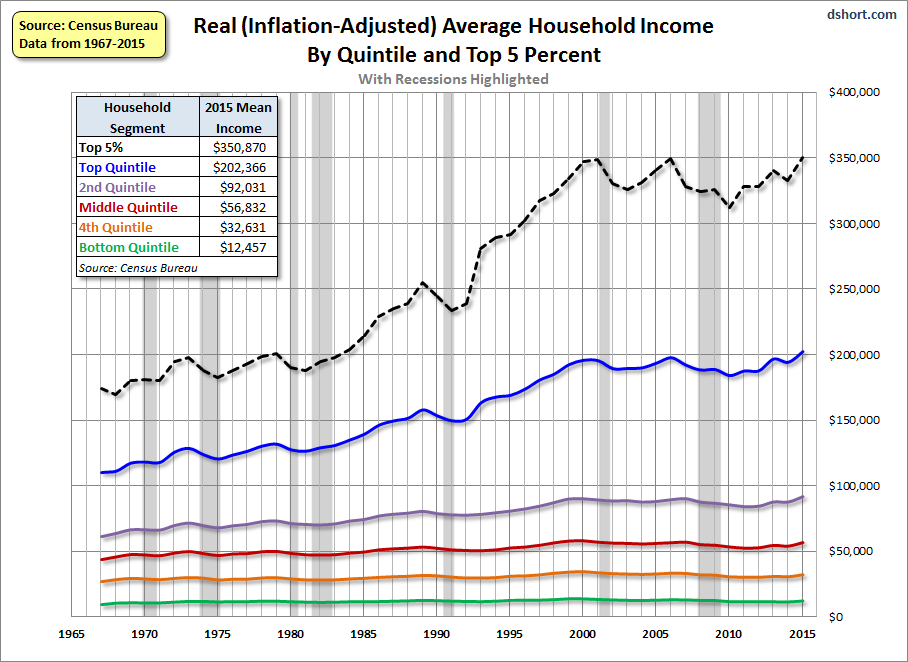

They are also supporting a government debt of $20 trillion and private debt of another $40 trillion or so. That puts the debt-to-full-time-worker ratio at $480,000. The average salary for a full-time worker is just $48,000. At a modest 5% interest, his share of the debt cost would set him back $24,000 each year. He’d have only the remaining $24,000 to support (1) his own family… and (2) all the malingerers, cronies, and zombies who are drawing government benefits. Obviously, those numbers don’t work. But they explain much of the weakness in the U.S. economy. The feds’ cheap credit keeps moving money (mostly in the form of asset price increases) to the wealthiest ZIP codes… while the average person’s budget gets tighter and tighter. |

US Real Average Household Income By Quintile And Top 5 Percent, 1965 - 2015(see more posts on U.S. Household Debt, ) |

Crisis LevelFoot traffic in chain restaurants is dropping, too. It’s down 3.4% from last month year over year. And all across the country, retail stores are closing their doors and shuttering their windows as though a hurricane were coming. And maybe it is… Household debt is once again at more than $14 trillion – the level that set off the crisis of 2008–’09. At that level, consumers have a hard time spending. Despite these warnings, the Fed is still patting itself on the back. Bloomberg:

Not only that, it is still talking about undoing the damage it has done over the past eight years, hoping to get down from its debt-mountain perch without breaking any bones. Bloomberg again:

|

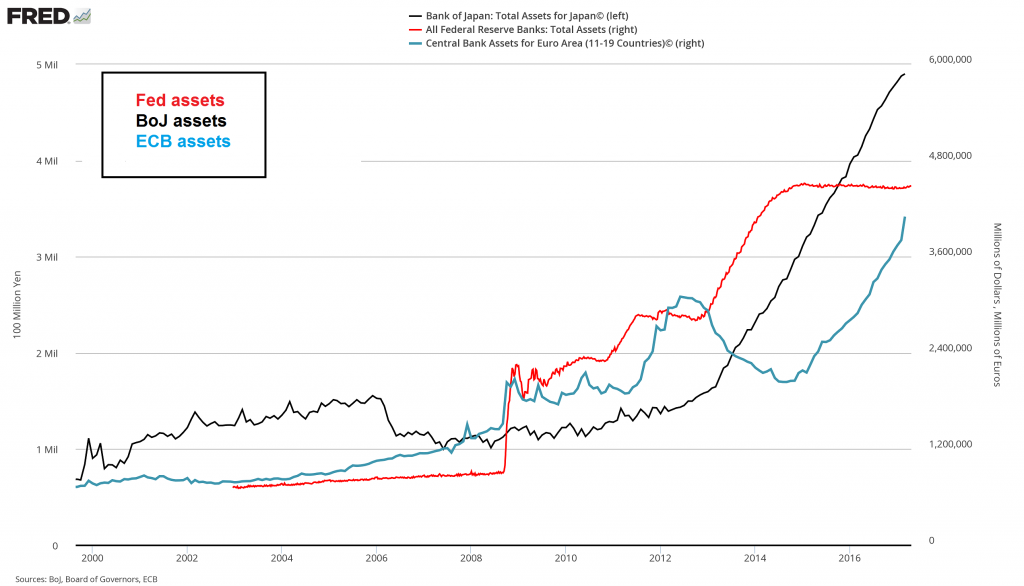

Bank Of Japan, Federal Reserve Bank And Central Bank Assets, 2000 - 20016 |

Easy-PeasyLet’s see… central banks began buying debt eight years ago. Now they own $13 trillion of it. Hey, it was fun, wasn’t it? Nothing bad happened. So now they can get rid of the debt… and nothing bad is going to happen again, right? The Fed bought the debt, adding money into the economy – especially the richest part of it. Now all they have to do is sell it. Easy-peasy. |

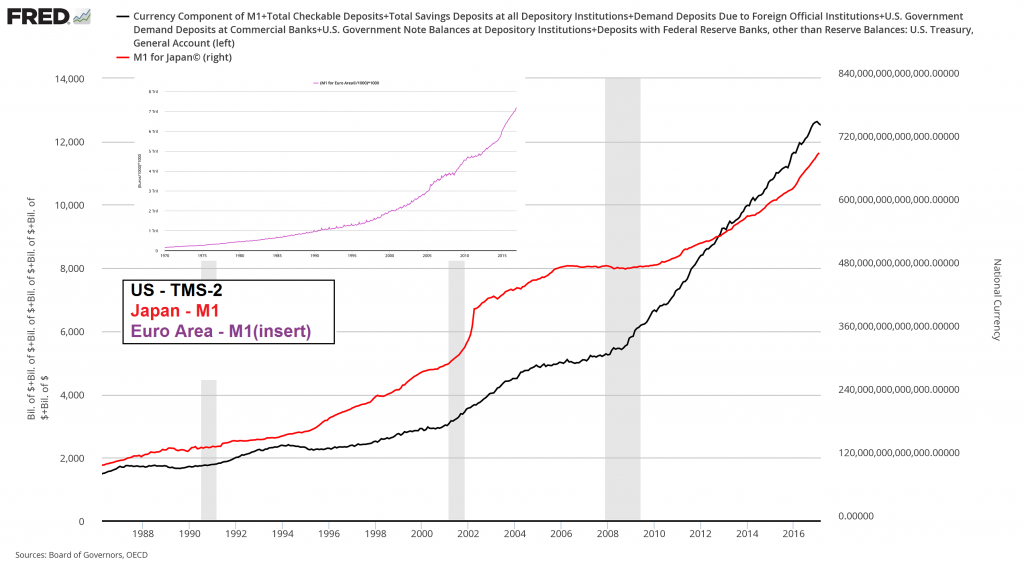

Currency Component Of Japan, US and Euro Area, 1988 - 2016 |

| The main effect of the vast central bank balance sheet expansion discussed above was the creation of boatloads of deposit money & currency. US TMS-2, Japan M1 and euro area M1 (inserted chart) have grown like weeds – so someone does have all that money lying around somewhere. Alas, a reversal of QE will destroy it again. One guess as to what would happen to asset prices in that case – click to enlarge.

A lot of people have a spare trillion dollars lying around. They’ll consider it an honor to help the Fed down off the ledge and buy bonds just as the bond market turns south. The hangover will be just as much fun as getting drunk. The divorce will be just as exhilarating as the affair that caused it. Getting hanged for murder will be just as satisfying as shooting the bastard. Sure. |

Tags: Featured,newslettersent,On Economy,On Politics