The Raw Deal We stepped out on our front stoop Wednesday morning and paused to take it all in. The sky was at its darkest hour just before dawn. The air was crisp. There was a soft coastal fog. The faint light of several stars that likely burned out millennia ago danced just above the glow of the street lights. After a brief moment, we locked the door behind us and got into our car. Springtime southern California mornings are exquisitely pleasant. The early morning drive to downtown Los Angeles, on the other hand, is exquisitely painful. Nonetheless, we make the best of it like we make the best of a trip to the dentist – or a visit with our accountant. If anything, it affords us the opportunity to do something most people rarely do. In particular, it gives us time to think. Before we knew it we’d reached our destination. But not before uncovering half dozen unrectified incongruities. The sorts of things that are futile to piece together. One thing that stuck in our craw like a broken chicken bone is the raw deal main street depositors and lenders get from credit unions and commercial banks. In short, the credit system is tilted against them. The rules of the game favor the bankers. And this is what they saw watching the sky from Mt.

Topics:

MN Gordon considers the following as important: Central Banks, Chart Update, Debt and the Fallacies of Paper Money, Featured, newslettersent, On Economy

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

The Raw DealWe stepped out on our front stoop Wednesday morning and paused to take it all in. The sky was at its darkest hour just before dawn. The air was crisp. There was a soft coastal fog. The faint light of several stars that likely burned out millennia ago danced just above the glow of the street lights. After a brief moment, we locked the door behind us and got into our car. Springtime southern California mornings are exquisitely pleasant. The early morning drive to downtown Los Angeles, on the other hand, is exquisitely painful. Nonetheless, we make the best of it like we make the best of a trip to the dentist – or a visit with our accountant. If anything, it affords us the opportunity to do something most people rarely do. In particular, it gives us time to think. Before we knew it we’d reached our destination. But not before uncovering half dozen unrectified incongruities. The sorts of things that are futile to piece together. One thing that stuck in our craw like a broken chicken bone is the raw deal main street depositors and lenders get from credit unions and commercial banks. In short, the credit system is tilted against them. The rules of the game favor the bankers. |

|

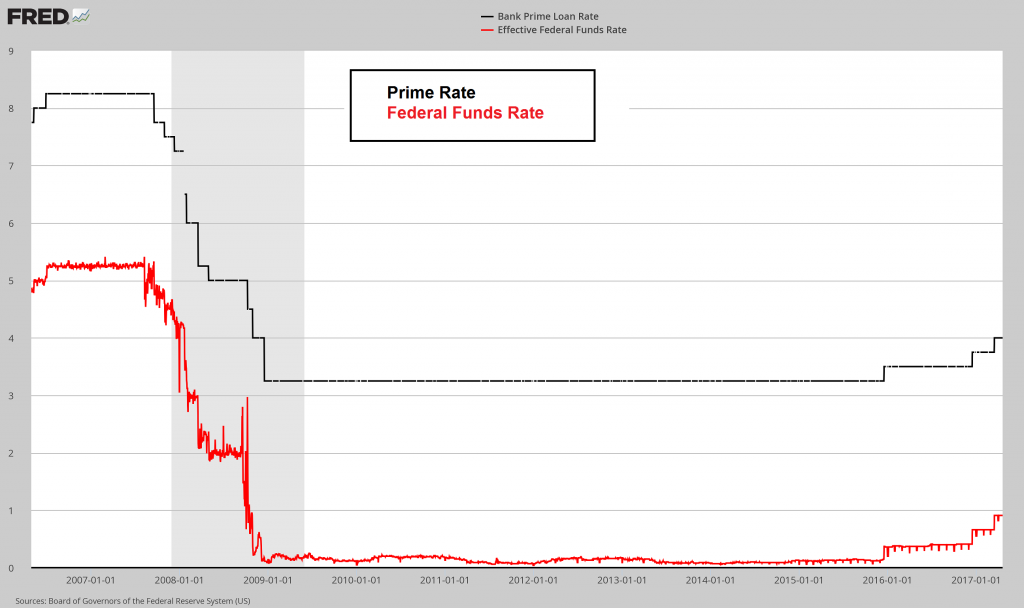

Extreme MaltreatmentPerhaps the rules of the game have always favored the bankers. Loaning out deposits at a higher interest rate than the yield paid is cornerstone to fractional reserve banking. However, the extreme maltreatment of individual depositors and borrowers that has persisted following the 2008 credit crisis is a downright disgrace. Where to begin? The prime rate, if you recall, is the benchmark used by banks to set rates on consumer loans. These consumer loans include credit cards, auto loans, and home equity loans among others. Obviously, the prime rate is reserved for only the most qualified clients. These are primarily corporations. Not individual customers. Certainly, they’re not your typical credit card user. Individual customers typically pay the prime rate plus a percentage above, based on their default risk. When the Federal Reserve raises or lowers the federal funds rate the prime rate moves in tandem. Similarly, the variable rate paid on credit cards and other lines of credit also moves up or down accordingly. |

Prime Rate vs Federal Funds Rate, Jan 2007 - 2017(see more posts on Federal Funds Rate, ) |

| The prime rate, based on The Wall Street Journal’s consensus survey of the 30 largest banks, is presently at 4 percent. For perspective, the typical credit card rate these days has an annual percentage rate (APR) on the order of 16 percent – or more. This is all well and good, of course. No one’s twisting the consumers’ arms and forcing them to take on debt.

To the contrary, consumers are eager and addicted to the readily available credit card debt the banks offer. Still this doesn’t change the fact that main street depositors and lenders continue to get a raw deal. This, indeed, is a fact. There’s no guesswork or conjecture about it. Rather it’s a matter of simple math. |

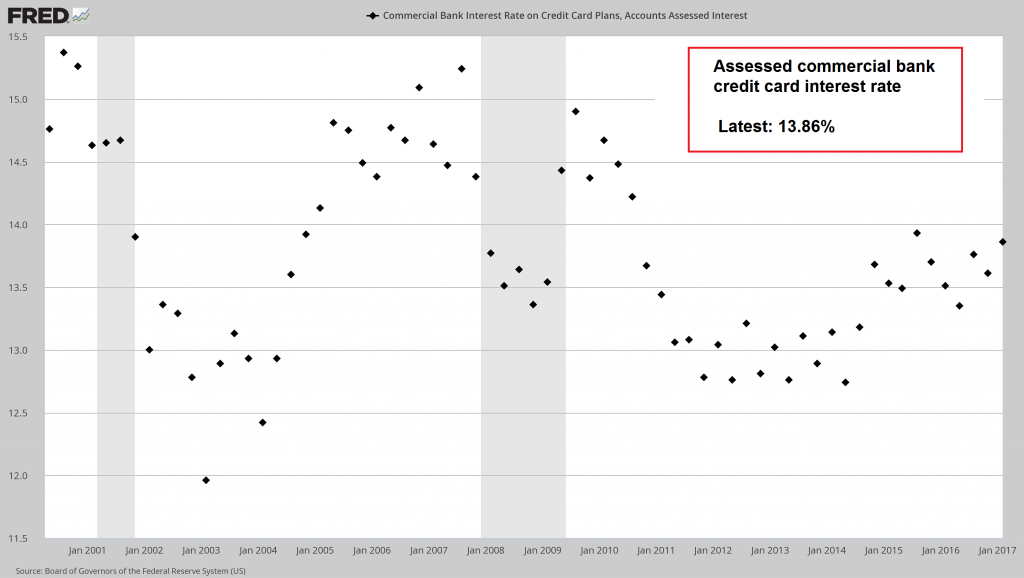

Commercial Bank Interest Rate, Jan 2001 - 2017(see more posts on Interest Rate, ) Average assessed credit card interest rate since ~2000. Interestingly, these rates went to far lower levels in the 2001 – 2002 downturn, presumably because average consumer credit scores were still much better at the time. Note that the 13.86% average is as of February 2017, i.e. the figure predates the most recent rate hike. It’s also not what consumers pay typically - Click to enlarge |

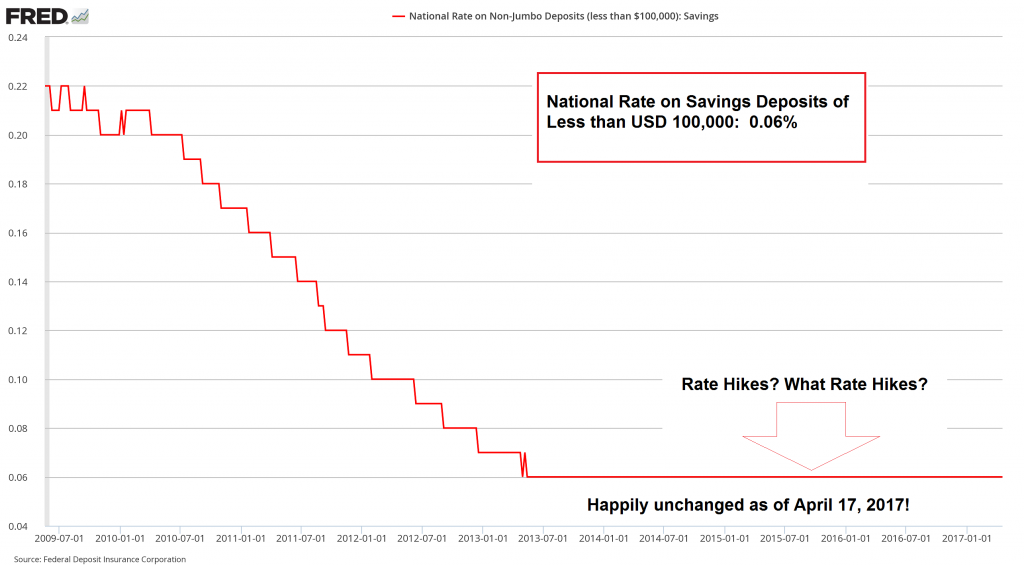

Simple Math of Bank Horse-PuckeyAs noted above, the typical credit card APR for individual consumers these days is on the order of 16 percent. But if an individual loans their money to the bank, in the form of a savings deposit, do you know what the bank presently pays in return? The typical annual percentage yield (APY) on savings deposits is not 1 percent. It’s not even 0.1 percent. Rather, it’s about 0.01 percent; which is effectively less than zero after inflation. |

|

| What’s more, if an individual loans $10,000 to the bank for an entire year, in the form of a certificate of deposit (CD), they’ll get an APY of about 0.35 percent. No doubt, an APY of 0.01 percent on deposits and 0.35 percent on 1-year CDs in the face of 16 percent APR on credit card debt is an utter insult.

Conversely, the banks have never had it so good. They borrow from the Fed at less than 1 percent interest. Then they buy U.S. Treasury notes – currently the 10-Year note is yielding 2.24 percent. After that they issue credit to consumers at 16 percent APR while paying 0.01 percent yield on savings deposits. Has there ever been a more questionable business that’s given every advantage under the sun? Incidentally, Bank of American reported first quarter earnings this week of $0.41 per share, beating analyst expectations by a whole $0.06 per share. How did they do it? |

Interest Rate on Savings Deposits, Jul 2009 - 2017 Give us your money, suckers! The Fed’s rate hikes have clearly affected loan rates – the same cannot be said of interest paid on the deposits of the army of suckers who hold altogether USD 9.2 trillion in savings deposits at US commercial banks. Somehow, the banks failed to pass on the rate hikes in this case. We reckon this happy oversight translates into a fat net interest margin boost - Click to enlarge |

“Our approach to responsible growth delivered strong results again this quarter,” CEO Brian Moynihan said in a statement. What’s responsible growth? Is it like responsible drinking, or an honest thief? According to the BofA website:

What a load of horse-puckey. Tangible value is only created for certain customers. That is, shareholders. Not depositors. The point is in today’s fiat money financial system, where debt is money and money is debt, the house always wins. Place your bets accordingly. |

Tags: central banks,Chart Update,Featured,newslettersent,On Economy