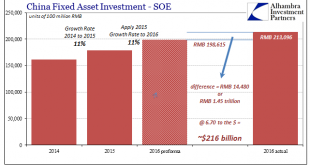

All the way back in January I calculated the total size of China’s 2016 fiscal “stimulus.” Starting in January 2016, authorities conducted what was an enormous spending program. As it had twice before, the government directed increased “investment” from State-owned Enterprises (SOE).By my back-of-the-envelope numbers, the scale of this fiscal side program was about RMB 1.45 trillion, or nearly 2% of GDP. It was about...

Read More »FX Daily, September 14: New Trump Tactics Help Greenback and Rates

In the face of much cynicism and pessimism about the outlook for the Trump Administration’s agenda, we have repeatedly pointed out the resilience of the system of checks and balances. Many of the more extreme positions have been tempered, either on their own accord, such as naming China a currency manipulator or pulling out of NAFTA or KORUS, or the judiciary branch, such as on immigration curbs, or the legislative...

Read More »Moscow Rules (for ‘dollars’)

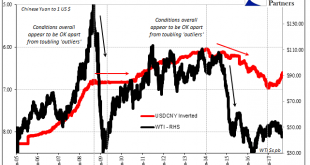

In Ian Fleming’s 1959 spy novel Goldfinger, he makes mention of the Moscow Rules. These were rules-of-thumb for clandestine agents working during the Cold War in the Soviet capital, a notoriously difficult assignment. Among the quips included in the catalog were, “everyone is potentially under opposition control” and “do not harass the opposition.” Fleming’s book added another, “Once is an accident. Twice is...

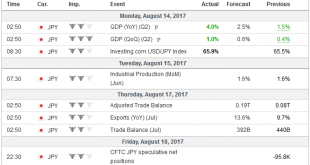

Read More »FX Daily, August 15: Greenback Firms, Encouraged by Dudley and Ebbing of Tensions

Swiss Franc The Euro has fallen by 0.43% to 1.1397 CHF. EUR/CHF and USD/CHF, August 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates NY Fed President Dudley appears to have stolen any potential thunder in the July FOMC minutes that will be released tomorrow. While we put more emphasis on today’s US retail sales data and the August Fed surveys, many others argued that the...

Read More »FX Daily, August 14: Sigh of Relief Weighs on Yen and Gold, while Lifting Equities and the Dollar

Swiss Franc The Euro has risen by 0.64% to 1.1425 CHF. EUR/CHF and USD/CHF, August 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The lack of new antagonisms over the weekend between the US and North Korea has prompted the markets to react accordingly. Already before the weekend, we detected some signs that at least some market participants had begun looking past...

Read More »FX Weekly Preview: Synthetic FX View — Macro and Prices

Summary: Economic data due out are unlikely to change macro views. Swiss franc’s price action suggests some return to “normalcy” despite rhetoric remaining elevated. Sterling’s 3.25 cent drop against the dollar looks over. An escalation of threatening rhetoric by the United States and North Korea emerged as the key driver last week. The US was unable to build on the success it enjoyed at the UN on August 5...

Read More »FX Daily, August 07: Outlaw Mondays

Swiss Franc The Euro has risen by 0.17% to 1.1469 CHF. EUR/CHF and USD/CHF, August 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed to start the new week. Two main developments stand out. First, the dollar-bloc currencies are trading heavily. The Australian dollar is pushing lower for the fifth consecutive session. The greenback is advancing...

Read More »FX Daily, July 19: Dollar Stabilizes on Hump Day, Awaits Thursday’s BOJ and ECB Meetings

Swiss Franc The Euro has fallen by 0.38% to 1.0987 CHF. EUR/CHF and USD/CHF, July 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After being shellacked to start the week, the US dollar is being given a small reprieve today as investors await tomorrow’s BOJ and ECB meetings. The US may also report a bounce back in housing starts (residential investment) after a...

Read More »FX Weekly Preview: Focus Shifts from Fed to ECB

Summary: Market has downgraded chances of a September hike from low to lower, but the chances of a December hike are higher than the day after the June hike. ECB meeting is the most important event of the week. A small change in the risk assessment is likely. The US and Europe have been more disruptive to the global capital markets this year than China. The focus shifts in the week ahead from Yellen’s...

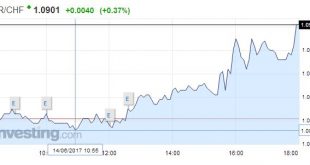

Read More »FX Daily, June 14: FOMC and upcoming SNB

Swiss Franc The Euro has risen by 0.37% to 1.0901 CHF. This is a typical movement ahead of the SNB meeting tomorrow. This movement is probably unrelated to the Fed rate hike, given that the USD/JPY has fallen. It makes sense to go long CHF against JPY, if you bet on an inactive SNB. Inactive SNB would mean that the central bank will not speak about stronger FX Interventions or about lower rates. EUR/CHF - Euro Swiss...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org