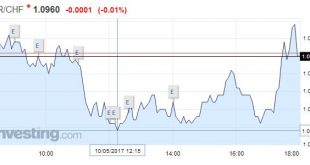

Swiss Franc EUR/CHF - Euro Swiss Franc, May 10(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Investors absorbed a few developments that might have been disruptive for the markets with little fanfare. North Korea’s ambassador to the UK warned that his country would go ahead with its sixth nuclear test, as South Korea elected a new president who wants to reduce tensions on the peninsula. The Dollar...

Read More »FX Daily, May 08: Euro Bought on Rumor, Sold on Fact

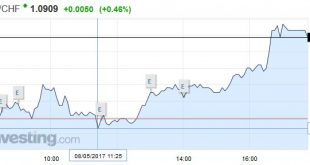

Swiss Franc EUR/CHF - Euro Swiss Franc, May 08(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge FX Rates The US Dollar Index initially fell to its lowest level since mid-November to 98.50. It rebounded but stalled in front of the pre-weekend high near 99.00. This area must be overcome to lift the tone. Sterling stretched to a marginal high but faded in front of $1.30. Initial support is seen...

Read More »‘Dollar’ ‘Improvement’

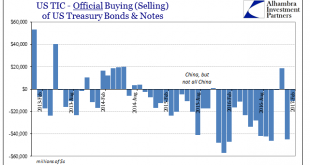

According to the headline TIC statistics, foreign central banks have in the past six months sold the fewest UST’s since the 6-month period ended November 2015. That may indicate an easing of “dollar” pressure in the private markets due to “reflation” sentiment. They are, however, still selling. In February 2017, the latest month available, the foreign official sector disposed of another $10.7 billion (net) after -$44.9...

Read More »More Thinking about Trade as Pence and Ross Head to Tokyo

Summary: Pence and Ross may “feel out” Abe for interest in a bilateral trade agreement. The US enjoys a small trade surplus with countries it has free-trade agreements. Ownership-based framework of the current account and value-added trade suggest the US trade imbalance is not a significant problem. US Vice President Pence and Commerce Secretary Ross will go to Japan this week. In addition to regional...

Read More »FX Daily, April 17: Markets Trying to Stabilize in Holiday-Thin Activity

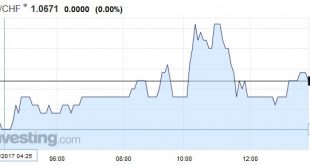

Swiss Franc EUR/CHF - Euro Swiss Franc, April 17(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Financial centers in Europe are closed for the extended Easter holiday. Australian and New Zealand markets were also closed. The drop in US 10-year Treasury yields in early Asia, with a brief push below 2.20%, appears to have kept the dollar under pressure. As the North American market prepares to...

Read More »FX Weekly Preview: What to Watch in the Week Ahead

Many observers misunderstood US President Trump’s “American First” rhetoric. Trump’s earlier writings show that this is not a reference to the 1940s effort to keep the US out of WWII, with its isolationist tint. Rather, Trump’s use goes back to the original use by President Harding in the 1920s. It was a rejection of the Wilsonian multilateralism (e.g. League of Nations) and a robust defense of unilateralism. That...

Read More »FX Daily, April 05: Dialing it Up on Hump Day

Swiss Franc EUR/CHF - Euro Swiss Franc, April 05(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Swiss Franc may come under pressure tomorrow after Consumer Price Index inflation numbers are released. Inflation is expected to fall from 0.6% to 0.5% for the month of March and any weakening in the numbers could see the Swiss Franc weaken. Fridays unemployment data from Switzerland could also give a...

Read More »Inclusion in SDR Does Not Spur Official Demand for the Yuan

Summary: China’s share of global reserves is in line with expectations prior to its inclusion in the SDR. Three factors influencing allocated reserves – valuation, portfolio decisions, and China’s gradual inclusion in allocated reserves. The Swiss franc’s as a reserve asset diminished, but the “other” category appeared robust. The inclusion of the Chinese yuan in the SDR basket at the start of Q4 16 did not...

Read More »FX Weekly Preview: The Macro Backdrop at the Start of the Second Quarter

The macroeconomic fundamentals have not changed much in the first three months of the year. The US growth remains near trend, the labor market continues to improve gradually, both headline and core inflation remain firm, and the Federal Reserve remains on course to hike rates at least a couple more times this year, even though the market is skeptical. The uncertainty surrounding US fiscal has not been lifted, and it...

Read More »Pressure, Sure, But From Where?

It may just be that in life you have to get used to disappointment. Though not for lack of trying, I have spent a great deal of time over the years intending to piece together exactly what happened on days like October 15, 2014. The official explanation is an obvious whitewash, one so haphazard that I doubt it will ever be referred to again outside of ridicule. So much changed after that one day, a buying panic in the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org