Swiss Franc The Euro has fallen by 0.25% to 1.1539 CHF. EUR/CHF and USD/CHF, October 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The 30th anniversary of the 1987 equity market crash the major US benchmarks at record highs. The drop in the market was at least partly a function of the lack of capacity, sufficient instruments, and regulatory regime. Each of these...

Read More »FX Weekly Preview: The Markets and the Long Shadow of Politics

Summary: Rise in paper asset prices, including so-called cyber currencies, reflects the abundance of capital. Have we forgotten what Minski taught again? Political considerations may dominate ahead of the ECB meeting later this month. Why should we think there is anything amiss by looking at the global capital markets? The S&P 500 and the German Dax are at record levels. The Japanese market is at 20-year...

Read More »FX Daily, October 11: Markets Looking for a New Focus

Swiss Franc The Euro has risen by 0.04% to 1.1515 CHF. EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is consolidating after retreating since reversing lower following the US jobs data at the end of last week. While the greenback has largely been confined to yesterday’s ranges against the major currencies, the euro has made a...

Read More »FX Weekly Preview: Changing Dynamics

We agree with the consensus that the markets are in a transition phase. The consensus sees this transition phase as a new economic convergence. European and Japanese economic growth continues above trend. Large emerging markets, including BRICs, are also expanding. Central banks are gradually moving away from the extreme accommodation. We recognize the robust economic growth, but we do not see this economic convergence...

Read More »Not Political Risk For China, But Unwelcome Reality

China’s Communist Party concluded the Third Plenum of its 18th Congress in November 2013. It was the much-discussed reform mandate that many in the West took to mean another positive step toward neo-liberal reform. At its center was supposed to be a greater role for markets particularly in the central task of resource allocation. In some places, the Party’s General Secretary Xi Jinping was hailed as the great Chinese...

Read More »Location Transformation or HIBORMania

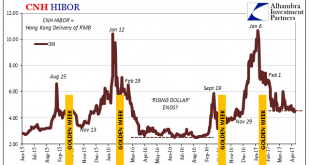

The Communist Chinese established their independence on September 21, 1949. The grand ceremony commemorating the political change was held in Tiananmen Square on October 1 that year. The following day, October 2, the Resolution on the National Day of the People’s Republic of China was passed making October 1to be China’s National holiday. It typically kicks off the second of China’s Golden Week holidays. The first...

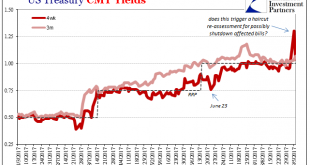

Read More »It Was Collateral, Not That We Needed Any More Proof

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. US Treasury, Jan - Sep 2017(see more posts on U.S. Treasuries, ) - Click to enlarge Within two days of that move in bills, the GC market for UST 10s had gone...

Read More »Little Behind CNY

The framing is a bit clumsy, but the latest data in favor of the artificial CNY surge comes to us from Bloomberg. The mainstream views currency flows as, well, flows of currency. That’s what makes their description so maladroit, and it can often lead to serious confusion. A little translation into the wholesale eurodollar reality, however, clears it up nicely. Demand for foreign exchange outstripped that for yuan for...

Read More »PBOC RMB Restraint Derives From Experience Plus ‘Dollar’ Constraint

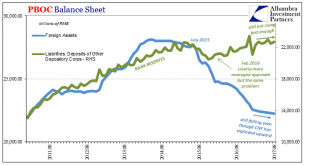

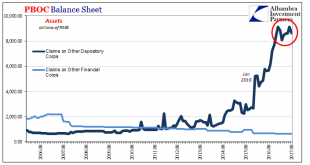

Given that today started with a review of the “dollar” globally as represented by TIC figures and how that is playing into China’s circumstances, it would only be fitting to end it with a more complete examination of those. We know that the eurodollar system is constraining Chinese monetary conditions, but all through this year the PBOC has approached that constraint very differently than last year.The updated balance...

Read More »Swimming The ‘Dollar’ Current (And Getting Nowhere)

The People’s Bank of China reported this week that its holdings of foreign assets fell slightly again in August 2017. Down about RMB 21 billion, almost identical to the RMB 22 billion decline in July, the pace of forex withdrawals is clearly much preferable to what China’s central bank experienced (intentionally or not) late last year at ten and even twenty times the rate of July and August. The US Treasury Department...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org