Summary: Economic data due out are unlikely to change macro views. Swiss franc’s price action suggests some return to “normalcy” despite rhetoric remaining elevated. Sterling’s 3.25 cent drop against the dollar looks over. An escalation of threatening rhetoric by the United States and North Korea emerged as the key driver last week. The US was unable to build on the success it enjoyed at the UN on August 5 when the Security Council unanimously voted to impose the stiffest sanctions to date on North Korea. Even if President Trump’s “fire and fury” threat was more visceral than strategic initially, there have been several opportunities to backtrack, and instead, the administration seemed to double down. Many

Topics:

Marc Chandler considers the following as important: $CNY, EUR, Featured, FX Trends, GBP, JPY, Korea, newsletter, SPY, USD, Venezuela

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary:

Economic data due out are unlikely to change macro views.

Swiss franc’s price action suggests some return to “normalcy” despite rhetoric remaining elevated.

Sterling’s 3.25 cent drop against the dollar looks over.

An escalation of threatening rhetoric by the United States and North Korea emerged as the key driver last week. The US was unable to build on the success it enjoyed at the UN on August 5 when the Security Council unanimously voted to impose the stiffest sanctions to date on North Korea. Even if President Trump’s “fire and fury” threat was more visceral than strategic initially, there have been several opportunities to backtrack, and instead, the administration seemed to double down.

Many observers in the US draw parallels with the Cuban Missile Crisis when the Soviet Union tried to install nuclear missiles in Cuba. The takeaway is the need for a forceful US response. However, the alternative analogy is Iran, as well as a few other countries, that surrendered its nuclear weapons capability and/or development. It is a negotiated settlement, not one dictated by military superiority. This is what US allies, such as Germany, and China and Russia will support.

The US strategy was to deny North Korea nuclear capability. It did not work. The US sought to deny North Korea the delivery mechanism. This did not work either. It is unfortunate, but the human cost of trying to turn by the clock is significant. As sour as it tastes, the US must accept a fait accompli and go from there,

Some military experts argue that North Korea may not only use its nuclear capability to deter a US (and/or South Korean), but it can be used offensively. One such scenario imagines North Korea invades South Korea to unite the country and threatens to its nuclear weapons if US forces join the conflict. Of course one can create all sorts of scenarios, but this one and many like it, seem to misunderstand the role of US forces in South Korea (23.5k). They cannot withstand a full fledged assault by North Korea. Their function is as a tripwire. Moreover, the US has a large military footprint in Asia, including 39k troops in Japan, and bases in Singapore and Guam. On top of this, add US naval power, including submarines, and aircraft carriers.

The point is that US forces dominate the escalation ladder at every rung. Yet the Tet Offensive, nearly 50 years ago, taught that even in defeat, victory was to be found for the North Vietnamese. Their military defeat was offset by moral and propaganda victories, that some credit with turning the tide in the war. What has changed now is that 1) North Korea’s capability continues to increase, 2) pressure on other countries, like China, to do more, has yielded limited results, and 3) the Trump Administration sees this as a test of its resolve.

We suspect that at least for the medium term, investors will have to live with a heightened degree of dramatic rhetoric by the US and North Korea. There are a few dates that may be noteworthy. First is August 15, when North Korea implied a potential plan to shoot some missiles into the waters off Guam as a display of force. One of the technical challenges for North Korean missiles is thought to be their accuracy. The risk of miscalculation is grave if a missile lands in the territorial waters of Guam as that could be seen as an act of war. The other is the joint US-South Korean exercises that run between August 21 and August 31. In the past, these exercises included a “decapitation strike” aimed at the political and military leadership.

Foreign investors were significant sellers of South Korean shares. They sold $810 mln of Korean shares. It was the third week of net sales, the first such streak since last November. Over the past three weeks, foreign investors sold $3.1 bln of Korean shares. In three weeks of liquidation in November, foreign investors sold about $1.3 bln of Korean shares. Foreign investors appeared happy to take on Korea’s credit risk and were net buyers of nearly $495 mln of Korean bonds last week. Foreign investors have been net buyers of Korean bonds for five consecutive weeks for a cumulative total of nearly $2.4 bln.

The takeaway is that although foreigners have pared this year’s purchases of Korean shares, they have continued to buy Korean bonds, arguably blunting the full impact on the currency. The Kospi gapped lower before the weekend, but technical indicators suggest the market may be near exhaustion. The won seems to be suggesting the same thing. The won was under pressure all week. The dollar recorded its high early Friday but then trended lower and closed on its lows before the weekend.

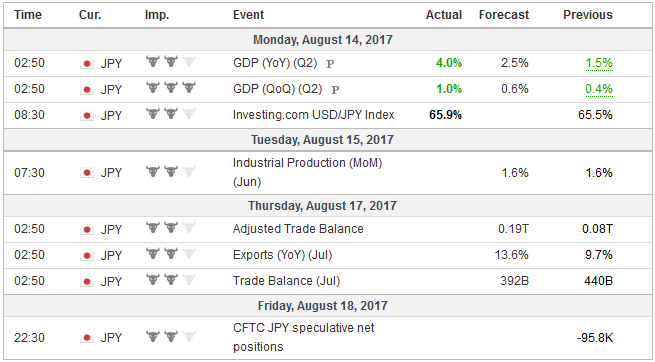

JapanThe yen and the Swiss franc were the strongest of the major currencies, appreciating 1.5% and 1.2% respectively against the US dollar. Although the dollar remained on the defensive, the fact that Swiss franc weakened against the euro ahead of the weekend also suggests some normalization of the political tensions. The euro also recovered against the yen ahead of the weekend. It is worth looking closer at the safe haven conventional narrative. We do not think that investors bought yen or the Swiss franc like they bought gold, for example. There is an important difference between buying to taken on exposure and buying that is meant to cover previously sold positions. The Swiss franc and yen were used as funding currencies, to finance the purchase of other assets. What we have witnessed is the unwinding of some of these positions. Speculators in the futures market covered nearly 10% of its gross short yen position (~13k contracts) in CFTC reporting week ending August 8. Speculators added to 3k contracts to the gross long position. Foreigners have not been particularly large investors in Japanese bonds or stocks in recent weeks. The four-week moving average of both is declining. On the other hand, through August 4, Japanese investors had the strongest three-week buying spree of foreign bonds since July 2016. The dollar fell to JPY108.75 before the weekend, a four-month low, but managed to close back above JPY109.00. It finished marginally lower to extend the streak to four losing sessions and is the fourth weekly loss in the last five. A move above JPY109.40 is needed to stabilize the tone, while a move above JPY110.20 would reinforce lower end of the range. The US rate premium is not particularly attractive at 213 bp at the 10-year mark. It is below the 50-day average (218 bp) and 100-day average (222 bp). At 140 bp, the two-year differential is the lowest in three months. Nevertheless, for Japanese investors who buy US bonds on an unhedged basis, and believe that lower end of the dollar’s range will hold, may still find Treasuries attractive. |

Economic Events: Japan, Week August 14 |

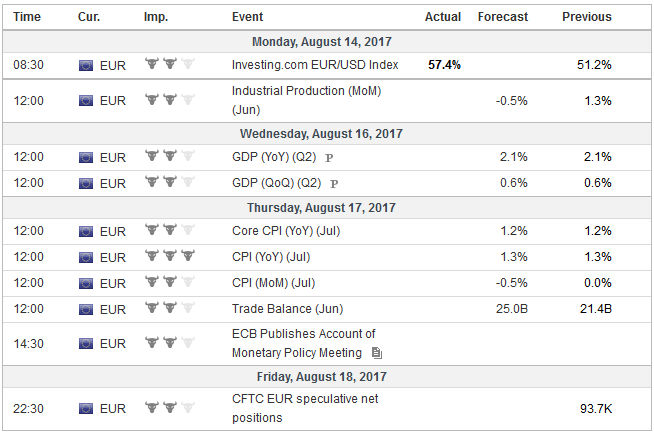

EurozoneThe euro finished its fifth weekly advance, though it remains a little below the peak of about $1.1910 set on August 2. It rallied ahead of the weekend, and 0.4% advance was also the weekly gain. The technical indicators did not respond much to the pre-weekend gain, but many still have their sights set on the $1.20-$1.22 area, with Draghi’s speech at Jackson Hole anticipated to provide new cues. The US premium over Germany is a little above 200 bp. This is near its 20-day average. A widening premium tends to give the dollar better traction. The 10-year premium has widened to 180 bp from the year’s low near 170 bp reached in mid-July, and which incidentally is the weekly average in 2016. Recall that the US premium peaked last December near 235 bp. Since the end of the last year, the 10-year US yield has fallen by 25 bp while the German yield has risen 19 bp. Economic data in the week ahead include a second look at Q2 GDP (0.6%) and final July CPI (1.3% headline and 1.2% core). July industrial output figures kick off the week, and the risk is to the downside of the median expectation for a 0.5% decline. It appears that the economic momentum stalled at the beginning of Q3. Most likely the data will not alter expectations for the September ECB meeting. There are some observers who warn of disappointment then as officials wait for the October meeting to announce its early 2018 intentions. While that is possible, it seems to us that the ECB will have the staff forecast update in September, giving it a reason to act. Waiting until the October meeting would seem to break that pattern, and would be vulnerable to criticisms of waiting until after the German elections toward the end of next month. Sterling posted a key reversal against the dollar on August 3 by making new highs (a little above $1.3265) and then dropping through and closing below the previous day’s low. A 3.25 cent decline followed to the pre-weekend low of $1.2940, just ahead of the 50% retracement objective of the low from June 21, the last time it traded below $1.26. Sterling posted potential reversal ahead of the weekend; recovering to close almost (1/100 of a cent below) at the previous day’s high. A move above $1.3050 would lend credence to our suspicions that the corrective low is in place. |

Economic Events: Eurozone, Week August 14 |

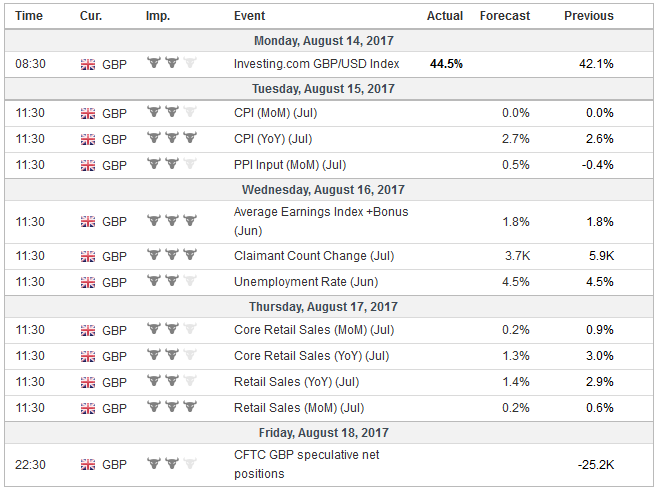

United KingdomThe economic reports in the days ahead are unlikely to alter the general understanding of the UK economy. Growth has downshifted, and consumption has slowed. The labor market is robust, but wage growth is slow and slower than inflation, which remains a firm and above target. The BOE’s preferred inflation measure (CPIH) is expected to tick higher to 2.7%, though for the second consecutive month prices were likely flat. The past depreciation of sterling appears to be a key factor, and therefore, it is still reasonable to expect price pressures to peak in the coming months. Meanwhile, the UK claimant count has been gradually rising since Q4 16, but the unemployment rate (likely remaining at 4.5% for the three months through June) is the lowest more than 40 years. Wage growth, similar to what is being experienced in many other countries, remains limited. Average weekly earnings in June are not expected to have changed from the 1.8% (and 2% excluding bonuses) reported for the three-month year-over-year period through May. UK retail sales are volatile month-to-month. A moving average helps smooth it out to see the trend It has clearly slowed. Last year the retail sales rose an average of 0.4% a month. In the first half of 2017, the pace has been halved. The median forecast in the Bloomberg survey was for a 0.1% rise in July after a 0.9% gain in June, and the first back-to-back increase since last summer. Investors seem skeptical of the UK. Sterling was not rewarded when the recent PMIs were generally stronger than expected. To the contrary, thoughts that the BOE may begin normalizing policy has been unwound. The implied yield on the December short sterling futures contract has fallen 17 bp to 35 bp since the end of June. It had finished 2016 near 47 bp. However, the place to express that skepticism may not count against the US dollar, which has its own challenges. On a trade-weighted basis, sterling has fallen 4.5% in the past three months. Sterling’s weakness is seen through the euro. Since the days before Macron won the first round of the French presidential contest, the euro has risen 9.5% against sterling. The euro poked through GBP0.9100 briefly at the end of last week. It was near GBP0.8300 in mid-April. The technicals look stretched and the euro is bouncing against the upper Bollinger Band, but short-term participants will want to be particularly attentive to potential reversal patterns. |

Economic Events: United Kingdom, Week August 14 |

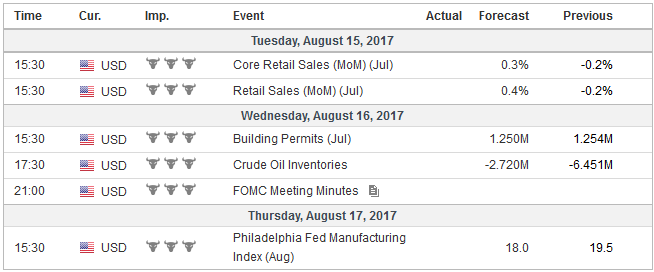

United StatesThe US also reports several economic reports, but what has emerged as a consensus among economists is unlikely to be changed by the data. Specifically, a recent Wall Street Journal survey found nearly 75% of economists expect the Fed to announce its balance sheet operations in September and a December rate hike. The FOMC minutes, among the week’s highlights, may reinforce such expectations by showing concerns about the slowing of inflation, while also finding the willingness to decouple the balance sheet strategy from the more direct monetary policy. Retail sales, at both the headline and GDP-component levels, likely snapped a two-month decline. The expected 0.4% would offset those declines. Industrial output and manufacturing production appear to be weathering the slower impulses from the auto sector. Small increases are expected. Early readings for August from the Empire and Philly Fed surveys are unlikely to signal a material change in the trajectory of the US economy, which appears to be uninspiring but near trend. |

Economic Events: United States, Week August 14 |

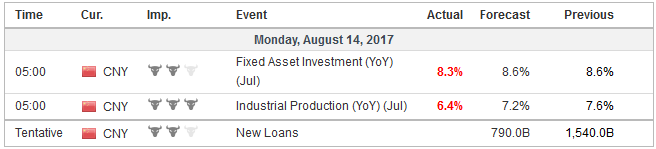

ChinaChina’s official economic metrics have held up better than many had expected so far this year, and surely the yuan’s 4.2% appreciation against the dollar is even more surprising. Still, it appears that perhaps like the eurozone, the Chinese economy has lost some momentum at the start of Q3. Both retail sales and industrial output is expected to slow slightly from the pace reported in June. Aggregate financing is expected to have slowed considerably in July, but caution is advised. Lending typically (without fail since 2002) slows in July from June. Many suspect that efforts are being made to avoid turbulence ahead of the Party Congress in two months. |

Economic Events: China, Week August 14 |

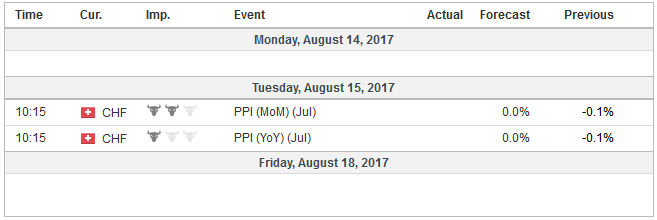

Switzerland |

Economic Events: Switzerland, Week August 14 |

In conclusion, the macroeconomic data on tap are unlikely to sway views on the state of the economies or the trajectory of monetary policy. Without renewed widening of the interest rate differentials, the dollar may struggle to sustain traction, even against sterling. The price action of the Swiss franc may suggest that participants are beginning to see the rhetorical barbs as part of the US declaratory policy, while the operational policy is a different thing. It has held back from its most strident stances (citing China as a currency manipulator, pulling out of NAFTA, NATO as obsolete, steel tariffs on national security grounds, etc.). Still, the US has reportedly signaled new measures directed toward China (intellectual property rights seems to have superseded steel and aluminum as the focus) will be announced as early as August 14.

On the other, the hand, the too frequent use of threats and innuendos will dilute their purchasing power. In the middle of heightened tensions on the Korean peninsula, the US President’s explicitly threat of military force in Venezuela seemed to many to be more bluster and distraction. However, despite China’s previous support for the Maduro government, it is Russia that is making the most strategic inroads, and through Rosneft controls an estimated 13% of Venezuela’s oil exports. At the same time the heated criticisms of the Republican leadership in the Senate, and indications that at least a couple of Republican Senators who have been critical of the President will face sponsored primary challenges makes many unsure that the debt ceiling and spending authorization will be addressed in a timely manner.

The S&P 500 is up nearly 9.5% this year, and that is after last week’s 1.4% drop, the largest in six months. The Dow Jones Industrials gained for 10 consecutive sessions before falling for three sessions starting August 8. Both managed to recover early losses to post minor gains ahead of the weekend. We are watching a gap (from the higher opening on July 12) that is found roughly between 2429 and 2435. If that area does not hold, a more important test on 2400 looms.

Tags: #GBP,#USD,$CNY,$EUR,$JPY,Featured,Korea,newsletter,SPY,Venezuela