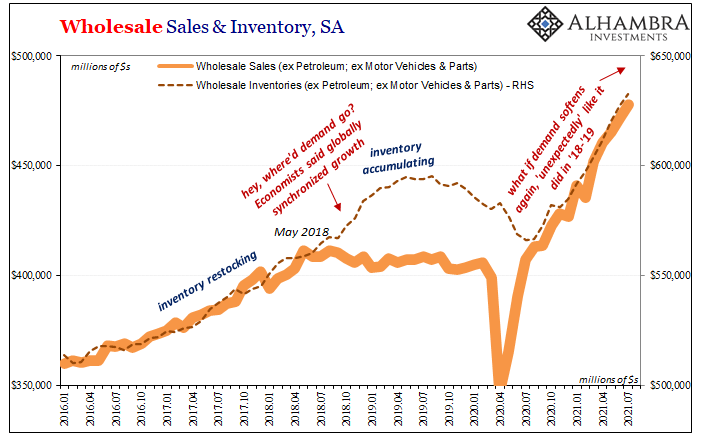

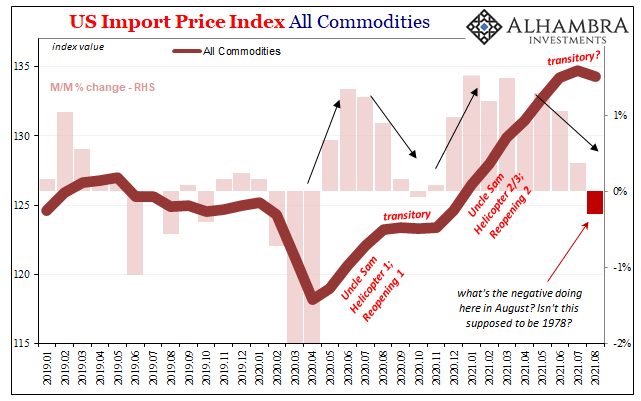

The inventory saga, planetary in its reach. As you’ve heard, American demand for goods supercharged by the federal government’s helicopter combined with a much more limited capacity to rebound in the logistics of the goods economy left a nightmare for supply chains. As we’ve been writing lately, a highly unusual maybe unprecedented inventory cycle resulted (creating “inflation”). The worse the shipping snafus, the more was ordered and piled into it – if for no other reason than to increase the odds of receiving something out of the supply mess particularly before the upcoming Christmas holiday almost everyone believes will be total gangbusters. Believed? . On the other hand, should it not go so smoothly on the demand side, then we’d expect to see softening

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, China, china nbs manufacturing pmi, china nbs non-manufacturing pmi, currencies, economy, exports, Featured, Federal Reserve/Monetary Policy, global trade, Inventory, inventory cycle, manufacturing, Markets, new export orders, new orders, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The inventory saga, planetary in its reach. As you’ve heard, American demand for goods supercharged by the federal government’s helicopter combined with a much more limited capacity to rebound in the logistics of the goods economy left a nightmare for supply chains. As we’ve been writing lately, a highly unusual maybe unprecedented inventory cycle resulted (creating “inflation”).

The worse the shipping snafus, the more was ordered and piled into it – if for no other reason than to increase the odds of receiving something out of the supply mess particularly before the upcoming Christmas holiday almost everyone believes will be total gangbusters. Believed? |

|

| On the other hand, should it not go so smoothly on the demand side, then we’d expect to see softening perhaps more than that for new orders from down at the production level. Retailers and wholesales may have been confident in Uncle Sam’s “stimulus” holding off the worst potential about this rush of inventory, a very different story if demand does not keep to the plan.

The unusual inventory cycle then risks transforming into its classic case more like what used to be of downturn even recession. New orders, then, that’s what to watch. |

|

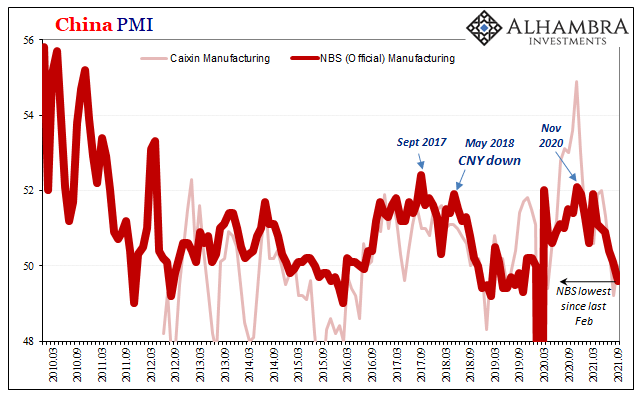

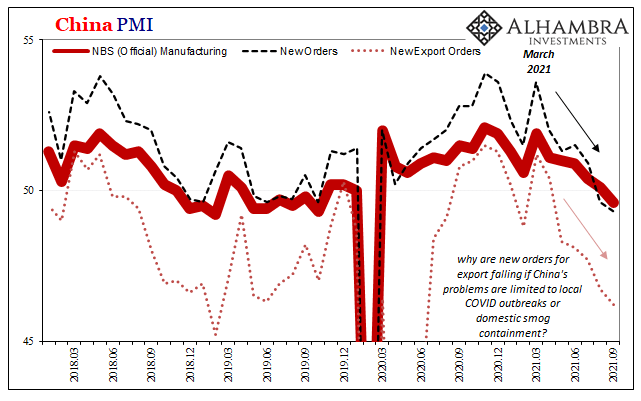

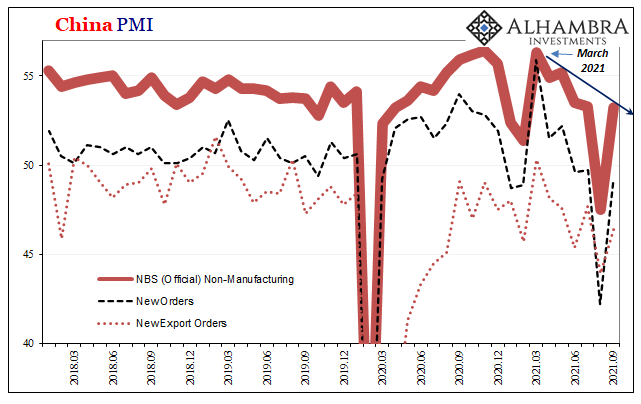

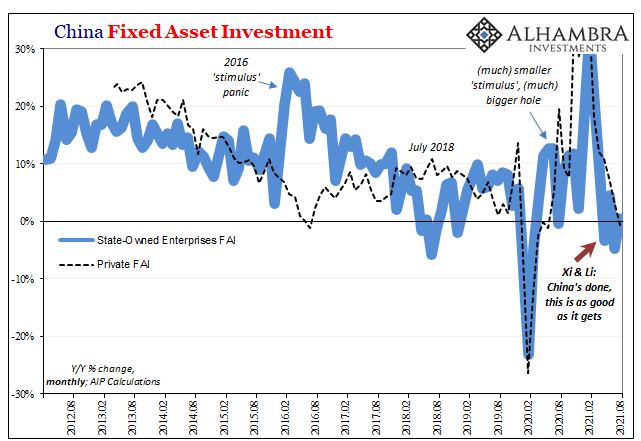

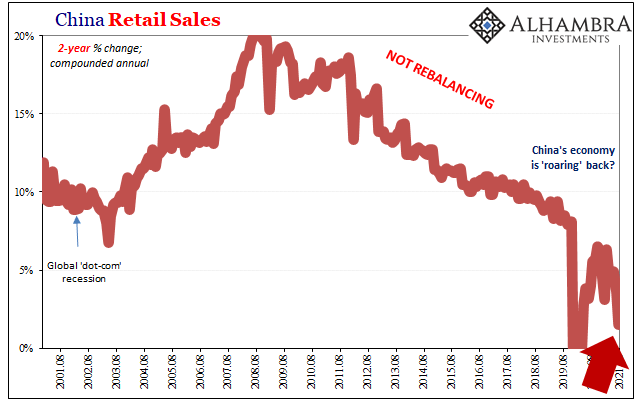

| According to China’s National Bureau of Statistics (NBS) late last night, that country’s official manufacturing PMI dropped under 50 for the first time since February 2020. At 49.6, it’s not how far under fifty – not far – that’s the plain issue, rather the unbroken and ongoing declining trend as well as the timing of its arrival. Like inflation numbers in the US or globally more deflationary bond yields, March and April will still have marked a turning point.The reason for this sub-50 market, to our inventory point, just ugly for…new orders. Such gross colorization includes lessening rather than quickening for both internal Chinese demand (the index of total New Orders for Chinese manufacturers was 49.5) as well as what China’s manufacturers have been trying to send overseas, the United States in particular (the index of orders for export at 49.3). | |

| But that’s just COVID!

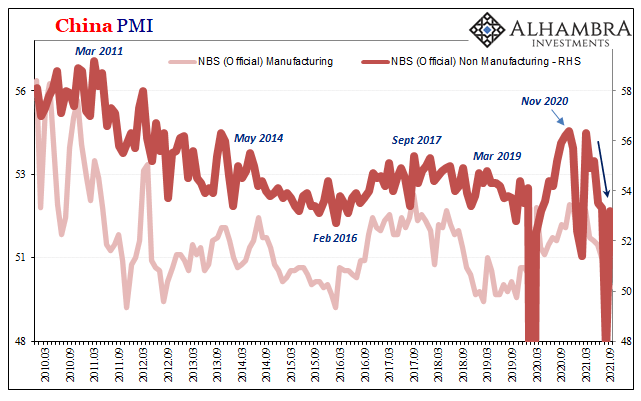

This was certainly the claim for the abysmal numbers in China outside of manufacturing during August. The NBS had put its non-manufacturing index as one of the worst in the entire series. Much of that extreme may, indeed, have been attributable to renewed pandemic measures which, apparently, didn’t spillover into September. The official PMI for services rebounded from that awful low of 47.5 last month to a still-low 53.2 this month. While certainly better, 53.2 is less than July’s 53.5 because being substantially below 50 in new orders – both overall as well as the one for export. |

|

| In other words, if the depth of August’s obscene drop was COVID, then into September that the downtrend continued regardless.

This, then, indicates that the further deterioration in Chinese manufacturing presented by the latest PMI estimates sure wasn’t very likely to have been the coronavirus. If it had been, why no rebound at all? Services reopened up, yet still dented by the weakening economy while manufacturing continues to suffer worse from the same underlying problem. That’s not inflation.But it just might be inventory. Like several regional Fed manufacturing surveys lately, it’s still too early to draw hard conclusions but the possibility keeps rising by the month; by the datapoint no matter where it originates. |

|

| If there is anything somewhat surprising, it’s not that this inventory issue may be working out in this way, rather how quickly it may have come about. In the end, the global economy gets globally synchronized more often than not, just never in legit, inflationary growth. |

Tags: Bonds,China,china nbs manufacturing pmi,china nbs non-manufacturing pmi,currencies,economy,exports,Featured,Federal Reserve/Monetary Policy,global trade,Inventory,inventory cycle,manufacturing,Markets,new export orders,new orders,newsletter