Counterintuitive Moves Something odd happened late in the day in Wednesday’s trading session, which prompted a number of people to mail in comments or ask a question or two. Since we have discussed this issue previously, we decided this was a good opportunity to briefly elaborate on the topic again in these pages. A strong ADP jobs report for March was released on Wednesday, and the gold price dutifully declined...

Read More »LIBOR Pains

Wrong Focus If one searches for news on LIBOR (=London Interbank Offered Rate, i.e., the rate at which banks lend dollars to each other in the euro-dollar market), they are currently dominated by Deutsche Bank getting slapped with a total fine of $775 million for the part it played in manipulating the benchmark rate in collusion with other banks (fine for one count of wire fraud: US$150 m.; additional shakedown by US...

Read More »The Market Has Its Head Buried Deep In The Sand

The Market Has its Head Buried Deep In The Sand Several “black swans” are looming which could inflict a financial nuclear accident on the U.S. markets and financial system. I say “black swans” in quotes because a limited audience is aware of these issues – potentially catastrophic problems that are curiously ignored by the mainstream financial media and financial markets. The most immediate problem is the Treasury...

Read More »Blocher and the People That Ruined the EU

Last weekend, European leaders gathered in Rome for the 60th anniversary of the Treaty of Rome. They discussed, not for the first time, how to get the EU back on track. And they told each other they are still committed to the Union and believe in its future. (We’ve heard that one before, too.) But let’s just suppose that, when the European leaders sat down for lunch at the Quirinal Palace, some of them had a little too...

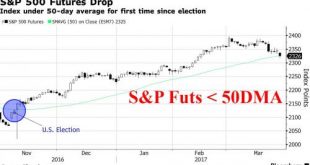

Read More »Global Stocks Slide, S&P Futures Tumble Below 50DMA As “Trump Trade” Collapses

Global stocks are lower across the board to start the week, as concerns about Trump's administration to pull off a material tax reform plan finally emerge, pressuring S&P futures some 20 points lower this morning, following European and Asian shares lower, while crude oil prices fall unable to find support in this weekend's OPEC meeting in Kuwait where a committee recommended to extend oil production cuts by another 6 months. Safe havens including the yen and bonds climbed as did gold,...

Read More »TIC Analysis of Selling

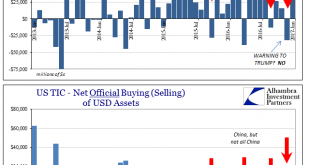

[unable to retrieve full-text content]When the Treasury Department released its Treasury International Capital (TIC) data for December, what was a somewhat obscure report suddenly found mainstream attention. Private foreign investors had sold tens of billions in US securities primarily US Treasury bonds and notes which the media then made into some kind of warning to then-incoming President Trump. It was supposed to be a big deal, the kind of rebuke reserved for disreputable leaders of banana...

Read More »TIC Analysis of Selling

When the Treasury Department released its Treasury International Capital (TIC) data for December, what was a somewhat obscure report suddenly found mainstream attention. Private foreign investors had sold tens of billions in US securities primarily US Treasury bonds and notes which the media then made into some kind of warning to then-incoming President Trump. It was supposed to be a big deal, the kind of rebuke...

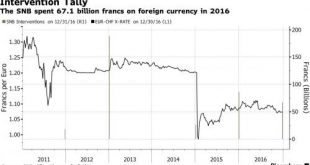

Read More »SNB Spent $68 Billion On Currency Manipulation In 2016

While Donald Trump has repeatedly expressed his displeasure with China for manipulating its currency, he appears to have recently figured out that over the past 2 years Beijing has been spending hundreds of billions in dollar to strengthen, not weaken, the Yuan and to halt the ~$1 trillion in capital flight from China. But while everyone knows that the biggest currency manipulation in the world, and perhaps the Milky...

Read More »Digital Gold – For Now Caveat Emptor

Digital Gold On The Blockchain – For Now Caveat Emptor – Bitcoin surpasses gold price – a psychological and arbitrary headline – Royal Mint blockchain gold asks you to trust in the UK government – Royal Canadian Mint and GoldMoney blockchain product asks you to trust in government and the technology, servers, websites etc of the providers – Invest in a gold mine using cryptocurrency – but wait until 2022 for your gold...

Read More »Gold and the Fed’s Looming Rate Hike in March

Long Term Technical Backdrop Constructive After a challenging Q4 in 2016 in the context of rising bond yields and a stronger US dollar, gold seems to be getting its shine back in Q1. The technical picture is beginning to look a little more constructive and the “reflation trade”, spurred on further by expectations of higher infrastructure spending and tax cuts in the US, has thus far also benefited gold. From a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org