Click to see the video. About a dozen hours after it became clear that a slight majority of the British voters favored leaving the UK, the Financial Times’ John Authers visited me at Brown Brothers Harriman to discuss the initial implications. The situation is very fluid and there are many moving pieces. In Chinese, the characters for crisis are “danger” and “opportunity.” The danger component is the first cut...

Read More »SNB Intervenes during Brexit Turmoil

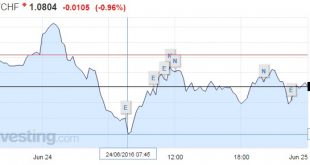

SNB interventions During the Brexit turmoil on Friday, the Swiss National Bank has intervened in markets. Just after they got into the office, at 7.45 am CET, they started the interventions. Apparently the Singapore office did not have a mandate to do interventions. The central bank drove the EUR/CHF price from a low of 1.0646 towards 1.08. FX traders might have moved it higher to 1.0850. We do not think that the...

Read More »Brexit and what if means for the Bank of England

“Some market and economic volatility can be expected as this process unfolds,” Carney said in a televised statement in London after the referendum result. His comments followed Prime Minister David Cameron’s announcement that he will step down this year, which will inject political uncertainty into an already volatile period. His full announcement is below and his statement can be found here: [embedded content]...

Read More »Investitionsmöglichkeiten nach dem Brexit

Welchen Kurs sollen Investoren nach dem Brexit einschlagen? Nach dem "Leave"-Votum der Briten erwarten die Experten von Pioneer Investments kurzfristig ein Risk-Off-Szenario an den Märkten. Sie glauben, dass die Zentralbanken bereit zum Handeln sind und ihren unmittelbaren Fokus auf die Stabilisierung der Märkte legen und sie gegebenenfalls die nötige Liquidität bereitstellen. Die Ereignisse werden...

Read More »FX Daily, June 24: Brexit Sends Shock Waves, SNB Intervenes

SNB interventions During the Brexit turmoil on Friday, the Swiss National Bank has intervened in markets. Just after they got into the office, at 7.45 am CET, they started the interventions. Apparently the Singapore office did not have a mandate to do interventions. The central bank drove the EUR/CHF price from a low of 1.0646 towards 1.08. FX traders might have moved it higher to 1.0850. We do not think that the...

Read More »Brexit shakes global markets and the SMI

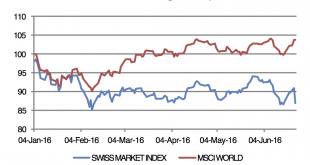

Investec Switzerland. Swiss Market Index The Swiss Market Index (SMI) is set to post a modest gain this week despite confirmation that the UK has decided to leave the European Union. The SMI opened almost 7% lower following the announcement before recovering. The Swiss franc strengthened the most since the Swiss National Bank (SNB) lifted its cap against the euro in 2015. click to enlarge Around...

Read More »UK’s Brexit vote to have wide repercussions, changes economic & market scenarios

By referendum, UK voters have decided the UK should leave the EU. This result leads us to alter our economic and market forecasts Looking at the referendum result in terms of macroeconomics, financial markets and politics, our views are as follows:Macroeconomics. The vote for Brexit is, we believe, likely to reinforce a recent loss of momentum in parts of the UK economy. We believe the result of the referendum will hit consumer and business confidence, at least in the short term. Business...

Read More »Briten sagen Tschüss, Anleger ebenfalls

Foto Pixabay Der Austritt Grossbritanniens aus der EU schickt das Pfund und die Aktienmärkte auf Tauchstation. Premierminister David Cameron hat nach der Abstimmungsniederlage den Rücktritt im Herbst angekündigt. 52% der Briten haben im Referendum für den Austritt Grossbritanniens aus der EU gestimmt. Die Märkte haben darauf das britische Pfund in den Keller geschickt. Die...

Read More »Britain votes to leave EU

All of the votes have been counted. 51.9% of the votes were for “leave”. Voter turnout was 72.2%. Voting was divided. Scotland (62.0% remain) and Northern Ireland (55.8% remain) voted too stay, while England (53.4% leave) and Wales (52.5% leave) voted to leave. © Donfiore | Dreamstime.com In the markets, the pound dropped as low as 1.32 US dollars, 1.20 Euros and 1.29 Swiss francs according to Reuters. By around 9:00 am the pound had moved from these lows to 1.37 US dollars, 1.24 Euros and...

Read More »FX Daily, June 23: R-Day is Here, but Can it Prove Anti-Climactic?

The UK’s referendum is underway. The capital markets are continuing the move that began last week with the murder of UK MP Cox. The tragedy seemed to mark a shift in investor sentiment. Sterling bottomed on June 17 just ahead of $1.40. Earlier today in Asia, after more polls showed a move toward remain, sterlingrallied to almost $1.4845, its highest level since last December. The market continues to put anticipate...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org