Click to see the video. I had the privilege to be on CNBC’s Trading Block show to discuss how the market is positioned for the UK referendum. The markets are strongly anticipating the UK to vote to stay in the EU, even though polls remain very tight. Given that leveraged participants and speculators have rallied sterling more than nine cents from last week’s lows. This makes us wary of the risk that...

Read More »FX Daily, June 22: Markets Consolidate as Table is Set for Referendum

There is a nervous calm in the capital markets today. The focus is squarely on tomorrow’s UK referendum. Brexit According to a BBC focus group, the leeave camp won the debate 39%-34%. The last polls show a contest that it too close to calls in that the results are within the margin of error. The Financial Times poll of polls has it at 45%-44% in favor of Brexit. However, the betting markets appear to be telling a...

Read More »Great Graphic: UK Referendum–Turnout it Key

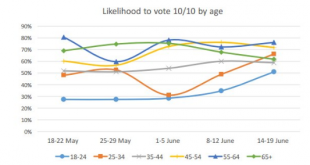

Summary Younger voters are more supportive of the EU. There has been an increase in the intention of younger cohorts to vote. There has been a decline in the intention of some older cohorts to vote. We showed that younger age cohorts in the UK are more inclined to vote to stay in the EU than their elders. However, some suggested that this consideration is blunted by the fact that the younger people are less...

Read More »“Brexit” oder “Bremain”: Fondstrends-Umfrage mit klarem Ergebnis

Bild: Pixelio (Andrea Damm) Die Welt schaut am 23. Juni gespannt nach Grossbritannien. Entscheiden sich die Briten tatsächlich für einen Ausstieg aus der Europäischen Union? Die Fondstrends-Umfrage zeigt ein deutlicheres Bild als die Meinungsumfragen auf der Insel. Seit Monaten schwebt der "Brexit", also der mögliche Austritt Grossbritanniens aus der EU, wie ein Damoklesschwert über...

Read More »Great Graphic: Age and Brexit

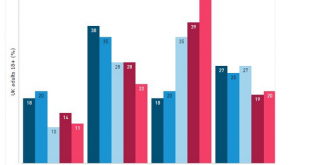

The betting and events markets have shifted more decisively than the polls in favor of the UK to remain in the EU. Sterling extended its rally from $1.4010 last Thursday to nearly $1.4785 today, as the market participants adjust positions. What is particular striking is that the asymmetrical perceptions of the personal impact of a vote to leave the EU. The Great Graphic here was posted on Business Insider,...

Read More »FX Weekly Preview: It is All about Europe

Major data this week: German Constitutional Court ruling on OMT. UK referendum. EMU flash PMI. ECB TLTRO II launch. Yellen testifies before Congress, RBI Rajan to step down in early Sept. The Chair of the Federal Reserve testifies before Congress on Tuesday and Wednesday. Given the recent FOMC meeting and Yellen’s press conference, it is unlikely new ground will be broken. It is difficult for the market to price out...

Read More »FX Daily, June 17: Martyrdom of Cox Acts as Catharsis

The assassination of Jo Cox, a member of the UK parliament is a personal and political tragedy. Her needless death provided an inflection point. The suspension of the referendum campaigns and a steady stream of reports and speeches has the emotionalism of contest freeze. Investors quickly understood that the Cox’s death injected a new unknown into the forces that seemed to build toward a decision to leave the EU....

Read More »Swiss stocks tumble and franc rises on Brexit fears

Investec Switzerland. The Swiss Market Index (SMI) is set to post one of its largest falls since February this week as growing uncertainty around the result of Britain’s referendum on its membership of the 28-nation European Union bloc led to a global sell-off of company shares. © Evgenyi Gromov | Dreamstime.com Stocks around the world tumbled and demand for safe haven assets sent sovereign bond yields to record lows as new opinion polls fueled anxiety that the UK will...

Read More »Brexit und Spanien wirken verunsichernd auf den ETF-Markt

Im Mai 2016 waren die Zuflüsse in den europäischen ETF-Markt vergleichsweise begrenzt. Die Nettomittelzuflüsse betrugen im Mai 1,7 Milliarden Euro. Seit Jahresbeginn summieren sie sich auf 10,6 Milliarden Euro, was lediglich einem Drittel der Zuflüsse während der ersten fünf Monate des Jahres 2015 entspricht. Dies geht aus dem Lyxor ETF Barometer hervor. Das gesamte in ETFs...

Read More »“Brexit”: Mehrheit befürchtet negativen Einfluss auf britische Assets

Bild: Pixelio Ein "Brexit" hätte mit hoher Wahrscheinlichkeit einen negativen Einfluss auf britische Aktien, Bonds und andere Assets sowie auf das Pfund Sterling. Dies ergab eine weltweite Umfrage mit 1’750 Mitgliedern von CFA Institute, wovon 75% ausserhalb Grossbritanniens domiziliert sind. 71% der Umfrageteilnehmer meinen, dass britische Portfolios generell im Falle eines Brexits...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org