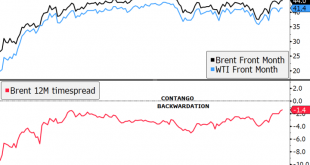

Covid vaccine results from AstraZeneca and Oxford University brought another wave of optimism; dollar weakness has resumed; that said, we will refrain from making any longer-term calls for the demise of the dollar Reports suggest President-elect Biden is pushing House Democrats to reduce the size of their fiscal package demands to unlock negotiations; Republicans have an interest in compromising President-elect Biden has reportedly picked his diplomatic team; it’s a...

Read More »EM Preview for the Week Ahead

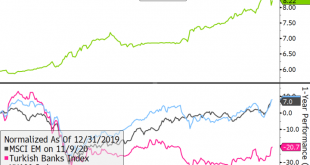

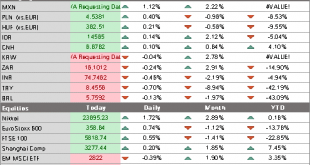

Most EM currencies were up last week, once again taking advantage of broad dollar weakness. In addition, EM equities also performed well, with MSCI EM up for the third week in a row and for seven of the past eight. We expect EM assets to continue benefiting from the global liquidity story as well as the weak dollar trend. AMERICAS Brazil reports mid-November IPCA inflation Tuesday. Inflation is expected at 4.15% y/y vs. 3.52% in mid-October. If so, this would be the...

Read More »Dollar Bounce Likely to Fade

The negative virus news stream is taking a toll on market sentiment; the dollar is benefiting from the risk-off price action but is likely to fade Weekly jobless claims data will be of interest; Fed manufacturing surveys for November will continue to roll out; Judy Shelton’s Fed confirmation is looking less and less likely The row about EU funding takes center stage today as leaders hold a conference call to iron out their differences; UK CBI November industrial...

Read More »Dollar Weakness Continues Ahead of US Retail Sales Data

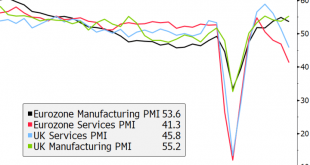

The dollar continues to soften October retail sales will be the US data highlight; Fed manufacturing surveys for November have started to roll out; Republican Senator Alexander opposes Judy Shelton’s nomination to the Fed Newswires reported (again) that a Brexit deal is at hand; Hungary and Poland will veto the EU budget and recovery fund; ECB signaled that they are focused on asset purchases and long-term funding for the next round of stimulus; Hungary is expected...

Read More »Dollar Soft as Markets Start the Week in Risk-On Mode

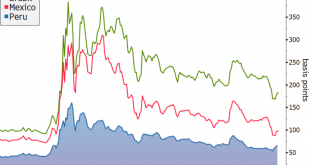

The odds of national-level action in the US against the second wave virus outbreak remains small, even after Biden takes over; the dollar continues to soften There is growing speculation about former Fed Chair Yellen becoming Biden’s Treasury Secretary; Fed manufacturing surveys for November will start to roll out; Peru’s interim President Merino resigned under pressure from more demonstrations Several UK MPs and Prime Minister Johnson were forced to isolate due to a...

Read More »Drivers for the Week Ahead

The virus numbers in the US show no signs of slowing; the dollar should continue to soften October retail sales Tuesday will be the US data highlight for the week; Fed manufacturing surveys for November will start to roll out; the Senate will hold a procedural vote this week to advance Judy Shelton’s nomination to the Fed Board of Governors Canada has an important data week; Brexit talks will (hopefully) wind up soon; UK reports key data Japan and Australia have...

Read More »Dollar Softens Ahead of CPI Data

Pressure on the dollar has resumed; October CPI data will be the US highlight; US bond market was closed yesterday but yields have eased a bit today Weekly jobless claims data will be reported; monthly budget statement for October will hold some interest; Mexico is expected to cut rates 25 bp to 4.0%; Peru is expected to keep rates steady at 0.25% UK Q3 GDP rebounded strongly but September data show a loss of momentum; Brexit talks remain unresolved; the domestic...

Read More »Dollar Consolidates, Weakness to Resume

Despite rising infections worldwide, the virus news stream has turned positive; the dollar is consolidating its gains today With the 10-year yield rising to near 1.0%, US financial conditions are tightening; the Fed released its Financial Stability report yesterday and it pulled no punches; with the Fed media embargo over, many officials will speak today UK House of Lords altered the Internal Market Bill; UK employment numbers were slightly better than expected;...

Read More »Dollar Soft as Risk On Sentiment Dominates Ahead of FOMC Decision

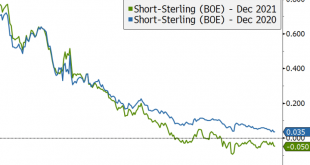

Dollar weakness has resumed as risk on sentiment dominates; the US election outcome is starting to take shape Senate Majority Leader McConnell said passing a stimulus bill is a top priority during the lame duck session; the two day FOMC meeting concludes today with a likely dovish hold; weekly jobless claims will be reported BOE increased its asset purchases by GBP150 bln vs. GBP100 bln expected; UK government is due to announce more details of the growing fiscal...

Read More »Markets Gyrate Ahead of Protracted Period of Uncertainty

Markets likely facing an extended period of uncertainty; the dollar is seeing some safe haven bid but is well off its highs Despite President Trump’s claim of victory and his call to halt vote counting and go to the Supreme Court, it’s important to emphasize that the election is simply not over yet; asset prices are sending a cacophony of signals as investors struggle to price multiple possibilities The two day FOMC meeting starts today and concludes with a likely...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org