After several months of heated market speculation, to Amazon’s chagrin the question of which stock would be the first to reach trillion in market capitalization was answered when Apple reported strong Q2 results (which included billion in stock buybacks) and its stock soared 9% this week, rising above the very round number and elevating its YTD gain to 23% (Amazon, with a market cap of just under 0 billion, will most likely be second). To Goldman, however, that was the “wrong trillion question.” Instead, The correct trillion question according to the bank’s chief equity strategist David Kostin, is: what amount of buyback will companies authorize in 2018? Three weeks ago, we reported that according to

Topics:

Tyler Durden considers the following as important: 7) Markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

After several months of heated market speculation, to Amazon’s chagrin the question of which stock would be the first to reach $1 trillion in market capitalization was answered when Apple reported strong Q2 results (which included $21 billion in stock buybacks) and its stock soared 9% this week, rising above the very round number and elevating its YTD gain to 23% (Amazon, with a market cap of just under $900 billion, will most likely be second).

To Goldman, however, that was the “wrong $1 trillion question.” Instead, The correct $1 trillion question according to the bank’s chief equity strategist David Kostin, is: what amount of buyback will companies authorize in 2018?

Three weeks ago, we reported that according to TrimTabs calculations, buyback announcements swelled to a record $436.6 billion in the second quarter, smashing the previous record of $242.1 billion set just one quarter earlier, in Q1. Combined, this brings the first half total at a ridiculous $680 billion. We calculated that annualized, this number amounts to a staggering $1.35 trillion.

To be sure, that particular extrapolation may be a little extreme, or maybe not because just a few weeks later, repurchase authorizations have surged by 80% YTD and are now almost $100 billion greater, totaling $754 billion.

| As a result, Kostin writes that Goldman’s buyback desk this week increased its estimate of 2018 stock buyback authorizations to a record $1.0 trillion – a result of tax reform and strong cash flow growth – which would represent a 46% rise from last year. |

Annual US Share Buyback Activity, 2000 - 2018 |

| And hers is the kicker: whereas some traders have voiced caution that August has in recent years been the month with the highest seasonal volatility, and could therefore surprise to the downside, especially with virtually non-existent liquidity… |

VIX Seasonals, January - December |

| … Goldman has a far more optimistic take on what’s in story: “August is the most popular month for repurchase executions, accounting for 13% of annual activity.”

The reason: with over 80% of the S&P having reported, the buyback blackout period has now ended for most companies and may resume repurchasing stock after being on hiatus for the past month. |

Percent of Annual Corporate Repurchase Spend, January - December |

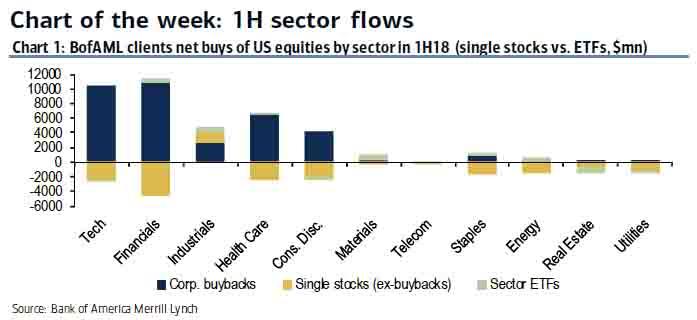

| And, as Bank of America noted one month ago, buybacks represent the only source of demand for shares given most other ownership categories are net sellers of stocks (households, mutual funds, pension funds). |

1H Sector Flows in 2018 |

For Goldman, the coming buyback deluge will also be sufficient to offset any potential follow through selling in the FAANG, or tech sector, following disappointing results from Facebook, Netflix and Twitter. Here’s Kostin”

But a number of different portfolio strategists declared this week that a correction in the US equity market is imminent. According to various news articles, the strategists each point to the Information Technology sector as a source of the problem. The bears argue that positioning in the sector is “crowded,” the sector is overvalued, growth has peaked, and 2Q results will lead to a sharp decline in long-term growth prospects, with devastating consequences for stocks as highlighted by the plunge in FB shares after it cut guidance last week.

Kostin concedes that, indeed, the nosebleed growth rate of recent years may now be history as “the rate of earnings growth has certainly peaked as the surge in profits from the initial cut in tax rate was always going to be most pronounced in 2018.” Furthermore, “glamour” stocks tend to disappoint investors when the lofty growth rates embedded in valuations turn out to be unachievable (even if as Goldman calculates, the the consensus forecast for 2019 Tech sector EPS has actually increased by 1% since the start of earnings season).

But where Goldman is confident is in its claim, which it initially made last week, that tech names are not nearly as overowned as some claim (even though Goldman’s own hedge fund tracker shows that tech names represent the bulk of hedge fund holdings as of Q1):

Our analysis of $2 trillion of mutual fund holdings shows large cap funds have a 217 bp overweight tilt in the Tech sector relative to their respective benchmarks. While this is the largest tilt among sectors, it is a smaller overweight than funds held during the last two years. Similarly, our analysis of public filings covering $2.3 trillion of hedge fund gross exposure shows funds have 25% net exposure to Tech stocks, an 84 bp tilt vs. the Russell 3000 that has actually declined from levels in 2016 and 2017. The Goldman Sachs Prime Services Weekly shows clients have 26% net exposure to the Tech sector. Our data and analysis conflict with the Bloomberg story this week in which another bank proclaimed its hedge fund clients have 46% net exposure to Tech.

However, whether one believes Goldman’s positioning claim or not – and with AAPL even the Swiss National Bank’s top holding, it’s ok to be skeptical that there are incremental buyers – is irrelevant, because a price indescriminate buyer is about to be unleashed in the tech space. No, not the Fed – the companies themselves:

While Tech has accounted for 40% of YTD repurchase authorizations, the sector only represents 21% of YTD executions. By extension, significant potential demand remains for Tech shares as firms look to complete their existing programs

And of this coming buybacks deluge, the bulk will of course be AAPL.

In parting, Goldman reverts back to the original question, and in a somewhat more downbeat preview, writes that another strategically important but more bearish $1 trillion question relates to the US government’s fiscal balance.

The US Congressional Budget Office now forecasts that the first annual deficit in excess of $1 trillion will be reached in 2020.

Actually, based on the accelerating net debt issuance by the US Treasury, which just announced an increase to new Treasury auctions this quarter, that particular target will be hit sooner; this particular trillion, Goldman concludes, could indicate a number of risks for investors, “including the possibility that interest rates rise more rapidly than expected and weigh on equity valuations.” That is, unless Trump manages to make it clear to Fed Chair Powell just how displeased he would be if the Fed continues its tightening path..

Tags: Featured,newsletter