Modern central banks have already moved far beyond what was once considered the proper role for a central bank as a “lender of last resort.” Now Keynesians and MMTers (modern monetary theorists) want to take things even further. As the COVID-19 pandemic and the consequent freezing of economic activity take place, many economists are hoping for central bankers and monetary policy to take the lead and steer the economy. However, this cannot possibly be the...

Read More »The Pandemic Exposed the Frailty of the Financial System

Despite the more optimistic claims of political pundits and Federal Reserve officials (Jerome Powell, specifically), things are far from being under control. Notwithstanding archetypal Austrian objections to “loose” monetary and fiscal policies on the grounds that they create production structures that ultimately deplete the pool of real savings, the operational failures of central banks cross-globally are largely nested in faulty axioms. Intellectually corrupt...

Read More »What Is the Good Entrepreneur to Do?

In a January 2020 Forbes Magazine article titled “Why Doing Good Is Good For Business” clearly left out critical information: who is the good or bad entrepreneur? According to the author, good entrepreneurs are doing good if their primary objective is not to make a profit. And bad entrepreneurs are doing bad if their primary objective is to make a profit. Basically, the author suggested that, to be good, a business should not pursue profit and, along with it,...

Read More »The Bureaucrats Can’t Fix This

In the midst of the emerging economic chaos triggered by the COVID-19 coronavirus, individuals are seeking answers from governments as to how to prevent the emerging economic disaster. Most economic experts are sympathetic to this and are urging the authorities to push massive injections of money. Thus in the US the central bank has embarked on a $2 trillion stimulus. At the same time government officials are imposing draconian measures to keep the population in...

Read More »The Crisis Has Exposed the Damage Done By Government Regulations

As we watch in real-time how governments respond to the novel coronavirus pandemic, some of the most predictable forms of state overreach—from restrictions on the freedom of assembly to the suppression of regular commerce—have been rolled out. Thankfully, there is no unified world government, so there exist various examples of how certain countries are dealing with the crisis that we can closely examine and learn from. Pessimism and cynicism are generally warranted...

Read More »End the Shutdown

The shutdown of the American economy by government decree should end. The lasting and far-reaching harms caused by this authoritarian precedent far outweigh those caused by the COVID-19 virus. The American people—individuals, families, businesses—must decide for themselves how and when to reopen society and return to their daily lives. Neither the Trump administration nor Congress has the legal authority to shut down American life absent at least baseline due...

Read More »Oren Cass and the Conservative Critique of Pure Laissez-Faire

Oren Cass is the executive director of American Compass (AmericanCompass.org), a conservative think tank that stresses the importance of family and domestic industry, in opposition to a singleminded devotion to economic efficiency. Cass was previously a senior fellow at the Manhattan Institute for Policy Research, and was the domestic policy director for Mitt Romney’s 2012 presidential campaign. Bob and Oren have a friendly discussion about their disagreements on...

Read More »The Last Thing We Need Right Now Is Bernie’s Proposed Tax on Financial Transactions

When one imagines working on Wall Street, he envisions stock traders scrambling to place buy or sell orders, perhaps even some puts or options. Today’s powerful artificial intelligence tools allow traders to game stock market trading. In some ways, this computer-driven high-frequency trading resembles actual gaming in that it may seem as if one is simulating various trading scenarios. Unexpectedly, politicians view this sort of behavior as providing little value to...

Read More »Diversification versus Risk

It is widely held that financial asset prices fully reflect all available and relevant information, and that adjustments to new information is virtually instantaneous. This way of thinking which is known as the Efficient Market Hypothesis (EMH) is closely linked with the modern portfolio theory (MPT), which postulates that market participants are at least as good at price forecasting as any model that a financial market scholar can come up with, given the available...

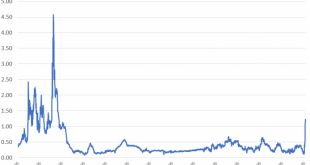

Read More »Central Bankers Are Running Out of Options

Corona fears have shifted the world’s central banks into hyperdrive. Talk more, do more, lend more—and buy everything that moves. One after the other, the major central banks took to the barricades, manned the canons, fired their bazookas, and every other military metaphor you can think of. Nobody stopped to think whether the policies that they quickly and loudly announced would work. Nobody investigated whether they could be prevented from reaching their...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org