Medicare for All is listed as the top priority of Democratic presidential candidate Bernie Sanders. He describes it as a single-payer system that is “free at the point of service” as there will be no premiums, deductibles, copays, or surprise bills. It will cover more services (dental, hearing, vision, long-term care, substance abuse treatment, etc.) than what the present Medicare system covers. It will also stop the “pharmaceutical industry from ripping off the...

Read More »The “Market Monetarists” and NGDP Targeting

[This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in late 2020.] In addition to the Keynesian perspective (covered in chapter 14), a relatively new challenge to the Austrian framework comes from the “market monetarists” and their endorsement of a central bank policy of “level targeting” of nominal gross domestic product (sometimes abbreviated as NGDPLT1). Although not as widespread as the...

Read More »If China Is the Problem, Can’t We At Least Have Free Trade with Everyone Else?

It remains unclear how much the stock market implosion of recent days will affect the larger economy. As David Stockman has noted often, the Wall Street economy is not synonymous with the Main Street economy, contrary to what the advocates of rampant bank bailouts and financialization would have us believe. Nevertheless, fear of a general crisis has driven Donald Trump to hint that tax cuts should be on the table. That’s good news, and the first place Trump should...

Read More »Why Sweden’s Negative Interest Rate Experiment Is a Failure

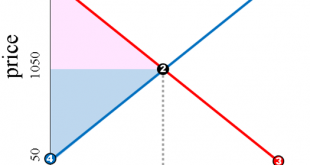

According to the Financial Times’s February 20 article “Why Sweden Ditched Its Negative Rate Experiment,” economists are pondering whether Sweden’s central bank experiment with negative interest rate was a success. Sweden’s Riksbank, the world’s oldest central bank, introduced negative interest rates in early 2015. The reason given by central bank policymakers for the introduction of the negative interest was to counter deflation. Note that for the period November...

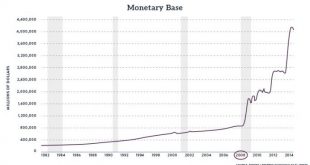

Read More »What Comes After Quantitative Easing?

[In the second part of this interview, Brazilian journalist André de Godoy speaks with Antony Mueller about the relationship between credit and money, the inflationary process, and its relation to the real economy. How will the current debt binge end? What comes after Quantitative Easing?] André de Godoy: Ludwig von Mises mentions in his books that credit expansion is one of the causes of the inflation beyond the monetary expansion. What are the similarities and...

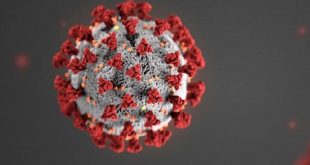

Read More »What Would Murray Say About the Coronavirus?

Murray Rothbard died in January 1995, long before this year’s coronavirus scare. But the principles this great thinker taught us can help us answer questions about the coronavirus outbreak which trouble many of us. Would the US government be justified in imposing massive involuntary quarantines in order to slow down the spread of disease? What about vaccines? If government scientists claim that they have discovered a vaccine for the coronavirus, should we take it? If...

Read More »The US Constitution Needs an Expiration Date

A unique feature of the Swiss Federal Constitution is the fact that the central government’s power to impose direct taxes on citizens expires every decade or so. In fact, the current taxing authority expires at the end of 2020. Fortunately for the Swiss republic’s central government, voters approved an extension (the “New Financial Regime 2021“) for another fifteen years in a March 2018 election. This was not a big surprise, since voters have approved extensions of...

Read More »“Heritage” Designation of Old Buildings Is Both Wasteful and Arbitrary

An old red barn in London, Ontario was recently given heritage protection by City Council. Two days later, after dark, the barn was demolished. Owner John McLeod, citing legal advice, wouldn’t comment when asked if he’d demolished the barn but said, “I’m delighted that it’s down.” McLeod had fought the heritage designation for the Byron barn, calling the push for it at city hall “complete stupidity.” City Hall responded to the demolition by issuing a stop work...

Read More »Christine Lagarde’s New Vision for the ECB

On December 12, Christine Lagarde introduced her goals and vision in her first rate-setting meeting as the new president of the European Central Bank (ECB). On the actual policy front, there were no surprises. She remained committed to the path set by her predecessor, Mario Draghi, and kept the current monetary stimulus unchanged. The central bank kept its deposit rate at the present record-low –0.5 percent and pledged to continue its €20 billion bond purchases every...

Read More »Governments Are Using the Coronavirus to Distract From Their Own Failures

The Johns Hopkins University Coronavirus Global Cases Monitor shows that the mortality rate of the epidemic is very low. At the writing of this article,1 there have been 92,818 cases, 3,195 deaths, and 48,201 recoveries. It is normal for the media to focus on the first two figures, but I think that it is important to remember the last one. The recovered figure is more than ten times the deceased one. This should not make the reader ignore the epidemic, but it is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org