[This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in late 2020.] Starting with Carl Menger’s undisputed role in the “marginal revolution,” which ushered in subjective value theory, the Austrian school has made important contributions that have been absorbed into standard economic theory. However, the Austrian theory of the business cycle is still something unique to the school, differing not...

Read More »More Protectionism and Regulation Won’t Fix the Economy

In the wake of the COVID-19 pandemic and its attendant economic strains, some protectionists and anti-immigration ideologues are trying to take advantage of this opportunity to advance their nationalist agenda. They argue that if the United States had restricted international trade and immigration more thoroughly in the past, as President Trump had fought to achieve, the public health crisis could have been curtailed. Some are also arguing that imposing further...

Read More »Three Reasons Why the Eurozone Recovery Will Be Poor

The eurozone economy is expected to collapse in 2020. In countries such as Spain and Italy, the decline, more than 9 percent, will likely be much larger than in emerging market economies. However, the key is to understand how and when the eurozone economies will recover. There are three reasons why we should be concerned: The eurozone was already in a severe slowdown in 2019. Despite massive fiscal and monetary stimulus, negative rates, and the European Central...

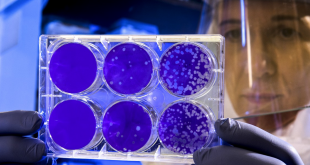

Read More »How the Corona Crisis Differs from the 2008–2009 Financial Crisis

[unable to retrieve full-text content]There are several important differences between the global financial crisis of 2007–08 (GFC) and the coronavirus crisis (CC). Origin and Nature of the Crisis. The GFC resulted from financial imbalances, primarily the housing bubble, while the CC was triggered by the external negative shock (the pandemic and the following economic shutdown) that dramatically reduced the labor supply.

Read More »When Governments Switched Their Story from “Flatten the Curve” to “Lockdown until Vaccine”

In the early days of the COVID-19 panic—back in mid-March—articles began to appear pushing the idea of “flattening the curve” (the Washington Post ran an article called “Flatten the Curve” on March 14). This idea was premised on spreading out the total number of COVID-19 infections over time, so as to not overburden the healthcare infrastructure. A March 11 article for Statnews, summed it up: “I think the whole notion of flattening the curve is to slow things down so...

Read More »The Global Airline Industry Is in Even Worse Shape Than You Think

The economic impact of the COVID-19 pandemic has reached all productive sectors. The massive spread of the virus and social distancing measures have led to a dramatic decrease in economic activity. The aviation industry, vital for tourism and business, has been hit hard. Investors and analysts state that this crisis could be worse than the one that followed the SARS outbreak in 2003 and the one after 9/11. In this article we will describe how the future of airlines...

Read More »Police Are Complicit in Politicians’ Disregard for the Rule of Law

People of a certain age might remember the old John Birch Society slogan “Support your local police!” The idea here is that your local policeman is a liberty-loving buddy of yours who would only ever support just laws and constitutional mandates. Only those bad guys in the FBI or BATF would ever consider violating your rights. Now, obviously that has always been a rather naïve fantasy, but the notion certainly has a long history of support among American...

Read More »Some Insightful Entrepreneurs Planned for a Pandemic

Listen to the Audio Mises Wire version of this article. Does a pandemic trump entrepreneurial foresight? Many in business will say yes, “nobody saw this coming.” Lack of customer demand and government lockdowns are “no fault of their own.” But Penny Chutima, co-owner of the Lotus of Siam restaurant, did see it coming. Chutima and her mother, Saipin, have operated the off-Strip Las Vegas staple for years. Saipin opened the original location with her husband in 1999....

Read More »Be Thankful for Those Who “Only Do It for the Money”

At least since I first read George Orwell’s Politics and the English Language, I have been a student of the use of weasel words. I have joined what he called the “struggle against the abuse of language,” because “Political language…is designed to make lies sound truthful…and to give an appearance of solidity to pure wind.” I even found the phrase’s origins interesting. As explained by phrases.org, “It has long been a widespread belief that weasels suck the yolks...

Read More »Money Creation – Not Low Interest Rates – Is Behind the Boom-Bust Cycle

[unable to retrieve full-text content]In a recent article entitled “Where Are All the Austrian Scholars' Yachts?” John Tamny has criticized Austrian economists, and Mark Thornton in particular, for their skepticism regarding the relatively “ebullient stock market” in the midst of the pandemic. Mark Thornton responded to Tamny’s main argument in an earlier post. In this post, I will address two serious errors that underlie Tamny’s argument.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org