◆ “Gold is the perfect piggy bank – it’s the anchor of trust for the financial system” says the Central Bank of the Netherlands ◆ “If the system collapses, the gold stock can serve as a basis to build it up again” astutely and prudently observes the Dutch Central Bank ◆ The Dutch people “hold more than 600 tonnes of gold. A bar of gold always retains its value, crisis or no crisis” ◆ “Gold bolsters confidence in the stability of the central bank’s balance sheet and...

Read More »Motte and Bailey Fallacy, Report 13 Oct

This week, we will delve into something really abstract. Not like monetary economics, which is so simple even a caveman can do it. A Clever Ruse We refer to a clever rhetorical trick. It’s when someone makes a broad and important assertion, in very general terms. But when challenged, the assertion is switched for one that is entirely uncontroversial but also narrow and unimportant. The trick is intended to foreclose debate of the broad assertion, not really to...

Read More »Gold ETFs See Holdings Reach All Time Record Highs In September

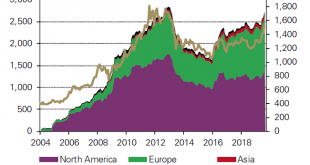

◆ Global gold ETF holdings reach all time record highs, increasing by 13.4% so far in 2019 on hedging and safe haven demand ◆ Global gold ETFs, ETCs and similar products had US$3.9bn of net inflows across all regions, increasing their collective gold holdings by 75.2 tonnes(t) to 2,808t, the highest levels of all time in September ◆ Gold ETF holdings have surpassed late 2012 levels, at which time the gold price was near US$1,700/oz, 18% higher than current levels. ◆...

Read More »China’s Central Bank Buys 100 Tons Of Gold As Trade and Dollar Tensions With U.S. Escalate

◆ China has added more than 100 tons of gold bullion bars to its gold reserves since it resumed buying in December; China’s gold holdings rose to 62.64m ounces in September, an increase of 190,000 ounces in one month ◆ The People’s Bank of China (PBOC) increased it’s gold reserves for a 10th straight month in September, reinforcing its standing as one of the major official accumulators as many creditor nation central banks stock up on the precious metal ◆ China and...

Read More »Chinese Buy Gold In Large Volume In Holiday Week as Gold Jewelry Sales ‘Soar’

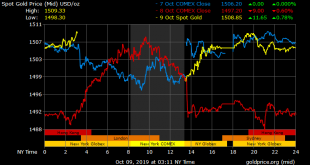

◆ Gold is marginally lower today at $1,503/oz and stocks are mixed ahead of what are set to be tense U.S. and China trade negotiations. ◆ Gold sales are expected to accelerate through the end of the year due to weakening global economic conditions, according to Mike McGlone, a Bloomberg Intelligence senior commodity strategist as quoted by China Daily (see below) ◆ Gold buying in China has fallen 3.3 (yoy) to 523.54 metric tons as safe haven buying of gold bars and...

Read More »A Wealth Tax Consumes Capital, Report 6 Oct

It seems one cannot make a name for one’s self on the Left, unless one has a proposal to tax wealth. Academics like Tomas Piketty have proposed it. And now the Democratic candidates for president in the US propose it too, while Jeremy Corbyn proposes it in the UK. Venezuela finally added a wealth tax in July. A Wealth Tax So how does a wealth tax work? The politicians quibble among themselves, as if the little implementation details that differ between them are...

Read More »The Purchasing Power of Capital, Report 29 Sep

We discuss capital consumption all the time, because it is the megatrend of our era. However, capital consumption is an abstract idea. So let’s consider some concrete examples, to help make it clearer. Flipping Homes, Consuming Capital First, let’s look at the case of Timothy Housetrader. Tim has a small two-bedroom house. Next door, his neighbor Ian Idjit, owns a four-bedroom house which is twice the size. For some reason, Ian offers to trade houses with Tim. Both...

Read More »World’s Largest Gold ETF Sees Holdings Rise 1.8 percent to 924.94 Tonnes In One Day

◆ Gold prices have inched 0.3% higher today as a sharp drop of nearly 2% yesterday has attracted bargain hunters ◆ Gold tested support at $1,500/oz after another peculiar sell off in the futures market saw prices fall $30 in two hours on the COMEX yesterday with most of the selling coming after European and London markets had closed ◆ The sell off came despite robust demand for gold globally as seen in the world’s largest gold ETF seeing yesterday, in just one day,...

Read More »Gold At 3 Week High As Stocks and Dollar Fall On Trump’s Hard Line Stance Against Iran and China

◆ Gold has edged higher to reach three week highs at $1,535/oz today after Trump took a hard-line stance on China and Iran during his U.N. speech ◆ Stocks fell in the U.S. yesterday and today in Europe on increasing political turmoil in the U.S. and the UK; Concerns about the global economy and the outlook for stocks is enhancing gold’s safe haven appeal ◆ Palladium has surged to an all time record high and we expect gold and silver to follow suit in the...

Read More »Treasury Bond Backwardation, Report 22 Sep

Something happened in the credit market this week. A Barron’s article about it began: “There have been disruptions in the plumbing of U.S. markets this week. While the process of fixing them was bumpy, it was more of a technical mishap than a cause for investor concern.” Keep Calm and Carry On So, before they tell us what happened, they tell us it’s just plumbing, it’s been fixed, and that we should not be concerned. The article asserts that the reasons for the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org