How do business cycles end? In the US, conventional wisdom is that they are murdered by the Federal Reserve. It is too slow to raise rates and then goes too quickly. This view is espoused by numerous well-respected economists and policymakers. President Trump’s criticism of the Federal Reserve is anchored by such views. America’s ambivalence toward a central bank is around 200-year old. It was the Panic of 1893 that...

Read More »FX Daily, January 16: Markets are Eerily Calm

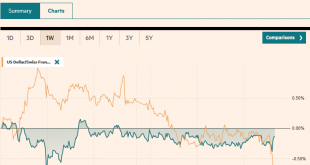

Swiss Franc The Euro has risen by 0.14% at 1.1286 EUR/CHF and USD/CHF, January 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is an eerie calm over in the capital market through the European morning today despite some ostensibly worrisome developments. While many, like ourselves, expect UK Prime Minister May to survive a vote of confidence, it hardly...

Read More »Cool Video: Brexit–Now What?

Marc Chandler, Wilf Frost, and Sara Eisen on the CNBC - Click to enlarge I joined Wilf Frost, and Sara Eisen on the CNBC set at the NYSE shortly after the House of Commons delivered an unprecedented defeat to UK Prime Minister May. Catherine Mann (Citi) and Christopher Smart (Barings). The guests generally agreed that a delay in Brexit was likely. Here is a distillation of my thoughts. Not all made into the video clip...

Read More »FX Daily, January 15: New Phase Begins with UK Vote

Swiss Franc The Euro has risen by 0.17% at 1.1272 EUR/CHF and USD/CHF, January 15(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Several of the equity benchmarks are flirting with six-week highs, including MSCI Asia Pacific Index and the Emerging Markets Index. The Dow Jones Stoxx 600 is trying to extend its advancing streak for a third week, something not...

Read More »FX Daily, January 14: Dismal Chinese Trade Data Sets Tone

Swiss Franc The Euro has fallen by 0.33% at 1.1248 EUR/CHF and USD/CHF, January 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: China’s exports and imports were weaker than expected, though the trade surplus swelled to its widest in a couple of years. The implications have undermined equities and weighed on risk appetites more broadly. Nearly all the...

Read More »FX Weekly Preview: Europe Moves to the Center Ring

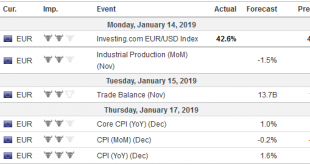

In recent weeks, the macro story focused on the shifting outlook for Fed policy and the Sino-American trade relationship. There is unlikely to be further progress on either issue in the week ahead. The Fed won’t raise interest rates until toward the middle of the year at the earliest. The government shutdown will limit new readings on the US economy. US and Chinese officials just met. Mid-level Chinese officials can...

Read More »Two Takeaways from ECB Record

The record of the ECB’s December meeting was released, and there are two takeaways. The first is that officials may have been more concerned with the deteriorating situation than they let on at the time. Apparently, paring near-term growth forecasts was seen as a sufficient signal that risks were increasing. This allowed Draghi to maintain the “broadly balanced” risk assessment. Although Draghi did acknowledge that the...

Read More »FX Daily, January 11: Trade Optimism and the Recovery in Oil Boosts Risk Appetites

Swiss Franc The Euro has fallen by 0.26% at 1.1287 EUR/CHF and USD/CHF, January 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Optimism on trade talks between the US and China coupled with the biggest rally in WTI in two years (11%+) have helped keep the equity market recovery intact.The MSCI Asia Pacific Index rose today, the eighth time in the past ten...

Read More »FX Daily, January 10: Equity Bounce Stalls while the Greenback Steadies at Lower Levels

Swiss Franc The Euro has risen by 0.39% at 1.1288 EUR/CHF and USD/CHF, January 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities, bonds and the dollar are consolidating the moves seen earlier this week. This means equities are trading heavy and bonds firmer. The euro is paring gains that carried it to its best level (~$1.1570) since mid-October. After...

Read More »FX Daily, January 09: Equities Continue Recovery, Greenback Remains Heavy

Swiss Franc The Euro has risen by 0.08% at 1.1233 EUR/CHF and USD/CHF, January 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities have extended the New Year rally. The MSCI Asia Pacific Index advanced for the fifth consecutive session and the 10th in the past 11. The Dow Jones Stoxx 600 in Europe is rising for the second consecutive session,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org