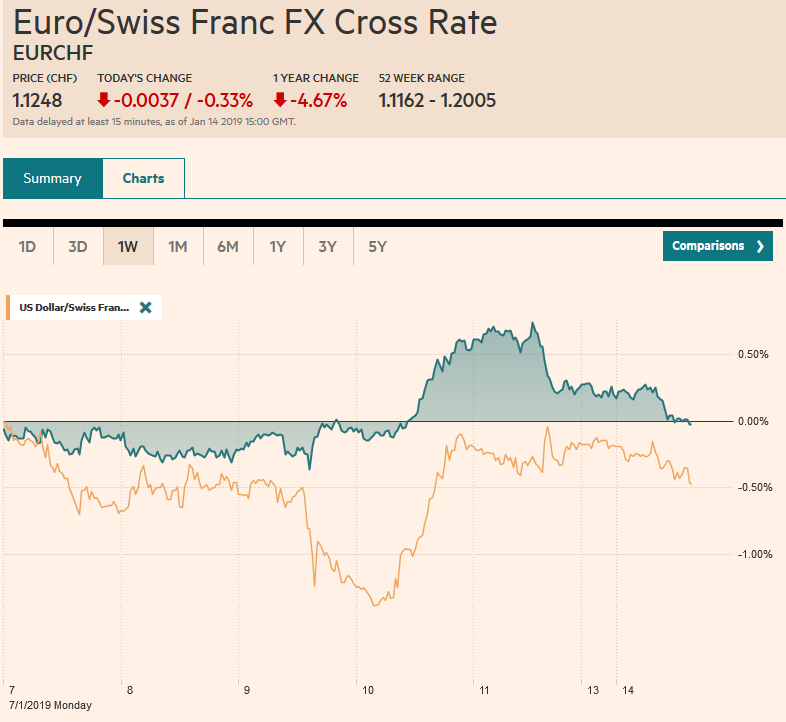

Swiss Franc The Euro has fallen by 0.33% at 1.1248 EUR/CHF and USD/CHF, January 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: China’s exports and imports were weaker than expected, though the trade surplus swelled to its widest in a couple of years. The implications have undermined equities and weighed on risk appetites more broadly. Nearly all the Asia-Pacific markets were lower except Japan and the Dow Jones Stoxx 60o in Europe is off 0.5% near midday to snap a four-day advance. US S&P 500 is about 0.8% lower. Core benchmark 10-year bond yields are off two-three basis points while peripheral yields are off a bit less, and Italy is bucking the trend with

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, AUD, CAD, EUR, EUR/CHF, Featured, FX Daily, GBP, JPY, MXN, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.33% at 1.1248 |

EUR/CHF and USD/CHF, January 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

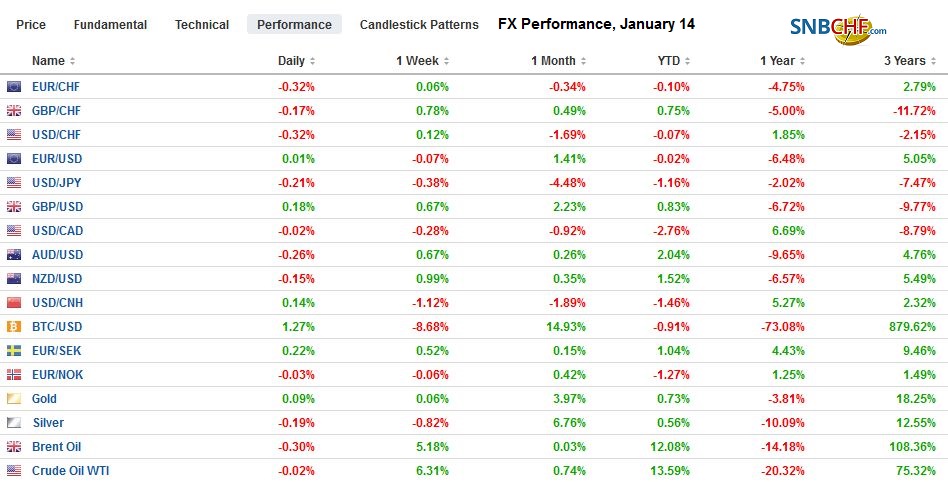

FX RatesOverview: China’s exports and imports were weaker than expected, though the trade surplus swelled to its widest in a couple of years. The implications have undermined equities and weighed on risk appetites more broadly. Nearly all the Asia-Pacific markets were lower except Japan and the Dow Jones Stoxx 60o in Europe is off 0.5% near midday to snap a four-day advance. US S&P 500 is about 0.8% lower. Core benchmark 10-year bond yields are off two-three basis points while peripheral yields are off a bit less, and Italy is bucking the trend with a couple basis point increase. The Antipodean currencies are the weakest (~-0.3%), while the yen (~+0.3%)and Swiss franc (~+0.15%) are performing best. The US government shutdown is now in the 24th day |

FX Performance, January 14 |

Asia Pacific

China’s December trade surplus widened to $57.06 bln from a revised $41.86 bln in November. The larger trade surplus hides a significant deterioration, which many see as a further confirmation that the world’s second-largest economy hit the shoals in Q4. Exports, which the median forecast in the Bloomberg survey called for 2% increase fell by 4.4%. This is a two-year low. Imports were expected to have risen 4.5% and instead tumbled 7.6%. Exports to the US rose 9.8% in November and plummeted to -3.8% in December. This looks like the unwinding of the effect of US front-loading imports from China ahead of threatened tariffs. However, exports to rest of the world also fell, and this is seen as reflecting the global slowdown. The drop in imports appears to be a combination of weaker prices (e.g., oil and semiconductors), and lower import volumes (e.g., industrial commodities).

Some media reports played up the fact that despite a WTO ruling, China has not even acknowledged receiving applications from Visa and Mastercard. There does not appear to be a new development that brought this story to the front pages. However, it serves the interests of those who are pushing back against a reconciliation between the US and China, which seemed to be gaining momentum after the recent round of negotiations and plans for another set later this month. It illustrates the non-tariff barriers to trade and the shortcomings of the enforcement of WTO decisions.

The dollar was turned back from JPY108.60 in early Asia. An option for about $430 mln struck there is expiring today. The dollar was sold to almost JPY108. There are nearly $1 bln in JPY108.00-15 options that will also expire today. Last week’s low was set just above JPY107.75. The Australian dollar rallied about a nickel from the flash crash low (January 3) near $0.6740 to $0.7235 before the weekend. Australia trade ties to China make it vulnerable to today’s news. The Australian dollar was sold to about $0.7175 before it stabilized in the European morning. There is a roughly A$625 mln $0.7200 strike that will be cut today. We suspect the near-term high is in place for the Aussie and look for a test on $0.7100. The Chinese yuan initially extended its recent gains. The dollar traded at its lowest level (~CNY6.7350) before recovering. That could be the medium-term low. The appreciation of the yuan probably reached the point of diminishing returns vis a vis the American trade negotiators and runs contrary to the government’s stimulus policies. We anticipate a CNY6.75-CNY6.95 range going forward.

Europe

The unexpectedly large drop in December industrial production in the four largest EMU countries was fully reflected in the aggregate report. The area’s industrial output dropped 1.7% in November, and the October rise was pared to 0.1% from 0.2%. Economists were still surprised, looking for a 1.5% fall. The year-over-year contraction was 3.3%, the weakest since 2013. Moreover, the December manufacturing PMI fell further (51.4 vs. 51.8) suggesting the region finished the year poorly. The data plays up the potential for back-to-back contraction (rule of thumb definition of a recession, not a technical definition) in Germany and Italy. It also plays on fears that the slowdown is was hitting even though monetary policy remains extraordinarily accommodative, even though the asset purchases were being wound down. We expect new measures, such as a third Targeted Long-Term Refinancing Operation (TLTRO) to be made available toward the middle of the year.

Ahead of tomorrow vote in the UK House of Commons, Prime Minister May is warning that a defeat of the Withdrawal Bill, which seems like a foregone conclusion, would increase the chances that the UK does not leave the EU. She suggests that that is a more likely scenario that an exit with no-deal. Although the UK does not have a written constitution, a defeat of the government tomorrow could very well spur a constitutional-like struggle between the executive and legislative branches for dominance. The Tories cannot have another vote of confidence in May, but Parliament could. Judging from various market indicators, it appears a consensus has emerged that the UK will at first delay the end of March exit.

The Independent Greek Party withdrew from the ruling coalition in a dispute over the name of the nearby country, which adopted the name Republic of North Macedonia. Greek nationalism is offended by a country adopting the name of a Greek province. This forces the government into a confidence vote later this week (Wednesday), which it could lose. If there is to be an election in Greece, it most likely will come before the EU Parliament elections in late May. A national election was due in the fall in any event, and the center-right New Democracy is ahead in the polls over Syriza.

Italian banking news has focused on Carige over the past couple of weeks. Before the weekend, the ECB warned that Monte Paschi needs to raise more capital. The shares are off today by the most in most than six months and appears to be weighing on Italy’s sovereign bonds. Monte Paschi is reportedly planning a covered bond offering later this week.

The euro peaked last week near $1.1570 but finished the week back below $1.15. Today it reached a low of about $1.1440, which is a retracement objective (50%) of its advance from the January 3 low near $1.13. The next retracement target is near $1.1410, which may be a bit too far today. The intraday technical indicators suggest the upside may beckon in early North America, with potential toward $1.1480. Sterling is little changed. There is an option for roughly GBP470 mln struck at $1.2850 that remains in play ahead of expiry later today. Here too the intraday technicals favor the upside.

North America

There are no economic reports or speeches of consequence for the US or Canada today. Traders will likely take their cues from the equity markets. The US government shutdown and the latest revelations over the investigation into Russia involvement in the 2016 election dominate the talking points.

The US dollar is building on the potential key upside reversal against the Canadian dollar ahead of the weekend, and the softer oil prices may be helping today. Initial resistance is seen near CAD1.33, and a move above there would immediately target CAD1.3360. The Dollar Index itself is consolidating in the upper end of its pre-weekend range, finding support near 95.50. The 96.00 is next important upside target. The risk-off tone may see more profit-taking on the Mexican peso after its recent run. Initial resistance for the US dollar is seen near MXN19.20. Above there look for MXN19.30 in the near-term.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,$AUD,$CAD,$CNY,$EUR,$JPY,EUR/CHF,Featured,FX Daily,MXN,newsletter,USD/CHF