In recent weeks, the macro story focused on the shifting outlook for Fed policy and the Sino-American trade relationship. There is unlikely to be further progress on either issue in the week ahead. The Fed won’t raise interest rates until toward the middle of the year at the earliest. The government shutdown will limit new readings on the US economy. US and Chinese officials just met. Mid-level Chinese officials can easily sign-on to buy more US foodstuff and energy because they previously agreed to do this. The more contentious issues will take further negotiations. The next set of talks will take place at the end of this month when Chinese Vice Premier Liu He travels to Washington. The focus in the in the week

Topics:

Marc Chandler considers the following as important: $CAD $GBP, $CNY, 4) FX Trends, CAD, EUR, Featured, MXN, newsletter, Norwegian Krone, Oil, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

In recent weeks, the macro story focused on the shifting outlook for Fed policy and the Sino-American trade relationship. There is unlikely to be further progress on either issue in the week ahead. The Fed won’t raise interest rates until toward the middle of the year at the earliest. The government shutdown will limit new readings on the US economy. US and Chinese officials just met. Mid-level Chinese officials can easily sign-on to buy more US foodstuff and energy because they previously agreed to do this. The more contentious issues will take further negotiations. The next set of talks will take place at the end of this month when Chinese Vice Premier Liu He travels to Washington.

The focus in the in the week ahead shifts to Europe, and the outlook is not good. The protracted and painful UK exit from the EU is approaching a climax of sorts as the House of Commons will vote on the Withdrawal Bill. Worrisome economic data from the euro will likely include softer inflation and recession-like drop in industrial output.

Despite the gestures, concessions, and threats, Prime Minister May appears unable to marshal a majority of the House of Commons to support the agreement struck with the EU. The BBC projects that the government is facing a defeat of historic proportions. It shows as many as 433 MPs will vote against the bill and 206 in favor of it. One study noted that in the past century the government has been defeated by more than 100 votes three times and the largest margin was by 166.

This obviously increases the likelihood of a disruptive exit without an agreement. It is not clear what happens next. May has rejected a Plan B, such as a second referendum or postponement of leaving, in the face necessity, politicians have been known to blink. The events market at PredictIt.org has about a 20% chance that the UK leaves on March 29. Pricing in the options market looks as if traders have pushed their expectations out as well.

Reuters reports that the two largest donors of Brexit, Hargreaves, and Odey, now fear that it will not take place at all. The former expects that a delay will be implemented before a second referendum is called and the latter appears to have reversed his initial trading position is now playing sterling from the long side.

Sterling rallied strongly ahead of the weekend. It traded on both sides of Thursday’s range on Friday against both the euro and dollar and closed above Thursday’s high (outside day). This bullish price action suggests market participants may be looking beyond the January 15 vote in the House of Commons. Sterling closed at its best level against the dollar since November 22. The nearby hurdle for sterling is about $1.2870, and a move above there can see an assault o $1.30.

The euro recorded an outside day and an outside week against sterling, confirming a near-term top is in place. Over the past five months, the euro tried to convincingly penetrate GBP0.9100 with little success. The market appeared to have given up on this and took the euro to GBP0;8920 (~50-day moving average) before the weekend. The 100-day moving average is found near GBP0.8900, and a break of the GBP0.8880 area could spur another 1% drop in the euro, which requires breaking below the 200-day moving average near (~GBP0.8860). Although the are countless imponderables about Brexit, on increased chances of a delay, while the economic, political, outlook in EMU take a toll, the euro can return to the lower end of the broad trading range that goes back to mid-2017 in the GBP0.8700.

To be sure the news from the eurozone is moving from bad to worse. Economic activity slumped sharply in November, fanning fears of a recession, especially in Germany and Italy, which contracted in Q3. Economists had expected German and Italian industrial output to have expanded by 0.3% in November. Instead, it fell 1.9% and 1.6% in Germany and Italy respectively. Industrial production in Germany was 4.7% lower than a year ago and 2.6% lower in Italy.

French and Spanish reports were equally dismal. Economists had expected Spain’s industrial output to have risen by 0.4%. It fell by 1.5% for a 2.8% year-over-year contraction. French output was forecast to be flat, but it reported a 1.3% decline for a 2.1% year-over-year fall.

There is little pressure on the ECB to make a formal decision for a few months. Like the Fed, it can be patient. We think the risks of diverging action by the two central banks near the middle of the year is more likely than the consensus. We expect domestic and foreign economic conditions, an easing of equity volatility, and a clearer picture on trade, to allow the Federal Reserve to hike rates around the middle of the year. Around the same time, the ECB will likely conclude that a new Targeted Long-Term Refinancing Operation (TLTRO), which would expand the central bank’s balance sheet in a less controversial way that renewing asset purchases, is needed.

The political landscape in Europe is also worrisome. The Gilets Jaunes demonstration in France continues. President Macron cannot seem to appease the Yellow Vests. Despite some course corrections, he remains unrepentant and seemingly increasing angry that his administration has been targeted. His assessment that “…too many of our citizens think they can get something without making the necessary effort” is often the sentiment of elites and will win him few new friends.

The cabinet of Spain’s minority government approved a budget that raises taxes on high-income earners and boosts infrastructure spending. While it may be broadly consistent with the demand for the Gilet Jaunes, it looks likely to struggle in parliament. The debate could take the next few weeks, but the inability to pass a budget would likely trigger snap elections.

After resolving its budget dispute with the EU, the populist-nationalist government in Italy faces a new crisis, albeit modest, over a troubled previously family-owned bank, Carige. The interplay between national law and EU regulation requires some difficult decisions by people who have been very critical of past support for banks. “Not a penny more” may be a nice rallying cry when in opposition, but when actually faced with the choices, the lesser evil is often chosen, no matter how distasteful.

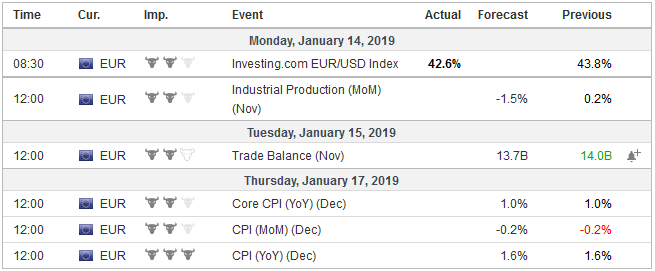

EurozoneThe eurozone will report the aggregate figure at the start of the new week. Economists have revised their forecasts and now look a 1.5% decline, which would be the year-over-year rate to -2.1%, the weakest in five years. Economists (and perhaps officials) have been slow to recognize the magnitude of the economic slow down that hit the euro area in H2 2018. Except for the employment data, economists’ forecasts (median in the Bloomberg surveys) have consistently been above the actual reports. What is going to end the surprise? Will economists begin adjusting their forecasts or with the economic activity strengthen? We think that risks remain on the downside for the upcoming economic data. The auto sector may be an important part of the drivers, so to speak, of the economic slowdown and EMU auto registrations, a proxy for sales, may attract more attention than usual. Some national figures do not look good, and that is after November registrations were 8.8% lower year-over-year. The euro area also reports construction output for November. The construction sector has contracted for three of the four months through October. Construction is strong in eastern and central Europe. In EMU, Germany (5.0% year-over-year), Netherlands (7.7%), and Portugal (4.5%) stand out. Construction output for the eurozone as a whole rose 1.8% year-over-year in October. In addition to weakening activity, price pressures have subsided. The preliminary December report showed that eurozone CPI slowed to 1.6% from 1.9% in November. This largely reflects the decline in oil prices and can be expected to be confirmed toward the end of the week ahead. The core rate was flat at 1.0%. The preliminary January figures wouldn’t be published until February 1. Two considerations show little change so far. Brent rallied 25% off the late-December low but reversed ahead of the weekend and is now virtually unchanged from a month ago. Deutsche Bank’s trade-weighted index for the euro is slightly softer from a month ago. |

Economic Events: Eurozone, Week January 14 |

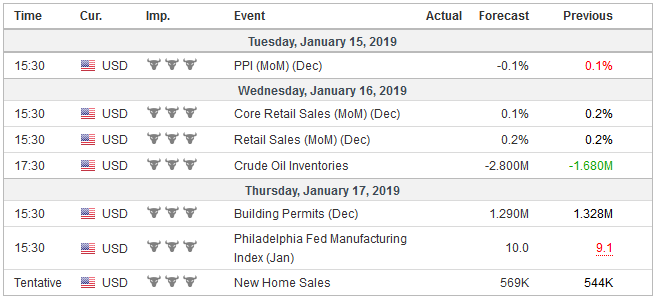

United StatesWhile we see the main focus being in Europe in the week ahead, there are three other developments to monitor. First, the US government shutdown is now record-long. What has been a stalemate with the between the executive and legislative branches may involve the judicial branch if the President declares an emergency to circumvent the legislative branch’s power of the purse. The longer the shut down continues, the more harm is done to the economy and the enforcement of regulations. The White House economic adviser Hassett was as just as tone deaf as Macron when he said that the furloughed workers were better off because they did not have to take vacation days over the holidays. |

Economic Events: United States, Week January 14 |

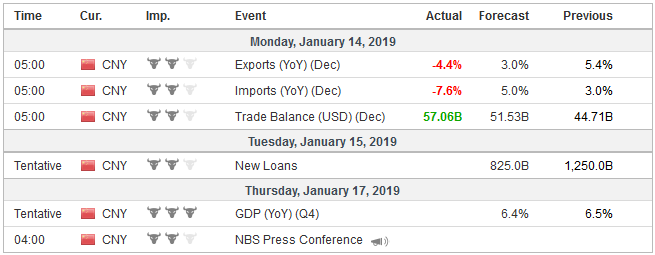

ChinaSecond, the Chinese yuan has appreciated by about 3.2% since the end of October. Part of this reflects the setback in the US dollar more broadly the recovery of many emerging market currencies. We think it is also likely that China is allowing it to appreciate to remove a potential flashpoint in negotiations with the Americans. However, yuan strength runs contrary to the thrust of policy, which is aimed at supporting the economy. We have been looking for China to signal that it does not want further appreciation and press reports quoting a source close to the PBOC indicated as much. That means to expect the dollar to trade between CNY6.70-CNY7.0 until there is a new material change. |

Economic Events: China, Week January 14 |

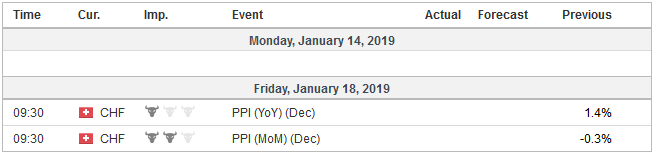

Switzerland |

Economic Events: Switzerland, Week January 14 |

Third, the reversal in oil prices before the weekend is potentially significant. The February light sweet crude oil futures contract posted an outside day ahead of the weekend, and the close matched the previous day’s low. This potential reversal pattern comes at the end of a nearly 26% bounce and as it approached the November highs and a retracement objective (38.2%) of the decline from the October high that are found a little above $53 a barrel. The Mexican peso, the Canadian dollar, and Norwegian krona have all appeared to have been helped by this dramatic rally in oil, while the Indian rupee has been punished. If oil begins moving lower, look for a reversal of fortunes.

Tags: #USD,$CAD,$CAD $GBP,$CNY,$EUR,Featured,MXN,newsletter,Norwegian Krone,OIL