Vultures, rats and maggots are often the focus of disgust, less because of anything for which they can be blamed, and more because of the conditions with which they are associated. Death, disease and squalor carry a stigma that is hard to shake. Something similar is true of credit-default swaps, financial instruments that make headlines during market turmoil and economic misery. When charts of credit-default swap prices begin to crop up in financial research it is...

Read More »As interest rates climb and the economy cools, can companies pay their debts?

Welcome to the American corporate-debt market of 2022. Often the only risky bonds that are being issued are the legacy debts of a now ancient-seeming time—when interest rates were low and a recession was unthinkable. Elsewhere, the high-yield market has almost ground to a halt. A paltry $83bn of risky debt has been issued so far in 2022, 75% less than in the same period last year. A sharp rise in interest rates in the first half of this year has cooled credit...

Read More »The Pandemic has Widened the Wealth gap. Should Central Banks be Blamed?

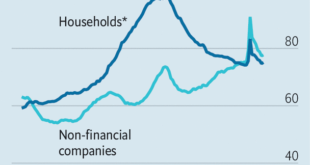

THE GLOBAL financial crisis of 2007-09 was socially divisive as well as economically destructive. It inspired a resentful backlash, exemplified by America’s Tea Party. That crisis at least had the tact to spread financial pain across the rich as well as the poor, however. The share of global wealth held by the top “one percent” actually fell in 2008. The pandemic has been different. Amid all the misery and mortality, the number of millionaires rose last year by 5.2m...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org