Claudia Aebersold-Szalay at a NZZ event. (Image: Evenito) Claudia Aebersold Szalay will assume the role of Head of Media Relations at the Swiss National Bank on 1 June, replacing Walter Meier who will be leaving the bank having reached retirement age. Ms Aebersold Szalay was previously an economics and business editor at the NZZ newspaper for eleven years. Her remit included covering European Central Bank and the...

Read More »Pound to Swiss franc forecast – Brexit impasse means a fragile pound

Brexit Limbo At present Theresa May is in talks with Jeremy Corbyn in order to try and come up with a mutually acceptable deal to put to Brussels. The problem is May can’t even get a deal that is acceptable within her own party let alone Labour as well. Her deal has been rejected three times and Brussels are stone walling us on the Irish border. Brussels have reiterated there will be no changes to the deal on the table...

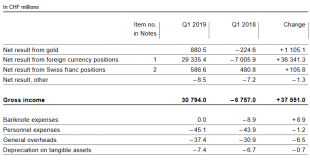

Read More »SNB Results: Big Win After Big Loss in Q4 2018

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the...

Read More »Pound hits best rate to buy Swiss francs in 6 weeks

. The pound is now trading close to a 6 week high to against the Swiss franc which has come as welcome news to the Swiss central bank. Swiss policy makers appear to favour a weaker currency as they aim to control low inflation. Inflation in Switzerland has remained below 1% for quite a while even though interest rates have remained in a negative territory. Since the start of the year as markets have lacked volatility...

Read More »What happens next on GBP/CHF exchange rates?

The pound to Swiss franc exchange rate has been rather volatile, oscillating in a tight range between 1.2942 and 1.3336 in the last month. There is an expectation that we could see the pound losing further ground with the market bracing for worse news in the future for sterling. Sterling has somehow managed to remain reasonably buoyant amidst all the political uncertainty that lies ahead. This is principally down to...

Read More »SNB-Aktie: Goldgrube oder Fettnäpfchen?

Das Bundesgesetz über die Nationalbank (Nationalbankgesetz, NBG) besagt in Artikel 25: „Das Aktienkapital der Nationalbank beträgt 25 Millionen Franken. Es ist eingeteilt in 100’000 Namenaktien mit einem Nennwert von je 250 Franken. Die Aktien sind vollständig liberiert.“ Und in Artikel 31 Absatz 1 steht: „Vom Bilanzgewinn wird eine Dividende von höchstens 6 Prozent des Aktienkapitals ausgerichtet.“ Schliesslich folgt...

Read More »Towards A Globalist Utopia: “Negative Rates Are Coming, Whether You Like It Or Not”

There is nothing that a human mind can’t conceive. It can shoot for the stars or dive in the ocean which twinkles in the shadows of stars and ascend back with sparkling mind bearing uncanny ambition only to float contended. Today, we live in fear of losing wealth, we worry what economic consequences would do to our cash, we look through a microscope and scrutinize every word, every policy, every regulation or find...

Read More »Pound to Swiss Franc forecast: Will the GBP/CHF rate drop below 1.30?

There is a very strong likelihood that the pound to Swiss franc exchange rate might slip should Theresa May find herself in trickier waters ahead as she attempts to negotiate an extension on the Brexit deadline this week. Pound to Swiss franc exchange rates could easily slip below 1.30, particularly since the Franc is a safe haven currency that can strengthen in times of economic uncertainty. Further troubles ahead for...

Read More »GBP to CHF weakness after no majority for alternative Brexit

The pound to Swiss franc exchange rate still struggles to push higher amidst global uncertainty and the pressing issue of Brexit. The Swiss franc maintains the higher ground with its safe haven status amidst concerns of a global slowdown, the effects of which are already being seen across China and the EU. There are now fears that a slowdown is starting in the US which is why the US Federal Reserve has decided to not...

Read More »Dépossession. Des politiques monétaires mortifères…

L’économie du pays est promise à un effondrement. Il suffit pour s’en convaincre de voir la quantité de surfaces commerciales disponibles. En Suisse, près de 1200 entreprises ont fait faillite entre janvier et février! L’information du jour est un non-évènement, puisque annoncé de longue date sur ce site. Par ailleurs, elle ne semble intéresser personne à Berne, dans les « agglomérations », ou autres »Régions »....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org