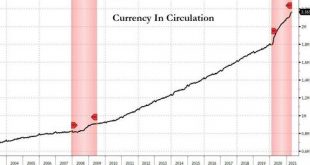

Authored by Matthew Piepenburg via GoldSwitzerland.com,Recently, my colleague, Egon von Greyerz, and I had some unabashed yet blunt fun calling out the staggering levels of open hypocrisy and policy desperation unleashed by former Fed Chairman, Alan Greenspan.Poor Alan was an easy target of what I described as the “patient zero” of the reckless interest rate suppression and unbridled monetary expansion policies of the Fed which have always led to equally reckless...

Read More »The $3 Trillion Hidden Exposure Behind The Archegos Blowup

Authored by Nick Dunbar of Risky FinanceWhen the family office Archegos Capital abruptly imploded in late March, prompting $50 billion in block trades and $10 billion in losses at Credit Suisse, Nomura, UBS and Morgan Stanley, many bank analysts were taken by surprise. Last week, many of these analysts sounded frustrated listening to Credit Suisse’s earnings call in which senior management skirted round without giving any real detail about the disaster.“Do you think...

Read More »Swiss Financial Accounts: Household wealth in 2020 and focus article

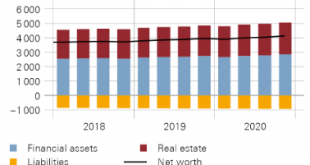

Financial and real estate wealth of households increases The Swiss National Bank is today publishing data on Q4 2020 as part of the financial accounts. Thus, household wealth data are now also available for the full year. Overall, financial assets held by households increased by CHF 108 billion to CHF 2,851 billion (up 3.9%) in 2020. High capital losses in Q1 2020 due to falling stock market prices were followed by a recovery during the remainder of the year. Both...

Read More »Astrid Frey appointed new SNB delegate for regional economic relations for Central Switzerland

With effect from 1 May 2021, Astrid Frey will take on the function of Swiss National Bank delegate for regional economic relations for the Central Switzerland region. She succeedsGregor Bäurle, who assumed the posit ion of Head of the SNB’s Regional Economic Relations unit on 1 January 2021. After concluding her studies at the University of St. Gallen, Astrid Frei worked as an economist at Bank Sarasin & Cie, after which she joined the KOF Swiss Economic...

Read More »Recall of banknotes from eighth series

The Swiss National Bank is recalling its eighth-series banknotes as of 30 April 2021. From this date on, the banknotes from the eighth series lose their status as legal tender and can no longer be used for payment purposes. This does not apply to the public cash offices of the Confederation (SBB/CFF, Swiss Post), which will continue to accept eighth-series banknotes until 30 October 2021. Due to the revocation of the statutory exchange period on 1 January 2020, the...

Read More »UBS erwartet 40 Milliarden Franken SNB-Gewinn

Die Frankenschwäche sowie der anhaltende Aufwärtstrend an den Aktienmärkten haben zum voraussichtlichen Gewinn der SNB beigetragen. (Bild: Shutterstock.com/MDart10) Am kommenden Donnerstag wird die Schweizerische Nationalbank (SNB) ihr Finanzergebnis für das erste Quartal 2021 präsentieren. Die UBS erwartet für diesen Zeitraum einen SNB-Gewinn von rund 40 Mrd. CHF, wie einer Mitteilung vom Montag zu entnehmen ist. Wie die UBS-Ökonomen ausführen, haben die...

Read More »2021-04-23 – U.S. dollar liquidity-providing operations from 1 July 2021

In view of the sustained improvements in U.S. dollar funding conditions and low demand at recent U.S. dollar liquidity-providing operations, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank, in consultation with the Federal Reserve, have jointly decided to discontinue offering dollar liquidity at the 84-day maturity. This operational change will be effective as of 1 July 2021. The auction schedule until 30 June 2021, as...

Read More »“Die Schattenseiten von Schuldenbremsen (The Dark Side of Debt Limits),” ifoSD, 2021

ifo Schnelldienst 4/2021, April 14, 2021. PDF. Was Schuldengrenzen aus politökonomischer Sicht besonders attraktiv erscheinen lässt – ihre vermeintliche Einfachheit und Klarheit – birgt also auch Risiken. Es führt dazu, dass Politiker und ihre Wähler die Solidität der Staatsfinanzen über Gebühr an expliziten Bruttoschulden messen. Was aber zählt, wenn es um unerwünschte Umverteilung zulasten künftiger Generationen geht, ist staatliches Nettovermögen in einer...

Read More »COVID-19, financial markets and digital transformation

Andréa M. Maechler / Thomas Moser, Member of the Governing Board / Alternate Member of the Governing Board In many ways, the coronavirus (COVID-19) pandemic is unprecedented. The economic shock has been global and massive, affecting both economic supply and demand simultaneously. To mitigate the economic impact, the crisis response has had to be swift and innovative – including in Switzerland. The Swiss National Bank has played an important role here, preventing an...

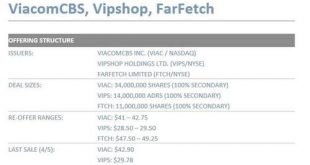

Read More »Credit Suisse Dumping Huge Archegos Blocks; Liquidating Millions In VIACS, VIPS And FTCH

Literally moments ago we said that the Archegos portoflio was being sold off all day on fears of “stealth” prime broker deleveraging, as tens of millions of shares were yet to be accounted for. Then, moments after 5pm, Credit Suisse – the firm that was hammered the hardest by the Archegos implosion and which had yet to provide a detailed breakdown of its Bill Hwang-linked P&L – confirmed what we said, when it unveiled a massive secondary offering dump, including...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org