About 3-5% of the investments of 180 Swiss financial institutions taking part in a government climate compatibility test flow into fossil energies like oil, gas and coal, according to a new report Keystone / Larry Mayer Swiss banks and retirement funds are still investing enormous sums in fossil fuel companies and thereby contributing to global warming. This is the conclusion of a government climate compatibility test. The Swiss National Bank (SNB) didn’t even take part in the test – and is lagging far behind foreign institutions in climate protection. About 180 Swiss financial institutions took part in voluntary climate compatibility tests this year. The Federal Office for the Environment

Topics:

Swissinfo considers the following as important: 1) SNB and CHF, environment, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

About 3-5% of the investments of 180 Swiss financial institutions taking part in a government climate compatibility test flow into fossil energies like oil, gas and coal, according to a new report Keystone / Larry Mayer[/caption]

About 3-5% of the investments of 180 Swiss financial institutions taking part in a government climate compatibility test flow into fossil energies like oil, gas and coal, according to a new report Keystone / Larry Mayer[/caption]

Swiss banks and retirement funds are still investing enormous sums in fossil fuel companies and thereby contributing to global warming. This is the conclusion of a government climate compatibility test. The Swiss National Bank (SNB) didn’t even take part in the test – and is lagging far behind foreign institutions in climate protection.

About 180 Swiss financial institutions took part in voluntary climate compatibility tests this year. The Federal Office for the Environment commissioned an independent think tank, 2° Investing Initiative, to screen their investments for climate compatibility. For the first time, wealth management funds took part, as well as pension funds and banks. This shows that awareness of the influence of stocks and bonds on the global climate has reached the world of finance. And those who also took part in the government’s climate tests three years ago fared better than their competitors, the report found. However, the Swiss financial sector is still generally much too focused on fossil fuels, bearing in mind that the goal is to limit the increase in the global temperature to 1.5 degrees Celsius. According to the report, published in mid-November, Swiss banks and pension funds invest four times more in companies that produce electricity from fossil fuels such as coal and gas than in producers of renewable energy. They even, on average, support an expansion of coal and oil production. These investments would have to diminish considerably in order to fulfil the terms of the Paris climate agreement, which Switzerland signed in 2015. The fact is that more than half of the institutions which claimed to exclude coal from their investments have not taken this step.Notable exception

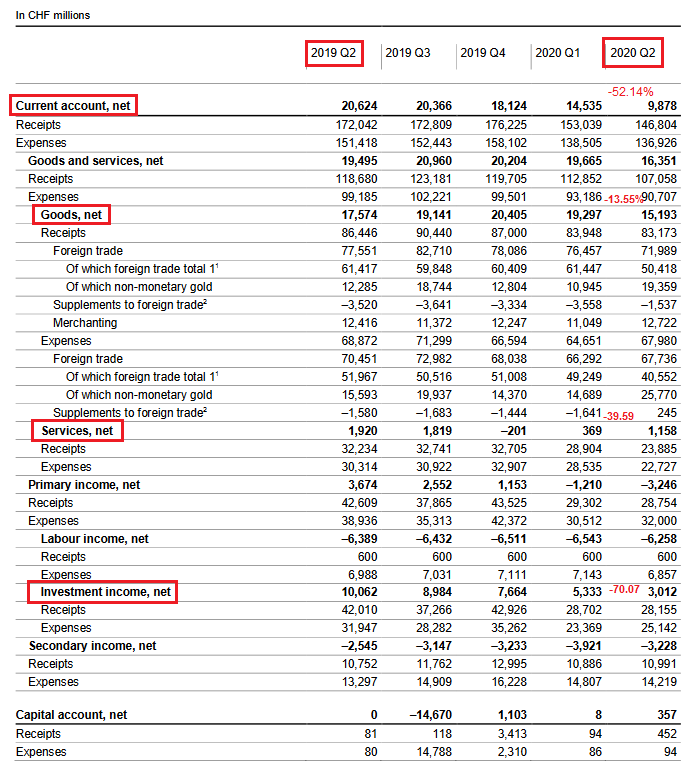

The names of the participating institutions in the climate compatibility tests, known under the acronym Pacta 2020 (Paris Agreement Capital Transition Assessment), are not publicly accessible. The Federal Office for the Environment says that 80% of the sector took part, meaning the conclusions are “representative” of the whole Swiss financial market. The financial institutions that took part will now receive an individual report showing them how they stand in comparison to the competition. Notably, the Swiss National Bank didn’t participate in the survey, SWI swissinfo.ch has learned. In response to the question of whether it would take part, the bank replied that it tries to invest in as “market-neutral” a way as possible and is therefore not overweight or underweight in individual sectors. It added that “the result of a possible climate test would essentially reveal the same conclusion as the ‘world stock portfolio’, which is calculated as a reference point in the scope of this test.” On average, about 3-5% of the investments of the 180 participating financial institutions flow into fossil energies like oil, gas and coal, according to the report. In the world stock portfolio referred to by the Swiss National Bank, this proportion is about 8%. The central bank is therefore clearly lagging behind the average investment rate of the financial institutions that took part in the climate tests. The central bank has no restrictions on its investments. It doesn’t invest in companies which produce weapons that are banned under international law, but it still invests in the armaments industry. The anti-arms-trade initiative, which would have banned the SNB from investing in companies that manufacture war materiel, was rejected by voters in a referendum at the end of November. A withdrawal from fossil-fuel investments is not at present on the central bank’s agenda. The bank stresses repeatedly that its task is to ensure financial and price stability. Other central banks, such as the Banque de France, already take ecological criteria into account in their investments.A doubling of Swiss emissions

The Swiss National Bank is one of the biggest institutional investors in the world. The greenhouse gas emissions financed by its share portfolio are almost as high as the entire Swiss domestic output of C02 emissions, according to calculations by the Fribourg-based NGO, Artisans de la Transition. The Zurich Social Democrat lawmaker Jacqueline Badran wanted to present a motion calling on the central bank to exclude companies which cause serious climate damage. The motion was never even discussed in parliament and was dismissed as unfinished business after two years. The deadline expired at the end of September, just when young climate demonstrators occupied the Bundesplatz demanding more climate protection from the government and the central bank. “If a motion isn’t capable of winning a majority then it’s pointless to fight against its dismissal,” Badran wrote in an email in relation to the parliamentary proceedings.A people’s initiative is possible

But that doesn’t mean the subject is off the agenda, either for the central bank or for other banks and pension funds. The Senate’s environment committee has proposed that financial investments should be geared towards the goals of the Paris agreement. The government is planning the next climate compatibility tests in two years. And if these voluntary measures don’t work, then legal requirements introduced by the state could help. The Climate Alliance, an association of Swiss environmental organizations, has already demanded that Swiss financial institutions should be obliged to publish “their strategies for reducing the financing of greenhouse gas emissions,” as is already the practice in the EU. The Social Democrats are even examining the option of launching a new people’s initiative to compel banks to invest in a more sustainable way for the climate, according to recent reports in the Tamedia group of newspapers.Tags: Environment,Featured,newsletter