Ein Drittel der Befragten gibt an, aufgrund der Pandemie das Zahlungsverhalten nachhaltig angepasst zu haben. (Bild: Shutterstock.com/Viktoriia Hnatiuk) Im Herbst 2020 hat die Schweizerische Nationalbank (SNB) nach 2017 ihre zweite repräsentative Zahlungsmittelumfrage durchgeführt. Die Umfrage zeigt deutliche Veränderungen in der Zahlungsmittelnutzung gegenüber 2017, mit markanten Verschiebungen vom Bargeld hin zu bargeldlosen Zahlungsmitteln. Diese Verschiebungen...

Read More »Swiss Banks Boost Capital Bases Despite Coronavirus Crisis

[unable to retrieve full-text content]Swiss banks have been able to strengthen their capital bases despite deteriorating economic conditions during the coronavirus pandemic, according to the Swiss National Bank (SNB). This applies to the two big banks, UBS and Credit Suisse, and also domestic banks.

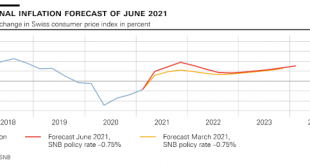

Read More »SNB Monetary Policy Assessment June 2021

Swiss National Bank maintains expansionary monetary policy The SNB is maintaining its expansionary monetary policy with a view to ensuring price stability and providing ongoing support to the Swiss economy in its recovery from the impact of the coronavirus pandemic. It is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and remains willing to intervene in the foreign exchange market as necessary, while taking the overall currency...

Read More »Aktualisierte Sanktionsmeldung

Das Eidgenössische Departement für Wirtschaft, Bildung und Forschung WBF hat eine Änderung des Anhangs 7 der Verordnung vom 8. Juni 2012 über Massnahmen gegenüber Syrien (SR 946.231.172.7) publiziert. Am 10. Juni 2021 hat das Eidgenössische Departement für Wirtschaft, Bildung und Forschung WBF die Liste der in diesem Kontext sanktionierten Personen, Unternehmen und Organisationen geändert. Die Änderung ist in der Schweiz direkt anwendbar. Das WBF hat daher die für...

Read More »The role of the Swiss National Bank (SNB)

(Disclosure: Some of the links below may be affiliate links) What the Swiss National Bank (SNB) does is not very clear for many people in Switzerland. So, I thought it would be interesting to research this subject and write about my findings. The Swiss National Bank is quite famous, even abroad, but what does it really do? It is because of it that we do not have any interest rate in our bank accounts? Let’s see in detail what this central bank is doing. We will also...

Read More »West Virginia Gov. Personally On The Hook For $700MM In Greensill Collapse

The collapse of Greensill Capital has been the biggest financial scandal of the year so far, having set off a massive public corruption scandal in the UK that has deeply embarrassed the ruling Conservative Party due to the close involvement of former PM David Cameron, who was on the Greensill payroll and was caught trying to steer relief funds meant for small businesses to Greensill to help avert its collapse. Most recently, Credit Suisse cited Greensill as its...

Read More »“Everything Is On Fire”

Authored by Egon von Greyerz via GoldSwitzerland.com, “Everything is on fire” – Heraclitus (535-475 BC) What Heraclitus meant was that the world is in a constant state of flux. But the big problem in the next few years is that the world will experience a fire of a magnitude never seen before in history. I have in many articles and interviews pointed out how predictable events are (and people). This is particularly true in the world economy. Empires come and go,...

Read More »UBS Reportedly Re-Starts Layoffs After “Doubling” One Time Bonuses To Some Associates

On one hand, UBS seems hell bent on keep its new Gen Z employees who have recently been promoted to associate positions. After all, it was just hours ago that we wrote about how the bank was showering some newly promoted employees with one-time $40,000 bonuses. Yet on the other hand, UBS apparently isn’t as determined to hang on to certain other employees. The bank has reportedly re-started its “Reduction in Force” job cut plan this week, according to Bloomberg, who...

Read More »UBS, Desperate To Retain Talent, Now Offering $40,000 Bonuses To Newly Promoted Associates

It looks like the hiring (and retention) shortage isn’t just for rank-and-file minimum wage jobs. UBS has now said that, amidst historic competition and a “retention crisis” in the investment banking world (which we noted weeks ago), it is going to pay a one time $40,000 bonus to its global banking analysts when they are promoted. This is double what some of the bank’s competitors are offering. It’s part of a push for lenders “to reward and retain younger employees...

Read More »Credit Suisse Hires Former Prime Brokerage Head To Restore Business After Archegos Blowup

After firing a raft of senior employees including its head of risk, Lara Warner, Credit Suisse has been struggling to move past a series of major risk-management failures that together could cost the bank $10 billion, or more, though the final tally of losses from the Archegos blowup isn’t yet known as the bank weighs whether it should cover some client losses associated with the “low risk” trade-finance funds that collapsed earlier this year. Following reports that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org