One quick note on yesterday’s retail sales estimates in the US for the month of November 2021. The increase for them was less than had been expected, but these were hardly awful by any rational measure. Instead, they seemed to further indicate only what we had proposed upon release of the October estimates: Christmas shopping came a bit early for more shoppers than otherwise. Not terribly dramatic by any means, yet noticeable. Even the “real” series adjusted for, because deflated by, the CPI merely suggested consumer spending in terms of volume was slightly less; and has been trending slightly lower since mid-year. . . . The question is whether this becomes a problem for not just retailers, given other inventory data, particularly wholesalers at the current

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, consumer spending, currencies, economy, Featured, Federal Reserve/Monetary Policy, Markets, newsletter, PCE, Personal Consumption Expenditures, retail inventories, Retail sales, Wholesale Inventories

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

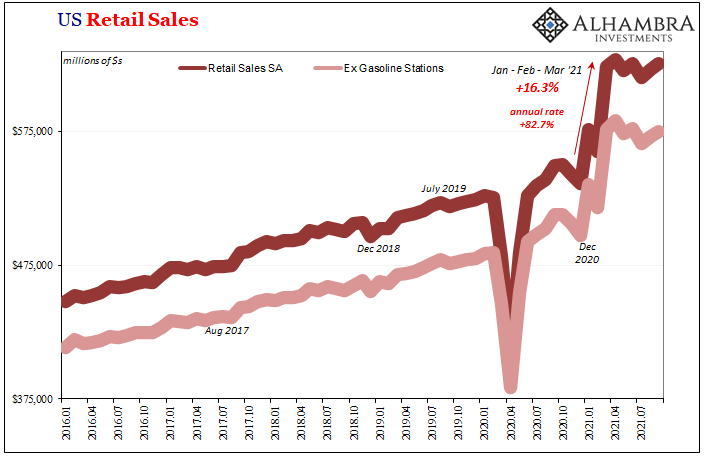

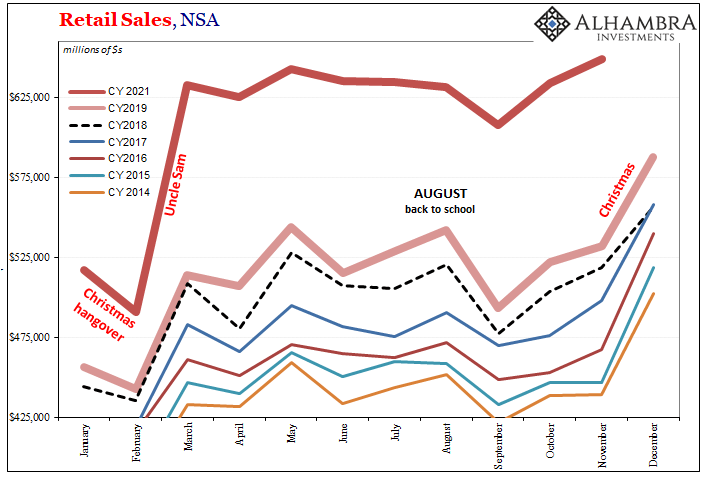

| One quick note on yesterday’s retail sales estimates in the US for the month of November 2021. The increase for them was less than had been expected, but these were hardly awful by any rational measure. Instead, they seemed to further indicate only what we had proposed upon release of the October estimates: Christmas shopping came a bit early for more shoppers than otherwise.

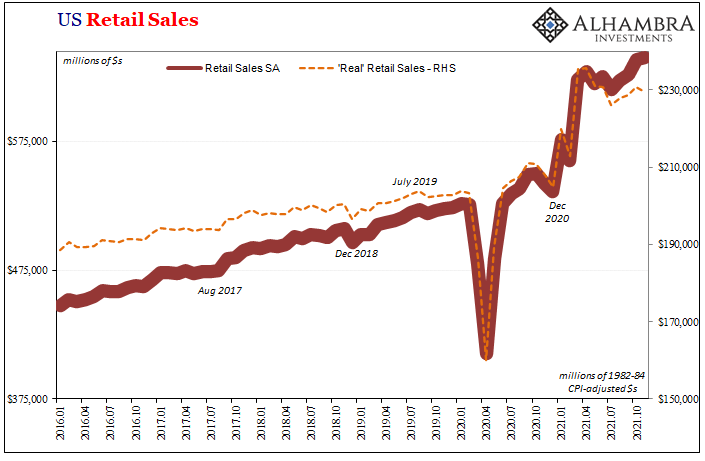

Not terribly dramatic by any means, yet noticeable. Even the “real” series adjusted for, because deflated by, the CPI merely suggested consumer spending in terms of volume was slightly less; and has been trending slightly lower since mid-year. |

|

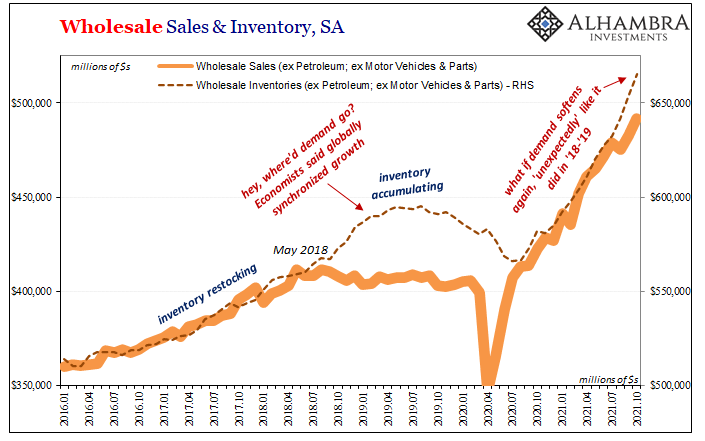

| The question is whether this becomes a problem for not just retailers, given other inventory data, particularly wholesalers at the current time.In nominal terms, wholesale sales like retail sales are and continue to be vibrant – though highly unusual as to this extent. Americans keep spending through the roof on goods that keep getting more and more expensive (even if at a much lesser rate than the headline CPI, driven mostly by energy and autos, makes it appear), consumers have refrained from spending on services.

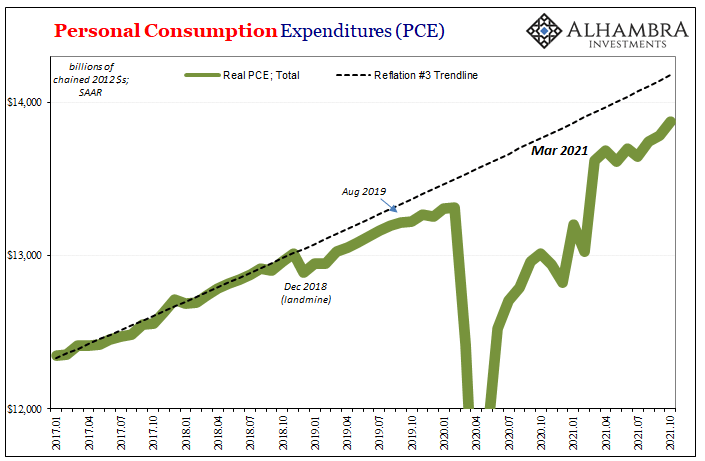

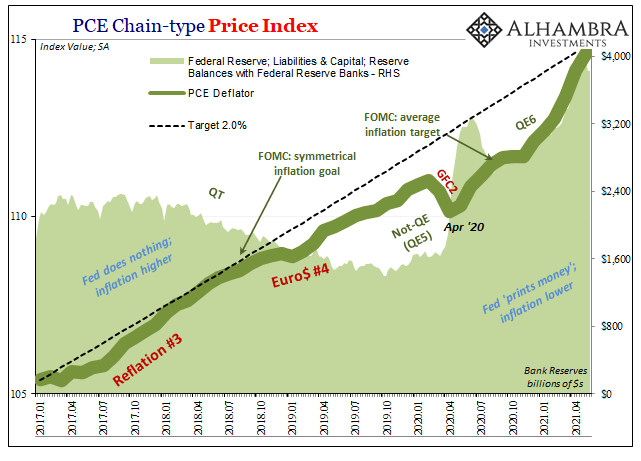

Overall, in separate figures by the BEA yet to be updated for November, total PCE (which includes spending on services) for October was troubling. |

|

| Not only do consumers lag behind the pre-COVID trend (which was already an order of magnitude behind the pre-2008 trend), it’s only by goods spending that the situation is anywhere close to even that much.

So, if activity in goods economy is threatened by any reason, then by what level and how quickly might demand revert? And you have to wonder just how much retailers, wholesalers, and manufacturers in the goods economy are wondering – to themselves –how to play substantial doubts along these lines. Historically speaking, the goods economy can be short run forgiving; inventory cycles take time to develop simply because businesses are generally optimistic and, correctly more often than not, any change in their demand or revenue situation is shown to be a temporary one. In other words, they don’t just give up and call a halt to ordering because sales drop off a bit one month or two. Instead, they give it some time before two months of weak sales becomes three, four, five, and more. |

|

| Only then should the softness keep up does the inventory cycle kick in (see: 2018).

However, these are highly unusual circumstances, to say the least. Contrary to maybe the majority of public opinion, outside of autos and energy there’s an increasingly tidal flow of goods into the system that, right now, is balanced by flagging yet still high overall sales – if only on the goods side. What that means is, on some level, businesses on that goods side might have some inkling just how precarious and artificial this condition must be given how weak overall PCE indicates underlying true demand. If, perhaps when, sales in this goods economy start to turn for whatever reason, this burgeoning inventory picture could more quickly and completely disassociate than historically speaking. Instead of waiting it out for six or seven months further on, maybe retailers and wholesalers (the “trade” segments of the supply chain) recognize more immediately what’s coming. |

Whether this is what’s happening, or how realistic a danger, that’s the question. Sales of goods have kept up, mostly, to now November. On the one hand, that seems to be a positive.

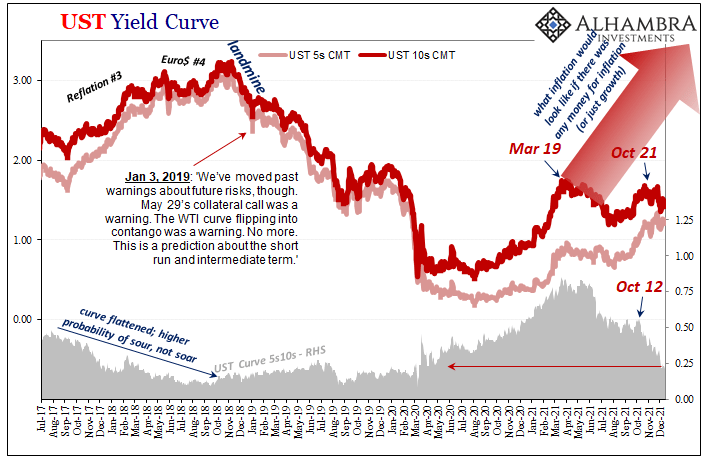

Yet, the way the curves are moving especially after double taper and triple rate hike 2022 (what the Fed expects, anyway), there is quite obviously something bothering the global marketplace as it relates in the opposite way to next year.

One “something” that might be is the inventory cycle and quick turnaround in it. A related one would be what the TIPS auction on October 21 (a date which keeps showing up) just may suggest about consumer susceptibility to less direct repercussions in overall demand (I write more about this for publication tomorrow; hint: oil supply shock).

Tags: Bonds,consumer spending,currencies,economy,Featured,Federal Reserve/Monetary Policy,Markets,newsletter,PCE,personal consumption expenditures,retail inventories,Retail sales,Wholesale Inventories