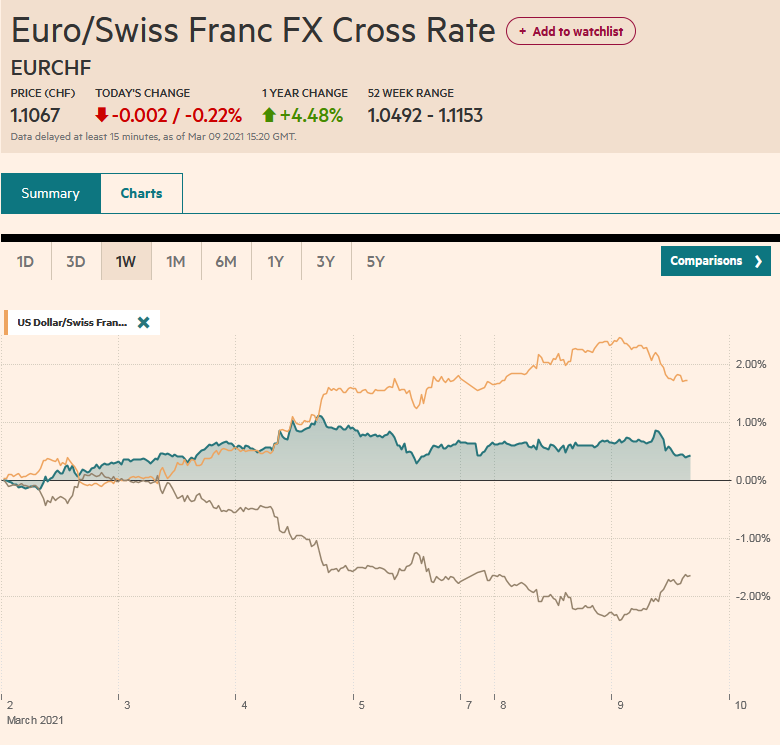

Swiss Franc The Euro has fallen by 0.22% to 1.1067 EUR/CHF and USD/CHF, March 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is not clear the trigger, but risk-taking appetites rebounded smartly today after the NASDAQ completed a more than 10% pullback from its highs yesterday. Ironically, the Dow Jones Industrials set new record highs yesterday too. Most equity markets in the Asia Pacific region rallied. The notable exceptions were South Korea and China. Buying state funds in China during the ongoing National People’s Congress failed to turn sentiment. The Shanghai Composite fell by 1.8%, and the Shenzhen Composite dropped 2.8%. European stocks are building on yesterday’s 2.1% rise, and the German DAX

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brazil, Currency Movement, Featured, Germany, Japan, Mexico, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.22% to 1.1067 |

EUR/CHF and USD/CHF, March 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

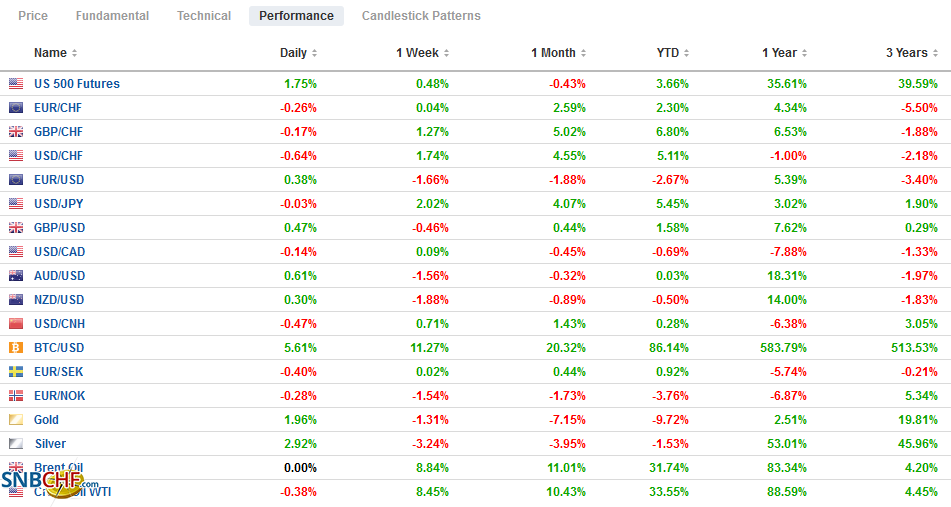

FX RatesOverview: It is not clear the trigger, but risk-taking appetites rebounded smartly today after the NASDAQ completed a more than 10% pullback from its highs yesterday. Ironically, the Dow Jones Industrials set new record highs yesterday too. Most equity markets in the Asia Pacific region rallied. The notable exceptions were South Korea and China. Buying state funds in China during the ongoing National People’s Congress failed to turn sentiment. The Shanghai Composite fell by 1.8%, and the Shenzhen Composite dropped 2.8%. European stocks are building on yesterday’s 2.1% rise, and the German DAX is at a new record high. US shares are trading higher, and the S&P futures are up around 1% and the NASDAQ up closer to 2%. Bonds are also being bought. The US 10-year yield is off more than six basis points at 1.53%, ahead of today’s $58 bln sale of three-year notes. European yields are mostly 4-6 bp lower. The ECB’s data shows that officials did not appear to step up their purchases despite the rise in yields, and the balance sheet implication continued to be blunted by maturing issues. The dollar is on its back foot and paring recent gains. The Scandis and Antipodeans gain 0.5%-0.8%, while the yen is the chief laggard among the majors, up less than 0.2%. Emerging market currencies are also firmer. The JP Morgan Emerging Market Currency Index that plunged through the 200-day moving average for the first time since early November yesterday is snapping a four-day slide today. Gold is recovering from nine-month lows and resurface above $1700. Crude oil is stabilizing after yesterday’s reversal. April WTI initially extended its losses, falling to around $64.35 before rebounding back toward $65.70. |

FX Performance, March 9 |

Asia Pacific

Japan’s Q4 20 GDP was revised down to 11.7% from 12.7% at an annualized pace and 2.8% from 3.0% quarter-over-quarter. It appears business investment was a little softer, and inventory liquidation may have been a bit greater. Consumption rose 2.2% in Q4 but is off to a poor start of 2021, hampered by the state of emergency. Household spending slumped 6.1% year-over-year, nearly three-times worse than economists expected. On a brighter note, the preliminary machine tool orders jumped 36.7% in February after a 9.7% gain in January.

Over the past few days, there has been more talk and reports about the possibility that Chinese demand for commodities has slackened. It could be sparked by the National People’s Congress, which set lower targets for the budget deficit and local bond sales. It could be ideas that had circulated before the NPC, that inventory levels had been brought to desired levels. Since the NPC began, iron ore prices are off almost 5%, and steel rebar has been around 2%.

The dollar initially extended its four-day rally against the yen to almost JPY109.25 before reversing lower. It is finding some bids in Europe a little below JPY108.60. Before today, the dollar has risen against the yen in nine of the past 10 sessions and closed above the upper Bollinger Band (two standard deviations above the 20-day moving average). It is found near JPY108.85 today. The most bearish price action today would be a close below yesterday’s low (~JPY108.25), but it seems unlikely. The Australian dollar initially fell to its lowest level in a month (~$0.7620) before catching a bid and moving back above $0.7700, where an option for about A$525 mln expires today. A close above yesterday’s high (~$0.7720) could signal an end of the pullback that began after the $0.80-level was breached on February 25. The PBOC set the dollar’s reference rate at CNY6.5338, a fraction above where the bank models in Bloomberg’s survey anticipated. The dollar rose to its best level of the year near CNY6.5440 before reversing lower, in line with its broader performance. The greenback fell for the first time in four sessions.

Europe

The German Dax surged to new record highs yesterday and is up another 0.4% near midday in Frankfurt. The 3.3% gain was led by Deutsche Bank announced a 1 bln euro share buyback program and will reinstate the dividend. The news comes ahead of next month’s earnings report. European benchmarks typically are less tech-laden than the US. Financials have more weight in European benchmarks than the US. Europe’s Dow Jones Stoxx 600 is up about 5.1% year-to-date compared with the S&P 500 1.7% gain (as of yesterday). An EMU bank shares index was up 22% this year, while S&P 500 Banks Select Industry Index is up nearly 25%. The recovery in the broader market today may weigh on the sector.

Germany’s January trade figures contained a few surprises, though the surplus of 14.3 bln euros was mainly in line with expectations, though the December figure surplus was revised to 15.2 bln euros from 14.8 bln. Exports defied expectations of a decline and instead rose by 1.4% after a revised 0.4% increase at the end of 2020. Imports slumped by 4.7%, which was more than two times larger than anticipated after a flat report in December. The broader measures, the current account, narrowed to 16.9 bln euros from a revised 25.9 bln (initially 28.2 bln euros). Separately, Italy reported a stronger than expected 1% rise in January industrial output figures, and the December series was revised to show a 0.2% gain instead of a contraction of that magnitude. The aggregate eurozone figure is due Friday.

The euro edged closer to the 200-day moving average (~$1.1830) in early Asia before rebounding and putting in a high near $1.1910. The intraday momentum indicator is stretched, and US leadership may be awaited. Initial support is seen around $1.1880. Yesterday’s high was a little above $1.1930, and the 5-day moving average is around $1.1940. It has not settled above the five-day average since February 25. Sterling dipped below $1.38 ahead of the weekend but the level held yesterday and again today. It rose to $1.39 but stalled there in late Asia and early European turnover. The $1.3840-$1.3850 area offers initial support.

America

US Commerce Secretary Raimondo appears to have become the first official in the Biden administration to repeat the earlier mantra about the strong dollar being good for America. It is difficult to detect much of a market reaction, as the greenback was already bid. At her confirmation hearings, Yellen shied away from the formulation and instead reverted to G7/G20 statements’ boilerplate language, recognizing exchange rates ought to be market-determined. In Trump’s administration, several voices talked about the dollar, including the President, Treasury Secretary, Commerce Secretary, the Trade Representative. Treasury is responsible for dollar policy, and Yellen will likely defend her turf, but privately and without much drama. We will see if it happens again.

The US economic diary is light today ahead of tomorrow’s February CPI figures. The Bank of Canada meets tomorrow and is not expected to change policy, though it appears to be more confident of a stronger recovery later in the year. February jobs data is due at the end of the week, and recovery from the nearly 213k jobs losses (all part-time) is expected. Mexico reports February CPI figures today. The year-over-year rate is expected to rise to 3.75% from 3.54%. This, coupled with peso weakness, may deter Banxico from cutting rates later this month.

Investors reacted strongly to the news that the 2018 conviction of former Brazil President Lula was annulled, and this will ostensibly allow him to run for president again next year. The Bovespa tumbled 4%, and Brazil’s real fell 2.3%, only outdone to the downside yesterday by the Turkish lira’s nearly 3% drop. Brazil’s 10-year dollar bond yield jumped 24 bp to 4.33%, the highest since last July.

The dollar peaked near CAD1.2735 ahead of the weekend and fell to around CAD1.2625 yesterday, and edged closer to CAD1.2600 in Europe. An option for about $590 mln is struck there, and it expires today. Support is seen near CAD1.2575, last week’s low, and a retracement objective of the bounce off the multiyear low set on February 25 (~CAD1.2470). The Mexican peso is snapping a four-day and more than 4% slide against the greenback. Yesterday it fell to its lowest level since the US election last November. The dollar is still confined to yesterday’s range (~MXN21.2140-MXN21.6360). Rising US rates did the peso no favors, and there is also concern about the government’s policies. At the same time, some reports indicate AMLO’s public ratings are improving, and his Morena Party may be the beneficiary in the June local elections.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brazil,Currency Movement,Featured,Germany,Japan,Mexico,newsletter