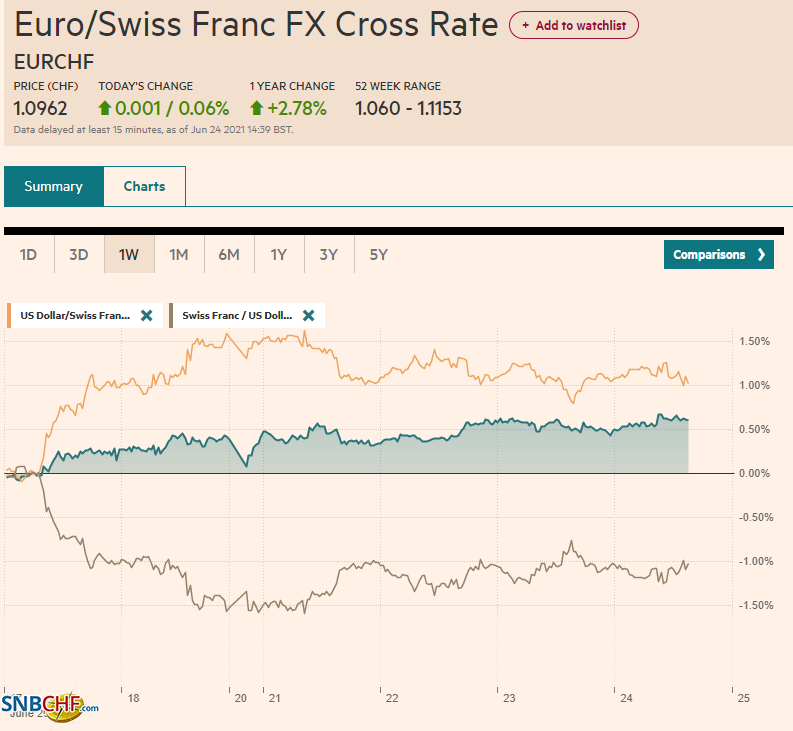

Swiss Franc The Euro has risen by 0.06% to 1.0962 EUR/CHF and USD/CHF, June 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is trading slightly lower against most of the major and emerging market currencies. The Scandis are leading the major currencies, while the Russian ruble leads the central and eastern European currencies higher. Emerging market currencies mostly firmer, though the Turkish lira and South African rand are notable exceptions. The JP Morgan Emerging Market Currency Index is higher for the fourth session. A clear signal by South Korea’s central bank of a rate hike later this year underpinned the won. The Bank of England meets but is unlikely to adjust policy. Mexico’s

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Australia, Bank of England, Banxico, China, Currency Movement, EUR/CHF, Featured, Federal Reserve, newsletter, South Korea, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.06% to 1.0962 |

EUR/CHF and USD/CHF, June 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

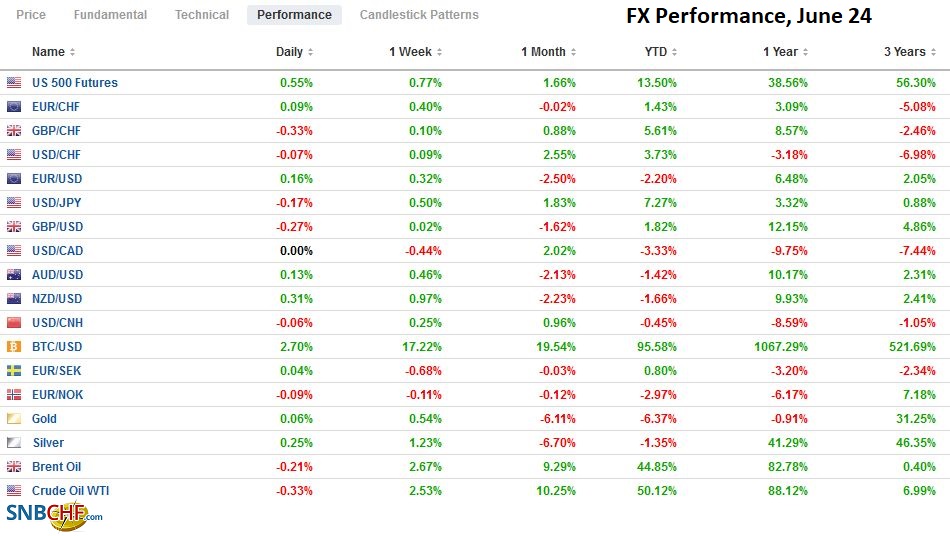

FX RatesOverview: The US dollar is trading slightly lower against most of the major and emerging market currencies. The Scandis are leading the major currencies, while the Russian ruble leads the central and eastern European currencies higher. Emerging market currencies mostly firmer, though the Turkish lira and South African rand are notable exceptions. The JP Morgan Emerging Market Currency Index is higher for the fourth session. A clear signal by South Korea’s central bank of a rate hike later this year underpinned the won. The Bank of England meets but is unlikely to adjust policy. Mexico’s central bank meets later today, and while it too will likely standpat, it may signal that it is closer to raising rates. Meanwhile, after the NASDAQ set a record high yesterday, Asia Pacific markets turned in a mixed performance. Japan and Australia were sporting small losses, while China, Hong Kong, South Korea, Taiwan, and India all advanced. Europe’s Dow Jones Stoxx 600 is higher for the fourth consecutive session, and US futures are also firmer. The US 10-year yield is numbing against the 1.50%-mark, and European yields are slightly firmer. Gold has steadied around $1780 after pulling back from approaching $1800 yesterday. Oil has also steadied. Although US inventories continue to be drawn down, OPEC+ meets next week, and Russia is pushing for a boost in production. Steel rebar and iron ore prices firmed, but copper’s three-day rally stalled. Lumber rose yesterday for the third time in four sessions, and grain prices gained to help the CRB Index extend its gains for the fourth consecutive session yesterday, the longest advance since early May. |

FX Performance, June 24 |

Asia Pacific

China countered Australia’s action before the WTO with its own cases. Beijing is formally complaining about anti-dumping and ant-subsidy measures imposed by Canberra on a number of Chinese products, including railway wheels, wind towers, and stainless steel sinks. Australia has filed WTO cases against Beijing’s tariffs on wine and barley. The underlying issue is the tension between Australia’s trade policy, where China is its biggest partner, and Canberra’s foreign policy orientation, which is firmly with the US.

The US is taking fresh action as soon as today against solar productions made in the Xinjiang region. Hoshine Silicon Industry and five other companies may be added to the US export ban list. A key product, polysilicon, is needed for semiconductors and solar panels, and about half the world’s supply comes from China. The US action may disrupt American solar efforts, but also third countries.

The Bank of South Korea’s Governor Lee Ju-Yeol made explicit what the market had begun recognizing. The strength of the economy and concerns about financial imbalances will allow the central bank to begin raising rates in H2 21. The market appears to have a quarter-point hike largely discounted for Q3 and another for Q4. Fiscal policy may pick up the slack, and there is talk of an extra budget later this year. Several other emerging market countries have begun raising rates. Brazil and Russia were joined this week by Hungary and the Czech Republic (the first EU countries to hike).

The dollar initially poked above yesterday’s JPY111.10 high, but the follow-through was limited, and the dollar is hovering below JPY111 in the European morning. There is an option for nearly $1.5 bln at JPY111.30, expiring today, and one for $1 bln at JPY111.00 that expires tomorrow. Support is seen in the JPY110.60-JPY110.70 area.

The Australian dollar has been confined to around 10 pips on either side of $0.7575, where it settled yesterday. Its recovery off last week’s low near $0.7475 stalled yesterday near $0.7600. The 200-day moving average comes in today near $0.7560.

The Chinese yuan rose for the second consecutive session for the first time this month. The gain of almost 0.15% over the past two sessions is smaller than the 0.2% loss seen on Monday and Tuesday this week. The dollar peaked yesterday near CNY6.4910, its best level since late April. We suspect Chinese officials are content with this month’s yuan pullback. The reference rate has gradually returned to its more predictable course, and today’s fixing was nearly spot on expectations at CNY6.4824.

Europe

The Bank of England meets, but not one expects new moves. While most of the MPC, like their counterparts at the Federal Reserve and the European Central Bank, see the elevated price pressures as a transitory phenomenon linked to the re-opening and the base effect, it is not universal. Haldane, the chief economist, will step down after today’s meetings, has sounded the inflation alarm, and could dissent. Two other MPC members, Saunders and Vlieghe, are sympathetic to Haldane’s arguments. Note that Vlieghe will be replaced by the former chief economist for the OECD and Citigroup, Catherine Mann. The re-opening of the economy has been delayed until the middle of July, and at the August meeting, the BOE will update its forecast.

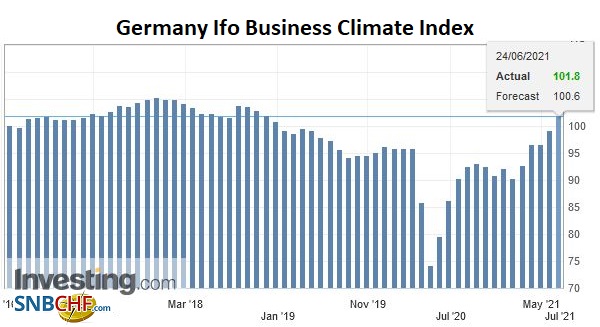

GermanyGermany’s June IFO survey beat expectations and comes on the heels of a strong preliminary PMI. The assessment of current conditions rose to 99.6 from 95.7, while the expectations component rose to 104 from a little below 103. Both represent new cyclical highs. |

Germany Business Expectations, June 2021(see more posts on Germany Business Expectations, ) Source: Investing.com - Click to enlarge |

| The overall business climate stands at 101.8, up from 99.2. It stood at 92.5 at the end of last year and 95.9 at the end of 2019. |

Germany Ifo Business Climate Index, June 2021 |

The euro is trading quietly in less than a 15-tick range on either side of $1.1930. Yesterday’s range was roughly $1.1910 to $1.1970. The single currency faces an important technical barrier in the $1.2000-$1.2020 area. It bottomed at the end of last week and at the start of this week a touch below $1.1850.

For its part, sterling stalled at $1.40 yesterday, and it traded down to $1.3950 today. Like yesterday, there is an option (for about GBP745 mln) at $1.40 that expires today. A break of $1.3920 could spur losses toward $1.3870.

America

There is a full slate of US economic reports today, including the advanced merchandise trade balance for May, wholesale and retail inventories, durable goods orders, another look at Q1 GDP, weekly jobless claims, and the KC Fed manufacturing survey. The most important for market participants will likely be the durable goods orders and the weekly jobless claims. Durable goods orders are likely to rebound from the 1.3% headline decline in April. Weekly initial jobless claims rose in the week ending June 11 to snap a six-week drop. A four-week moving average is often used to smooth out the noisy series. Last week, it broke the 400k level for the first time since the middle of March 2020.

Separately, the Fed will announce its stress test results for US banks, which is expected to pave the way for a sharp increase in payouts to shareholders (dividends and share buybacks). Several Fed officials speak today, but the market already knows where Bostic, Harker, Bullard, Kaplan, and Williams stand. Barkin speaks twice, and at least the first time will be new news.

Yesterday’s preliminary June PMI gave a cautionary signal. Many economists expect the US economy to peak around now and price pressures shortly afterward. The composite reading pulled back to a still-strong 65.9 from 68.7, and the prices charged also eased (64.9 from 66.1). New home sales unexpectedly fell (-5.9%), and the April decline was revised to -7.8% from -5.9%. The seasonally adjusted annual pace is the slowest since May 2020. Rising prices and limited supply seem to be the main culprit.

Mexico’s central bank meets later today after it reports the bi-weekly CPI reading and the May unemployment figures. The CPI print may ease, but it remains too close to 6% for comfort. The unemployment rate may have eased a little. Yesterday, Mexico reported a 0.4% decline in April retail sales while economists had expected a 0.6% increase. Banxico has a dovish board that has been largely appointed by AMLO. However, in the face of rising price pressures, it gradually changed its tone. While a rate hike is not likely today, further preparation in this direction can be expected. The market is pricing in tightening soon. It appears to discount around a 25 bp hike once a quarter over the next four quarters.

The US dollar fell to around CAD1.2250 yesterday, corresponding to the (50%) retracement of this month’s gains. It consolidates today so far in a little more than a 10-tick range on either side of CAD1.2290. A break of CAD1.2250 would target the CAD1.2190-CAD1.2200 area. On the upside, resistance is seen in the CAD1.2320-CAD1.2330 area. An option for almost $400 mln at CAD1.2350 expires today.

The Mexican peso fell every day last week and has risen in the first three sessions this week, and is extending those gains today. The dollar began the week near MXN20.65 and is below MXN20.15 in Europe now. The next target is in the MXN20.00-MXN20.04 area. The peso is the strongest emerging market currency so far this week, rising about 2.65% against the dollar to nudge ahead of the Brazilian real (2.50%) and the Hungarian forint (2.35%).

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Australia,Bank of England,Banxico,China,Currency Movement,EUR/CHF,Featured,federal-reserve,newsletter,South Korea,USD/CHF