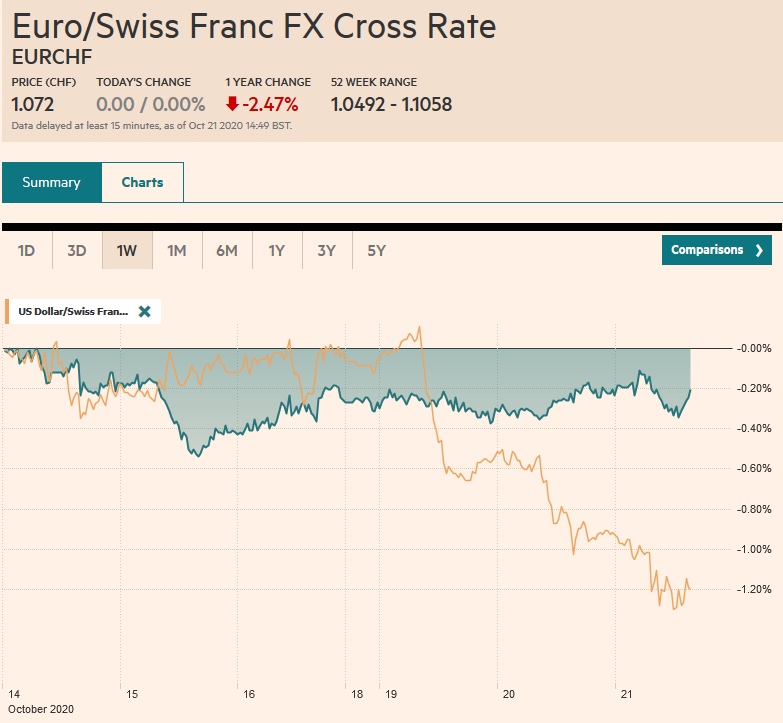

Swiss Franc The Euro is stable by 0.00% to 1.072 EUR/CHF and USD/CHF, October 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dollar is falling against most of the world’s currencies today, even as long-term yields rise to the most in four months and drags global yields higher. The US 10-year yield is pushing above 0.80%, and the 30-year is above 1.60%. Many are linking the backup in yields to prospects of additional fiscal support. European benchmark 10-year yields are 2-4 bp higher. China’s bond yield slipped marginally. Sterling and the Norwegian krone are leading the majors higher. The greenback has slipped below JPY105, and the euro reached .1870, its highest level in a month. Most emerging

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, Brexit, Canada, Currency Movement, Featured, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro is stable by 0.00% to 1.072 |

EUR/CHF and USD/CHF, October 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

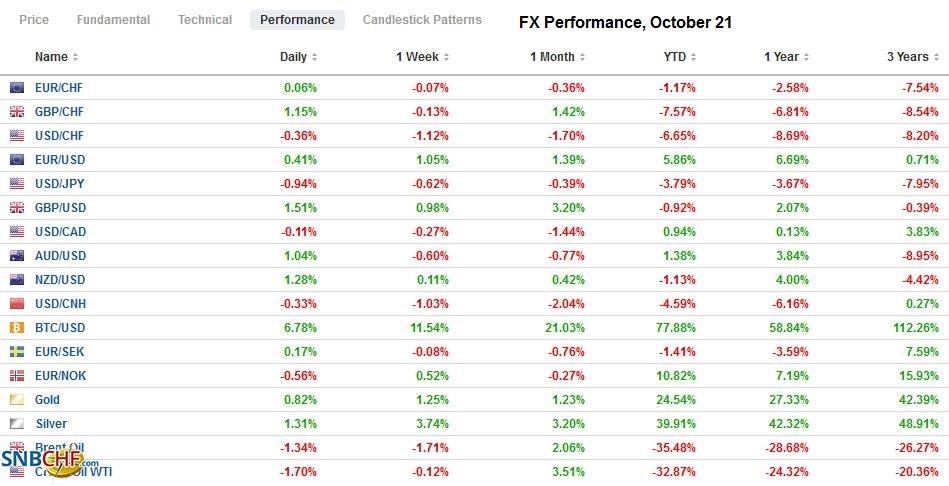

FX RatesOverview: The dollar is falling against most of the world’s currencies today, even as long-term yields rise to the most in four months and drags global yields higher. The US 10-year yield is pushing above 0.80%, and the 30-year is above 1.60%. Many are linking the backup in yields to prospects of additional fiscal support. European benchmark 10-year yields are 2-4 bp higher. China’s bond yield slipped marginally. Sterling and the Norwegian krone are leading the majors higher. The greenback has slipped below JPY105, and the euro reached $1.1870, its highest level in a month. Most emerging market currencies are higher, though the Hungarian forint and Polish zloty are struggling. The Chinese yuan extended its gains and is now at the best level since July 2018. Equity markets are mixed. In Asia, most of the large markets gained, but China, India, and a handful of smaller bourses were sold. Europe’s Dow Jones Stoxx 600 is off for the third day and the sixth session in the past seven. US shares are also a little heavy. Gold firmed but did not challenge last week’s high near $1933. The outside up day in December WTI prices yesterday did not spur follow-through buying, prompting some light profit-taking pushing the contract back below $41. |

FX Performance, October 21 |

Asia Pacific

Japan’s Suga is making his first trip abroad since becoming Prime Minister. He seemed to play down the likelihood of a near-term summit with South Korea and China. South Korea has threatened to liquidate Japanese assets to settle claims over the colonial-era actions.

In part drawn by the IPOs of mainland companies, flows into Hong Kong are forcing the Hong Kong Monetary Authority to step-up its intervention to prevent the US dollar from falling below its floor at HKD7.75. For settlement today was HK26.3 bln ($300 mln).

The dollar’s advance yesterday to JPY105.75, a five-day high, was a bit of a head fake. It has been sold through Asia and early Europe to approach JPY104.80, the lowest in a month. The suddenness of the move caught participants off-guard. The intraday technical readings are stretched. A $1.9 bln option at JPY104.50 that expires tomorrow could also help limit the dollar’s downside. A move above JPY105.20 is needed to stabilize the tone. The Australian dollar’s gains appear to be reflecting the broader US dollar weakness. Monday’s high was set near $0.7115, and it offers initial resistance today. The chances of an RBA move in early November seems to be deterring short-term players. The Chinese yuan continues to trend higher. The PBOC set the dollar’s reference rate at CNY6.6781, which was a bit higher than expected. The dollar fell to around CNY6.6415 before stabilizing. Note that the yuan is also appreciating against the trade-weighted basket. The risk of some near-term consolidation appears to be increasing.

Europe

Ahead of Friday’s release of the preliminary PMI for October, the focus in Europe is two-fold: the resurgence of the virus and the new restrictions that could cut short the recovery that was underway and the still stalled UK-EU trade talks. There is speculation that the EU will make some concessions so that Johnson can claim a face-saving victory at home. Some reports suggest behind the scenes preparation for a resumption of talks possibly later this week. A CIPS survey found nearly half of the businesses responded were less prepared for Brexit than a year ago, citing depleted financial resources and inventories. Even with an agreement, the exit from the standstill agreement will be disruptive, and it’s a question of magnitude and duration.

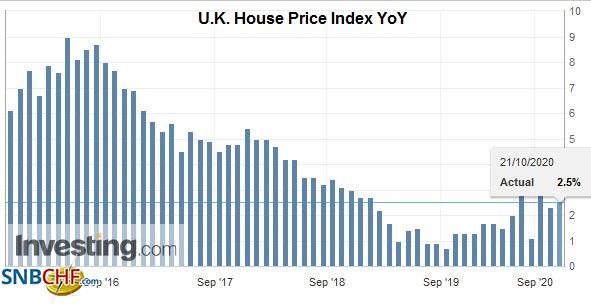

| The UK reported a rise in September’s CPI. The preferred measure that includes owner-occupied costs firmed to 0.7% year-over-year from 0.5% in August. This was a touch softer than expected, while the core rate rose from 0.9% to 1.3% as expected. Many governments, including the UK, took measures to support the economy that lowered prices. Japan provided incentives for travel. Germany cut the VAT temporarily. The UK Eat Out, Help Out discount programs, and a VAT cut for restaurants dampened core prices, which is being unwound. Without taking the impact of these efforts into account and extrapolating from current inflation, readings may be misleading. |

U.K. House Price Index YoY, October 21, 2020(see more posts on U.K. House Price Index, ) Source: investing.com - Click to enlarge |

The euro reached $1.1870 in early European turnover and is coming off ahead of the North American session. Initial support is seen near $1.1820. A fall through $1.1800 would be disappointing, and short-term momentum traders would likely have to move to the sidelines. Sterling is holding in better. It reached $1.3065, its highest since October 13, and overcoming some option-related offers around $1.3050, where a GBP230 mln option expires today. Last week’s high was just below $1.3085. The euro reached almost GBP0.9150 yesterday, after being as low as GBP0.9020 on Monday. It has come back offer today, and a break of the GBP0.9070 area warns of a return to the lows.

AmericaThe Pelosi-Mnuchin budget talks are said to be making progress. Some reports suggest that efforts to write up the legislation have begun. The agreement is for about $1.88 trillion. Although Senate leader McConnell says that if an agreement is struck, it would be voted on in the Senate, he has not indicated he will support it. Senator Romney, seen as a moderate within the party, has indicated he could not vote for such a large package. Separately, reports suggest that the Treasury is opposed to extending the Fed’s muni-lending program or making the terms more favorable (the facility has hardly been used). The facility is set to expire in December. The US economic calendar is light today, and the main feature is the Fed’s Beige Book for the November 5 FOMC meeting. Six Fed officials speak today, but the views are largely known. The spotlight is on Canada today. It reports August retail sales and September CPI. Retail sales are expected to have surged by 1.1%, nearly double July’s 0.6% increase. Excluding autos, a median forecast in the Bloomberg survey looks for a 0.9% increase after a 0.4% decline in July. The headline CPI may firm to 0.5% from 0.1% in August, but the central bank, which meets next week, looks past the headline to focus on the underlying rates. The three underlying measures are expected to be steady (1.5%-1.9%). On the political front, Prime Minister Trudeau is threatening to call snap elections in the opposition Conservatives press ahead with an investigation into the possible misuse of emergency funds. The issue has forced out the previous Finance Minister. |

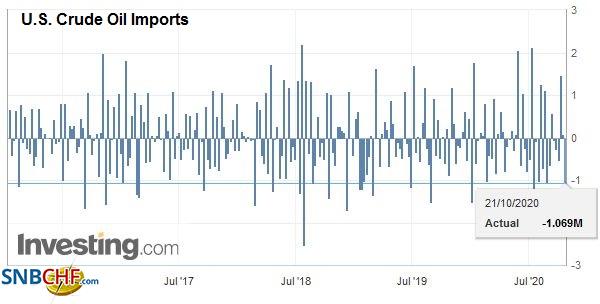

U.S. Crude Oil Imports, October 21, 2020(see more posts on U.S. Crude Oil Imports, ) Source: investing.com - Click to enlarge |

It is lost in the partisanship, which understandably emphasizes the differences between Trump and Biden. We have argued that on several foreign policy issues, there will be strong continuity. North Korea and Iran are obvious, but so is the US opposition to the Nord Stream II pipeline and the digital tax that several European countries are enacting. NATO members should fulfill their spending commitments. The US confrontation with China began before 2016 and will continue going forward. The Obama administration took 25 cases to the WTO, the most during 2008-2016; 16 were against China’s practices. And incidentally, the US won every case that had been decided by January 2017. Many observers have argued that a Biden government would be more aggressively pursuing anti-trust action against several tech giants. Yet, the first shot was fired yesterday as the Justice Department, backed by 11 Republican state attorneys, filed an antitrust complaint against Google. Contrary to conventional wisdom, a monopoly in and of itself is not illegal in the US. Google is being accused of engaging in unlawful exclusionary conduct and protecting and strengthening its market power.

The US dollar posted an outside down day against the Canadian dollar yesterday and follow-through selling today took the greenback to almost CAD1.3080, the lowest level since September 7. It has bounced toward CAD1.3120 in the European morning. A move above the CAD1.3140 area would help stabilize the US dollar’s technical tone. Meanwhile, the greenback slipped briefly below MXN21.00 and bounced back to MXN21.10 in the European morning. It looks set to probe a little higher, and initial resistance is seen near MXN21.15.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Brexit,Canada,Currency Movement,Featured,newsletter