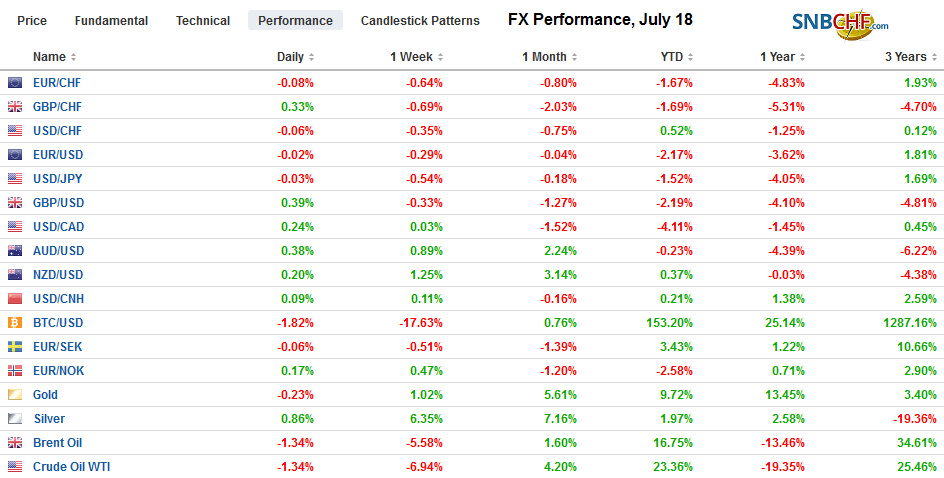

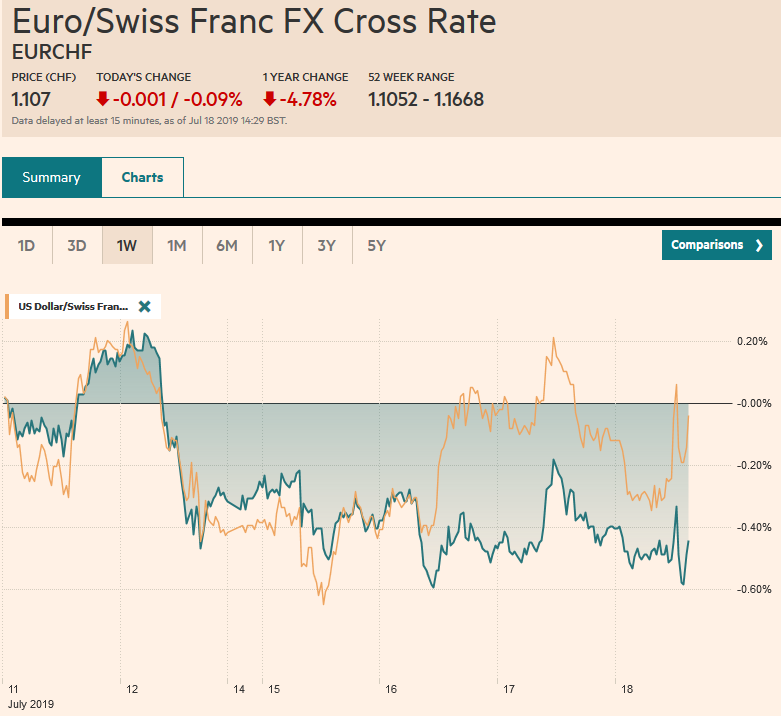

Swiss Franc The Euro has fallen by 0.09% at 1.107 EUR/CHF and USD/CHF, July 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Profit-taking continues to weigh on global equities earnings concerns saw the biggest drop in the S&P 500 in three weeks. The MSCI Asia Pacific Index fell for the fourth consecutive session. The Nikkei gapped lower for the second straight session and has now retraced half of the gains scored since early June. The Shanghai Composite is at its lowest level in a month. Led by information technology, industrials, and energy, the Dow Jones Stoxx 600 is off by around 0.5% near midday in Europe. US shares are trading lower. We see risk back

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, Brexit, Currency Movements, EUR/CHF, Featured, FX Daily, Indonesia, Japan Trade Balance, newsletter, South Korea, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.09% at 1.107 |

EUR/CHF and USD/CHF, July 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Profit-taking continues to weigh on global equities earnings concerns saw the biggest drop in the S&P 500 in three weeks. The MSCI Asia Pacific Index fell for the fourth consecutive session. The Nikkei gapped lower for the second straight session and has now retraced half of the gains scored since early June. The Shanghai Composite is at its lowest level in a month. Led by information technology, industrials, and energy, the Dow Jones Stoxx 600 is off by around 0.5% near midday in Europe. US shares are trading lower. We see risk back into the 2943-2963 area. Benchmark 10-year bond yields are lower across the world. Rate cuts in South Korea and Indonesia and a disappointing Australian jobs report saw yields fall 3-7 bp in the region, while European yields are 1-3 bp lower. The US dollar is struggling. It is weaker against nearly all the major currencies and most emerging market currencies, including against the South Korean won and the Indonesian rupiah. South Africa is expected to announce a 25 bp rate cut shortly. |

FX Performance, July 18 |

Asia Pacific

South Korea and Indonesia cut benchmark seven-day repo rates by 25 bp earlier today. The former was somewhat more surprising than the latter. South Korea’s rate now stands at 1.5%. The central bank also cut this year’s growth GDP forecast to 2% from 2.5%. There is scope for another rate cut before the end of the year. Indonesia’s rate cut had been more convincingly telegraphed. The 25 bp cut brings the seven-day repo rate to 5.75%. The central bank was dovish, and further rate cuts are expected in the coming months.

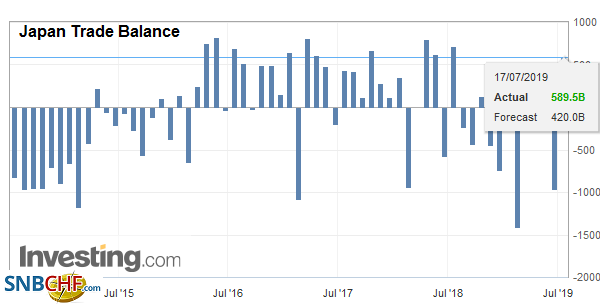

JapanJapan’s trade balance swung back into surplus in June (JPY590 bln from a JPY968 bln deficit in May). However, this is a bit of a statistical quirk as exports and imports fell more than expected. Exports were off 6.7% year-over-year. It was the seventh consecutive decline. A Reuters survey found a median forecast for a 5.6% decline. Exports to China were off 10% and fell 8% to the region as a whole. Exports to the EU fell by nearly 7%. Exports to the US rose by 4.8%. Imports were weaker still. The 5.2% decline compared with a 0.4% decline expected in the Reuters survey. Imports fell by 1.5% in May. Recall this follows a 17.3% plunge (more than twice what was expected) in Singaporean exports reported earlier this week. Last week China said its June exports fell 1.3%, while imports (someone else’s exports) dropped 7.3%. |

Japan Trade Balance, June 2019(see more posts on Japan Trade Balance, ) Source: investing.com - Click to enlarge |

Australia

The optics of the Australian employment report was worse the details. Australia created 0.5k jobs well below expectations and the 37k monthly average this year. It is the least this year. However, this was all due to part-time positions Full-time jobs increased by 21k, just below the prevailing average. Other details were unchanged, such as the unemployment rate (5.2%) and the participation rate (66.0%). The Reserve Bank of Australia cut rates at the past two meetings and is expected to stand pat in early August when it next meets. However, another rate cut is expected before year-end.

The dollar is at a 2.5-week low against the Japanese yen (~JPY107.65). A convincing break of JPY107.50 would undermine the technical picture for the greenback and warns of the risk of a break of the June low near JPY106.80. Resistance is pegged in the JPY108.00-JPY108.20 area. The Australian dollar is pushing toward its recent highs in the $0.7040-$0.7050 range. A break of the cap opens the door to our technical objective near $0.7100. The dollar remains in very narrow ranges against the Chinese yuan (CNY6.87-CNY6.88).

United Kingdom

The UK is the main focus in Europe today. Reports suggest that EC negotiator Barnier may be open to an alternative to the currently negotiated backstop. It is not clear what he has in mind or whether this is a rhetorical ploy. Both Johnson and Hunt have said they want to get rid of the backstop altogether. The House of Lords backed an amendment yesterday that seeks to block the suspension of Parliament to pursue a no-deal exit. That said, there is speculation that some of May’s cabinet will resign shortly.

Separately, they say what one will about the UK economy, but consumers are continuing to shop. UK retail sales jumped by 0.9% (excluding petrol). Economists in the Bloomberg survey had expected a decline. The year-over-year pace of 3.6% compares with 3.0% at the end of last year. Food sales edged (0.2%) higher, while household goods rose 1.9%. It was the first increase in retail sales in Q2 but was sufficient to offset the 0.4% decline in both April and May.

Sterling had been sold to new lows for the year yesterday near $1.2380 before recovering, and it is extending those gains today. It pushed briefly through $1.2480 in the European morning but appears to be running out of steam in front of $1.25 where a roughly GBP465 mln option has been struck that will expire today. The euro has also steadied after testing $1.12 yesterday. The upside may be deterred by the 3.3 bln euro in options between $1.1225 and $1.1235.

United States

US earnings season is in full swing. The miss by Netflix and lower sales forecast by CSX casts a pall over the market, even though IBM and eBay, for example, beat expectations. Before the opening of US equity trading, Morgan Stanley, Honeywell, Blackstone, Philip Morris, and PPG report among others. After the close, the highlights include Microsoft and E-Trade report.

The motion to begin the impeachment proceedings against Trump was overwhelmingly defeated in the House of Representatives yesterday (332-95). There did not appear to be any market impact. Today’s economic reports include weekly jobless claims, leading economic indicators, and the July Philly Fed survey. In our work, and with a 25 bp cut at the end of the month the odds on favorite scenario, what will determine the pace and extent of the easing is not to be found in Q2 data, but Q3. The Philly Fed, like the Empire State survey at the start of the week, is expected to recover from the soft June reading. The Fed’s Williams and Bostic speak today. As the President of the NY Fed, Williams votes at all FOMC meetings. Bostic does not vote this year. There are no economic reports from Canada or Mexico today.

The US dollar remains mired in a CAD1.30-CAD1.31 range. Within that range, it is difficult to get excited. We have noted the bullish US dollar divergences in the technical indicators (MACD and Slow Stochastics did not confirm the new lows in the greenback) seen at the end of last week. The dollar is testing the nearby cap against the Mexican peso near MXN19.12. The intraday technicals seem to favor it holding, but a break of it could spur a quick move into the MXN19.16-MXN19.18 area. The Dollar Index slipped toward 97.00. Many are watching the 200-day moving average that comes in near 96.80. Resistance is now seen around 97.20-97.30.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Brexit,Currency Movements,EUR/CHF,Featured,FX Daily,Indonesia,Japan Trade Balance,newsletter,South Korea,USD/CHF