Stock Markets EM FX was whipsawed last week but ended on a firm note. We look past the noise and believe that the true signals for EM remain higher US interest rates and continued trade tensions, both of which are negative. Turkish markets reopen after a week off. Nothing fundamentally has changed there, and so it still poses some spillover risk to wider EM. Stock Markets Emerging Markets, August 22 - Click to enlarge Mexico Mexico reports July trade Monday, which is expected at -.7 bln. Banco de Mexico releases its quarterly inflation report Wednesday. Inflation was a higher than expected 4.81% y/y in mid-August, still above the 2-4% target range. Next policy meeting is October 4, and much will depend on

Topics:

Win Thin considers the following as important: 5) Global Macro, Brazil, Chile, China, emerging markets, Featured, India, Israel, Korea, Mexico, newsletter, Peru, Poland, South Africa, Turkey, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

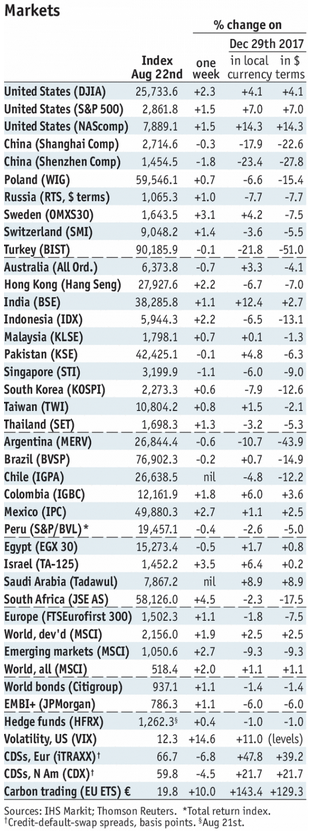

Stock MarketsEM FX was whipsawed last week but ended on a firm note. We look past the noise and believe that the true signals for EM remain higher US interest rates and continued trade tensions, both of which are negative. Turkish markets reopen after a week off. Nothing fundamentally has changed there, and so it still poses some spillover risk to wider EM. |

Stock Markets Emerging Markets, August 22 |

MexicoMexico reports July trade Monday, which is expected at -$1.7 bln. Banco de Mexico releases its quarterly inflation report Wednesday. Inflation was a higher than expected 4.81% y/y in mid-August, still above the 2-4% target range. Next policy meeting is October 4, and much will depend on the global backdrop then. If the peso comes under greater pressure, another hike becomes likely in Q4. BrazilBrazil reports July current account and FDI data Monday. A current account gap of -$3.8 bln is expected. July PPI will be reported Wednesday. Central government budget data and IGP-M wholesale inflation will be reported Thursday. Q2 GDP and consolidated budget data will be reported Friday, with growth expected at 1.1% y/y vs. 1.2% in Q1. Next COPOM meeting is September 19, and markets are pricing in the start of the tightening cycle than with a 25 bp hike to 6.75%. TurkeyTurkey reports July trade Wednesday. The lira was relatively stable last week due to the long holiday, but the lira remains vulnerable as markets reopen this week. Next policy meeting is September 13, and further tightening should be seen then. Much will depend on external conditions and the lira. IsraelBank of Israel meets Wednesday and is expected to keep rates steady at 0.1%. CPI rose 1.4% y/y in July, the highest since January 2014. PPI rose 5.7% y/y in June, the highest since November 2012 and pointing to building price pressures. The market is starting to price in the start of the tightening cycle in Q1, but we think Q4 is possible after the new central bank governor takes over in November. South AfricaSouth Africa reports July PPI, money, private sector credit, and budget data Thursday. July trade data will be reported Friday. The economy remains sluggish, but price pressures are rising as inflation was 5.1% y/y in July. This was the highest since September and is nearing the top of the 3-6% target range. The next policy meeting is September 20. While no change is expected, much will depend on external conditions and the rand. |

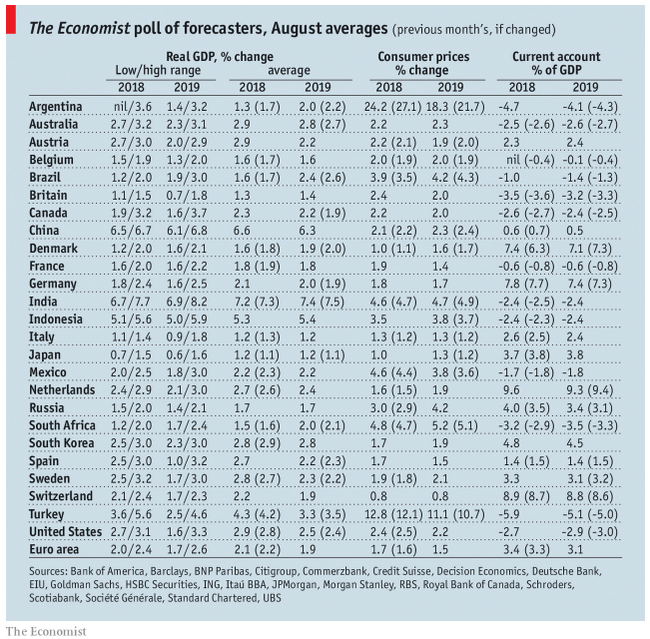

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, August 2018 Source: economist.com - Click to enlarge |

Chile

Chile reports July IP Thursday, which is expected to rise 1.8% y/y v. 5.0% in June. The economy is picking up, as is inflation. The central bank has signaled that the tightening cycle will begin in Q4. We concur. Next policy meeting is September 4, and no change is expected then.

Korea

Bank of Korea meets Friday and is expected to keep rates steady at 1.5%. CPI rose 1.5% y/y in July, still well below the 2% target. The BOK has shown no urgency to tighten, and we see steady rates into 2019. Earlier that day, Korea reports July IP, which is expected to rise 0.4% y/y vs. -0.4% in June. August trade will be reported Saturday.

China

China reports official August manufacturing PMI Friday, which is expected to fall to 51.0 from 51.2 in July. The economy is clearly slowing, as evidenced by recent stimulus measures seen by China. However, the recent move to re-introduce the counter-cyclical factor in the CNY fix suggests policymakers are not seeking to stimulate the economy with a weaker currency.

Poland

Poland reports August CPI Friday, which is expected to remain steady at 2.0% y/y. If so, it would remain in the bottom half of the 1.5-3.5% target range. Next policy meeting is September 5, and no change is expected then.

India

India reports Q2 GDP Friday. The economy remains robust even as price pressures remain elevated. Next policy meeting is October 5. While the RBI signaled a neutral stance, much will depend on the global backdrop then.

Peru

Peru reports August CPI Saturday. CPI rose 1.6% y/y in July, the highest since October but still within the 1-3% target range. However, we believe the central bank will likely start a tightening cycle in Q4 if the economy continues to pick up. Next policy meeting is September 13, and no change is expected then.

Tags: Brazil,Chile,China,Emerging Markets,Featured,India,Israel,Korea,Mexico,newsletter,Peru,Poland,South Africa,Turkey,win-thin