The new monthly cycle of high frequency economic data has begun. The manufacturing PMI shows the synchronized global recovery is continuing. The service sector and composite PMI will be reported in the week ahead. They are unlikely altering the general expectation for robust growth in Q4. Even the disappointing US auto sales (17.35 mln seasonally-adjusted annual pace vs. expectations for 17.5 mln and 18.0 mln in October), the US economy appears to be accelerating. The Atlanta Fed GDPNow points to 3.5% Q4 GDP. The New York Fed GDP trackers see a 3.9% pace. The November jobs report takes center state in the week ahead. Although the month-to-month report can move around, the averages are quite stable. Last year, the

Topics:

Marc Chandler considers the following as important: Brexit, CAD, EMU, Featured, FX Trends, newsletter, Politics, RBA, USD

This could be interesting, too:

Investec writes The Swiss houses that must be demolished

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

The new monthly cycle of high frequency economic data has begun. The manufacturing PMI shows the synchronized global recovery is continuing. The service sector and composite PMI will be reported in the week ahead. They are unlikely altering the general expectation for robust growth in Q4.

Even the disappointing US auto sales (17.35 mln seasonally-adjusted annual pace vs. expectations for 17.5 mln and 18.0 mln in October), the US economy appears to be accelerating. The Atlanta Fed GDPNow points to 3.5% Q4 GDP. The New York Fed GDP trackers see a 3.9% pace.

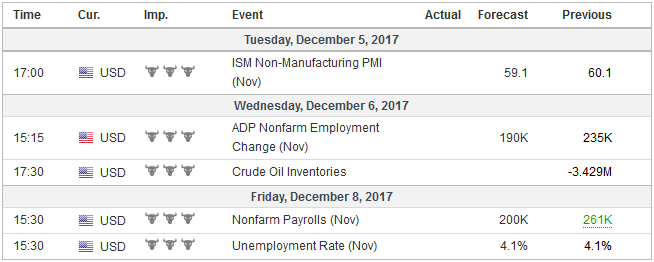

The November jobs report takes center state in the week ahead. Although the month-to-month report can move around, the averages are quite stable. Last year, the non-farm payrolls rose an average of 187k a month. Through August, before the storms’ havoc, the US created 176k jobs a month. The median expectation in the Bloomberg survey that the economy created net new 200k jobs in November.

Barring a significant surprise, the focus is on average hourly earnings more than the number of jobs created or the headline-grabbing unemployment rate. In the current debate, we find ourselves in the camp that expects inflation is accelerating next year. However, the November report may exaggerate the rise, which the median forecasts call for a 2.7% year-over-year pace from 2.4%. The base effect is less favorable this month.

There is little doubt the market, encouraged by commentary from Fed officials, continues to expect a Fed hike on December 13. We estimated fair value for the December Fed funds futures contract, assuming the hike, is 1.295% and it finished last week at 1.29%. The implied yield of the January 2019 futures contract has been fairly steady around 1.84%. This is consistent with a full hike and around 2/3 of a second hike discounted.

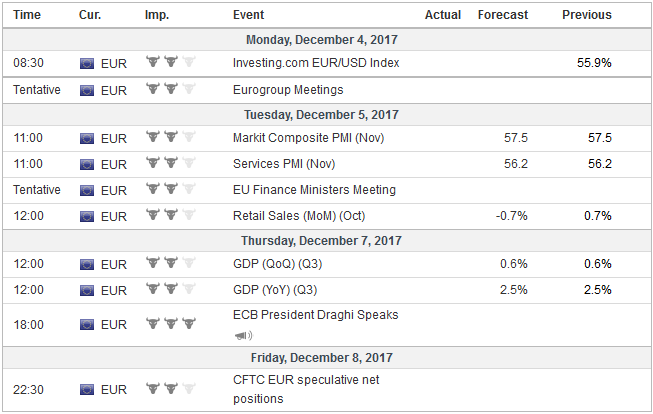

EurozoneEuropean economic activity is finishing the year on a strong note. Last week’s news that core inflation was unchanged at 0.9% in November disappointed the otherwise favorable economic momentum. This week, the disappointment may be delivered by weakness in retail sales, which have unwound October’s 0.7% increase. The year-over-year rate will fall back to 1.6%, which is where it was at the end of last year. |

Economic Events: Eurozone, Week December 04 |

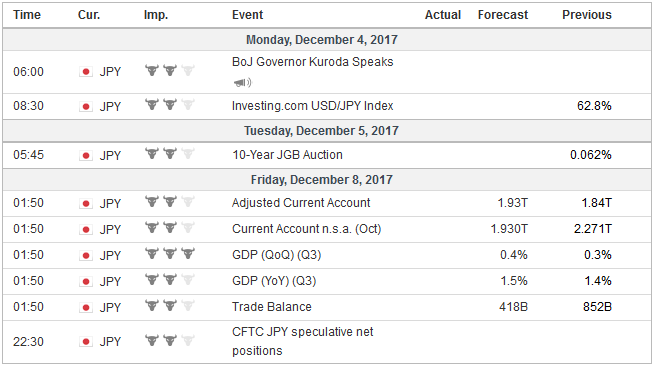

JapanJapanese trade highlights include a possible small upward revision to Q3 GDP from 1.4% to 1.5%. Japan’s October current account and trade balance is a useful reminder of the significance of earnings stream generated from foreign investment. The repatriation of yield, dividend, royalty, and licensing income outstrip the trade balance by a two-to-one margin. |

Economic Events: Japan, Week December 04 |

United StatesThe economic data may pose headline risks, but the stronger impetus will come from political developments in the week ahead. Investors got a taste for what could be in store at the end of last week as the two main political issues–the Russian investigation and tax reform–erupted at the same time. That Flynn admitted to lying to the FBI about contact with Russia during the transition period is puzzling. It was not illegal, so why the deception? That Flynn plead guilty to a minor crime compared with other charges that could have been made, seems to suggest Flynn not only will cooperate with the investigation but can provide significant information. Flynn is the fourth person indicted by the Special Investigator, Mueller. The risk is that what appear to be distraction tactics themselves disrupt the news stream, like seen last week. There may be some speculation that President Trump may think again about firing Mueller, but this is not the most likely scenario. Given the number of people indicted, firing Mueller would strength argument the the President was obstructing justice. It is a powerful charge, an d obstructing justice was the first charge in the draft of the articles of impeachment against Nixon. Although some of the event markets show that the “betting” that Trump will be impeached has increased, we think it is far premature to take seriously. The Senate version of the tax reform was fluid until the very end, and it finally passed early Saturday morning. The next step, which will begin in the coming days is to reconcile the House and Senate versions. There are several significant differences. There are some issues where the differences cannot be split. The last-minute gymnastics that were needed to balance the contradictory interests speaks to the delicate balance struck, which is put into jeopardy during the reconciliation process. Over the weekend, President Trump seemed to have suggested willingness to compromise on the corporate tax cut. One may be forgiven for thinking that because Republicans will control the reconciliation process that an agreement will be easy. The main reason behind the inaction by the legislative branch has been difficulty in reconciling competing interests within the Republican Party. After the reconciliation committee hammers out whole cloth from the remnants, both the House and Senate will vote on the bill again before it goes to the President. The declared goal is to have this done before Christmas. |

Economic Events: United States, Week December 04 |

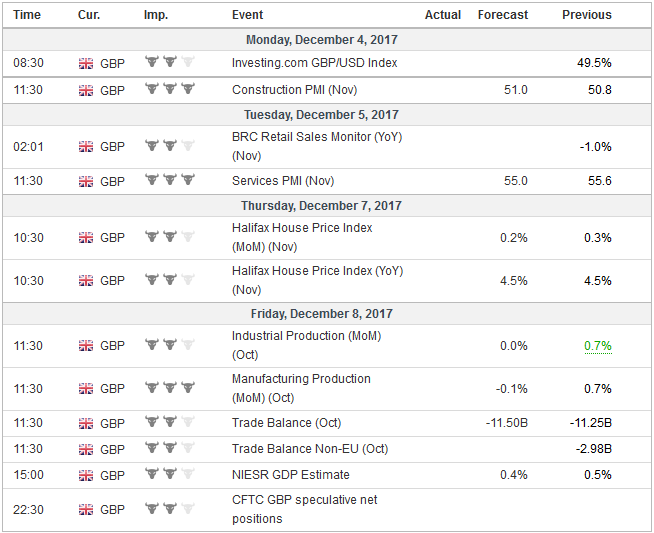

United KingdomThe UK offers a full slate of data, including PMI, industrial production, manufacturing output, house prices, and trade. On balance, it appears the UK economy is stabilizing at the quarterly growth rate of 0.3%-0.4%. The balance of opinion favors the BOE being on hold next year. The UK faces what appears to be a soft deadline of Prime Minister May’s lunch with EC President Juncker Monday to indicate a serious proposition to address the Irish border issue. The circle cannot be squared as the political forces are currently configured. If the UK is out of the single market, a customs border is needed. The EC and Ireland say it cannot be between Ireland and Northern Ireland. The Conservative government enjoys a majority at the will of the Democrat Unionist Party (DUP) from Northern Ireland, which insists that the customs border is not between Northern Ireland and the rest of the UK. Therein lies the rub. The irony is that if another election is forced, a Labour Government that could result would be less sympathetic to the interests of the DUP. It is a soft deadline in the sense that the ultimate decision about whether to proceed to the next stage of talks will be made at the heads of state summit in the middle of the month. It ought not to press the patience of EU President Tusk, who makes a recommendation to the summit. There seems to be a sense of frustration among the EU negotiators that the UK is still not demonstrating the sense of urgency that may be required. This first phase of negotiations should have been wrapped up by now. The previous deadline was missed. The kind of trade agreement that is hoped to emerge from the second phase often takes years to negotiate. The UK has a hard deadline, the end of March 2019. It is still going to require herculean efforts to make that deadline, and a potential UK election also could slow negotiations. Linkages between domestic politics and diplomacy are evident in another political drama that is playing out in Europe. The issue is who will replace Dijsselbloem as the head of the important Eurogroup of EMU finance ministers. Two candidates have emerged, Portugal’s Finance Minister Centeno and Luxembourg’s Finance Minister Gramegna. A secret ballot will be held Monday among the 19 finance ministers. It may seem unusual that Merkel supported Centeno from the Socialist government rather than Gramegna from the liberal (pro-business) party. However, it may serve domestic purposes of the Chancellor who is trying to convince the SPD to join her again (for the third time in four governments) as the junior partner in her coalition government-a grand coalition. It has cost the SPD dearly, with its support in the last election the lowest in modern times. Its fortunes could worsen if new elections were needed. By making a concession to a peripheral country, and allowing the Eurogroup head to remain in the hands to the center-left, Merkel is also making calculations for the horse-trading that will take place over the next couple years as many top posts will be open. This will include the vice president of the ECB in the middle of next year. That appointment is important in its own right, but also for the implications of Draghi’s successor, given the European sense of balance. |

Economic Events: United Kingdom, Week December 04 |

CanadaLastly, the Reserve Bank of Australia and the Bank of Canada hold policy meetings next Tuesday and Wednesday respectively. Neither is expected to change policy. The RBA’s economic assessment is known. The reasonable growth (Q3 GDP is reported the next day, probably 0.6%-0.7%) is blunted by the concerns about the household sector-weak wage growth, weak household consumption, high debt. The Q3 rate hikes have coincided with a sharp slowing of the Canadian economy. Growth slowed to 1.7% at an annualized clip in Q3 down from a 4.3% pace in Q2, which was reported before the weekend. However, Canada also reported an unexpectedly strong employment report, accompanied by an acceleration in wage growth (2.8% year-over-year average hourly wages), which spurred a nearly 1.7% rally in the Canadian dollar before the weekend, its largest single-day advance this year. While officials warn that they anticipate the economy will require less stimulus over time, implying a tightening bias, there is no hurry to act. |

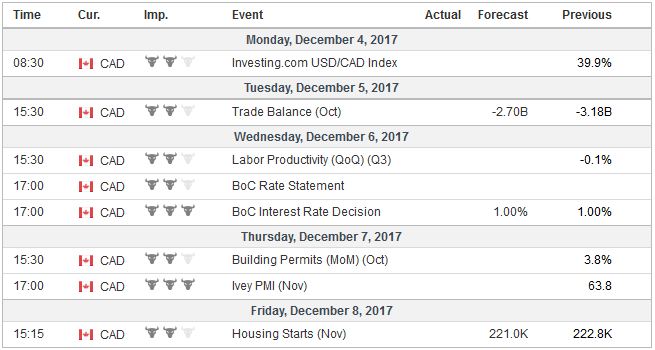

Economic Events: Canada, Week December 04 |

Switzerland |

Economic Events: Switzerland, Week December 04 |

Tags: #USD,$CAD,Brexit,EMU,Featured,newsletter,Politics,RBA