Hyperventilating Minds “What has been will be again, what has been done will be done again; there is nothing new under the sun,” explained Solomon in Ecclesiastes, nearly 3,000 years ago. Perhaps the advent of negative yielding debt would have been cause for Solomon to reconsider his axiom. We can only speculate on what his motive would be. As far as our studies have shown, negative interest rates are a brave new phenomenon. Still, we’ll concede the present day isn’t all that unique or special. We continue to look to the night sky with wonder. When the moon is full we let out a howl with the innate impulse of early man. So, too, we still put on our pantaloons one leg at a time. King Solomon, who reportedly was the go-to guy in his time when good advice was urgently needed. He also was a nigh inexhaustible fount of highly quotable statements. What would he have made of negative yields to maturity? Painting by Giambattista Tiepolo The context, however, and the fantasies, have their differences. Here we defer to Fred Sheehan, and a brief passage from his December 2006 historical essay, War of the Nerds, for edification from the not too distant past: “Every generation suffers its particular fantasies. So it was a century ago.

Topics:

MN Gordon considers the following as important: Debt and the Fallacies of Paper Money, Featured, Franz Ferdinand, Fred Sheehan, Global, King Solomon, negative yields, newsletter, On Economy

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Hyperventilating Minds“What has been will be again, what has been done will be done again; there is nothing new under the sun,” explained Solomon in Ecclesiastes, nearly 3,000 years ago. Perhaps the advent of negative yielding debt would have been cause for Solomon to reconsider his axiom. We can only speculate on what his motive would be. As far as our studies have shown, negative interest rates are a brave new phenomenon. Still, we’ll concede the present day isn’t all that unique or special. We continue to look to the night sky with wonder. When the moon is full we let out a howl with the innate impulse of early man. So, too, we still put on our pantaloons one leg at a time. |

|

The context, however, and the fantasies, have their differences. Here we defer to Fred Sheehan, and a brief passage from his December 2006 historical essay, War of the Nerds, for edification from the not too distant past:

|

|

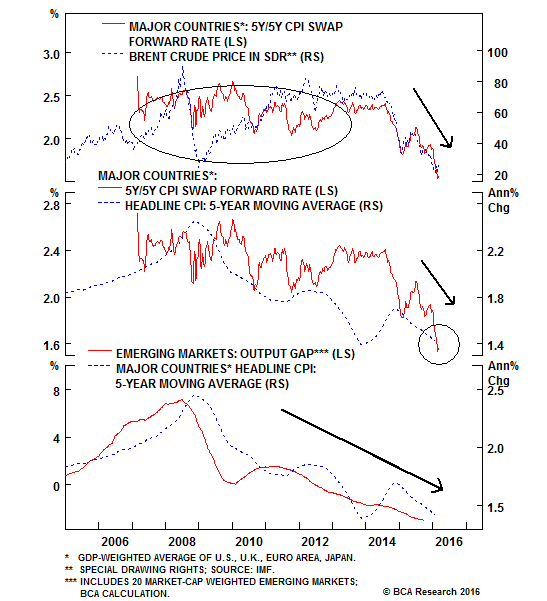

Danger AheadToday’s fantasies are vast and unremitting. Similar to the fantasies of 100-years ago, in hindsight, they’ll be equally absurd. One particularly captivating fantasy at the moment is that the more global central banks inflate their balance sheets the more expectations of inflation decline. Simple logic seems to have been suspended for the near universal disregard of the rules of common sense in the treatment of the money supply of the world. How long can this possibly persist? Obviously, at some point, this fantasy will be shattered. For just because central banks have continuously increased their balance sheets in recent years without igniting runaway price inflation doesn’t mean the danger isn’t there. Remember, correlation doesn’t imply causation. But it can imply confusion. |

|

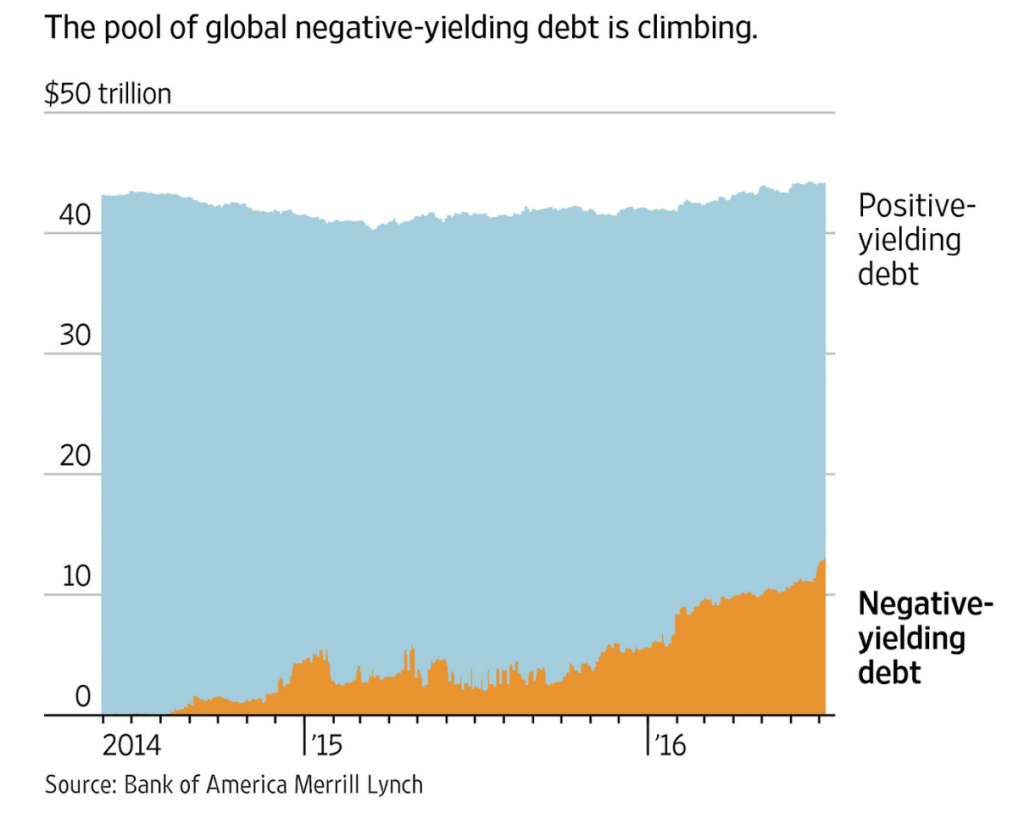

Pool of global negative-yielding debt is climbingFor example, even the short-term acceptance of an inverse relationship between central bank balance sheets and inflation expectations can produce considerable blunders. In this instance it has compelled millions of transactions to occur in error. Earlier this year bond markets passed from the extreme to the illogical. According to Bank of America Merrill Lynch, there is now $13 trillion in bonds globally with negative yields. Just two years ago there was hardly any negative yielding debt. |

|

More Signs the End is NighThe ultimate effect of continued inflation of central bank balance sheets will likely be the complete breakdown of the currency system. There’s little doubt about this eventual fate. What’s more, the prospect of helicopter drops will help accelerate this unpleasant outcome. Unfortunately, at this point there’s no way to reverse course without triggering the breakdown. Our advice, acquire some physical gold if you haven’t already done so and prepare yourself mentally and spiritually for the final phase of the crack-up boom. Remarkable things will happen. One interim scenario is that some stock market investors will believe they’re getting rich. There’s no telling what sort of mania could be propelled by the dual effect of perpetually low interest rates and perpetually brain-dead central bankers… or how many points outright debt monetization could add to the DOW. There’s great potential that the stock market will become a crude barometer of how successful central banks are at destroying the accumulated wealth and capital of the world. One signal they’re succeeding involves rapidly rising stock prices in the face of a stagnating economy. Another signal involves rapidly rising stock prices in the face of sluggish earnings. A third signal involves rapidly rising stock prices in the face of declining currency values. All of these signals are already visible to the naked eye. Their further magnification will presage the final bust. The point is, at this twilight in the rise and fall of our 45-year fiat based currency system, escalating stock prices are not something to be celebrated. Rather, they’re a signal that the end is nigh. Remember this in the coming months when you see DOW 20,000 hats circulating on the floor of the NYSE. |

IBC General Index in Caracas The IBC General Index in Caracas – the stock market of Venezuela is a classical example of a stock market signaling a hyper-inflationary “crack-up boom”, during which the economy actually gets destroyed even while stock prices soar. The German term “Katastrophenhausse” may actually be more apposite (literally: “catastrophic boom”). Rising stock prices are definitely not a sure sign that the economy is doing well – they may simply reflect massive monetary inflation – click to enlarge. |

Charts by: BCA Research, BofA/Merrill Lynch/WSJ, BigCharts

Chart and image captions by PT

M N. Gordon is the editor and publisher of the Economic Prism.