Swiss Franc EUR/CHF - Euro Swiss Franc, November 25(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar’s recent gains are being trimmed today, and it is down against all the major currencies. Many emerging market currencies, including the Turkish lira, Indian rupee, and Hungarian forint are firmer today. The dollar’s losses are minor, and the forces that drove it higher remain intact. One of the most important of these drivers has been the increase in US interest rates, and the US yields 2-3 bp higher today. The recent string of economic data leaves the Fed set to hike rates next month. Next week’s November employment report is seen as the last potential hiccup on the way to a rate hike. However, most are looking for an improvement in job creation after a 161k increase in October. FX Performance, November 25 2016 Movers and Shakers. Source: Dukascopy - Click to enlarge The dollar’s gains were initially extended to almost JPY114 in Asia, but corrective forces quickly emerged, and the greenback fell to JPY112.50 by late in the session. Europe has seen some consolidation. A break of the low could see the dollar slipped toward JPY111.85-JPY112.00 and still not do much technical damage to the charts. The euro’s high in early Asia near .

Topics:

Marc Chandler considers the following as important: CAD, EUR, EUR-GBP, Featured, FX Daily, FX Trends, Japan, JPY, newslettersent, U.K. Gross Domestic Product, U.S. Markit Composite PMI, U.S. Services PMI

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, November 25(see more posts on EUR/CHF, ) |

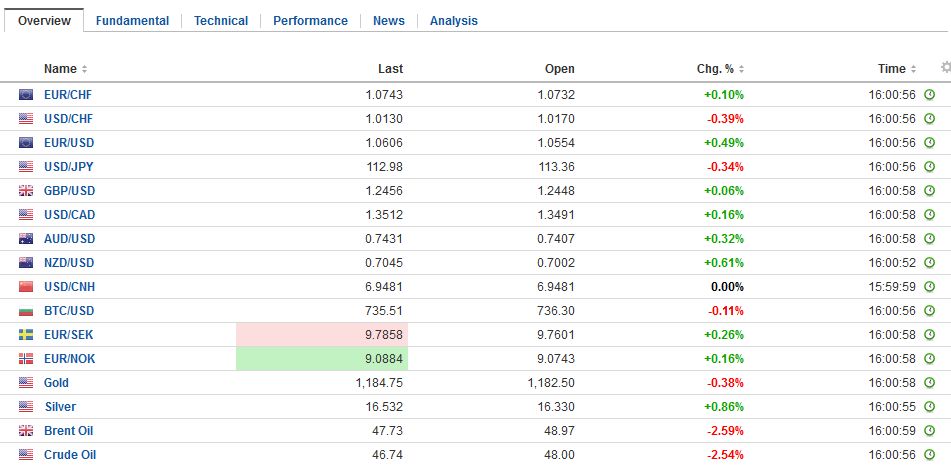

FX RatesThe US dollar’s recent gains are being trimmed today, and it is down against all the major currencies. Many emerging market currencies, including the Turkish lira, Indian rupee, and Hungarian forint are firmer today. The dollar’s losses are minor, and the forces that drove it higher remain intact. One of the most important of these drivers has been the increase in US interest rates, and the US yields 2-3 bp higher today. The recent string of economic data leaves the Fed set to hike rates next month. Next week’s November employment report is seen as the last potential hiccup on the way to a rate hike. However, most are looking for an improvement in job creation after a 161k increase in October. |

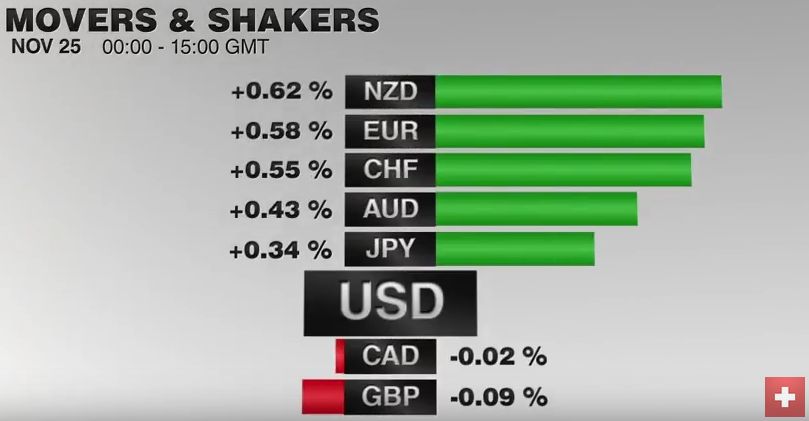

FX Performance, November 25 2016 Movers and Shakers . Source: Dukascopy - Click to enlarge |

| The dollar’s gains were initially extended to almost JPY114 in Asia, but corrective forces quickly emerged, and the greenback fell to JPY112.50 by late in the session. Europe has seen some consolidation. A break of the low could see the dollar slipped toward JPY111.85-JPY112.00 and still not do much technical damage to the charts.

The euro’s high in early Asia near $1.0620 brought in sellers in Europe. Look for initial support near $1.0560. For its part, sterling could not make it back to yesterday’s high near $1.25. Nearby support is pegged by $1.2420. The Australian dollar has moved higher for the fourth session this week but hit a wall of offers near $0.7470 that knocked it back toward $0.7430 in the European morning. Chart support is found between $0.7400 and $0.7420 today. The Canadian dollar is little changed, with the US dollar in the middle of its CAD1.34-CAD1.36 range. |

FX Daily Rates, November 25 (GMT 16:00) |

| The other important driver has been the anticipation that the populist-nationalist rise will be expressed shortly in Europe. The Italian referendum and the Austrian presidential election next week may be a dress rehearsal for the French Presidential election next spring. The center-right Republicans will have a run-off between a self-styled Thatcher-esque candidate (Fillon) and the old guard (Juppe). Perhaps obscured by the pressure on Italian bonds, the French premium over Germany continues to trend higher. It is near 54 bp today, the widest since Q1 2014. As recently as July, the premium was near 20 bp. |

FX Performance, November 25 |

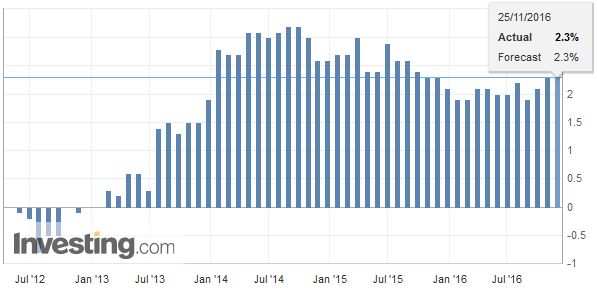

United KingdomIn Europe, the UK provided details about its Q3 GDP that rose 0.5%. The surprise was the 0.9% increase in business investment. Household spending increased by 0.7%, a little slower than recent averages. The external sector added 0.7 percentage points to GDP, the most since 2014. Exports rose 0.7%, while imports fell 1.5%. After the Autumn Statement in the middle of the week, the Office for Budget Responsibility slashed its forecast for 2017 growth to 1.4% from 2.2% (in March). |

U.K. Gross Domestic Product (GDP) YoY, November 2016(see more posts on U.K. Gross Domestic Product, ) . Source: Investing.com - Click to enlarge |

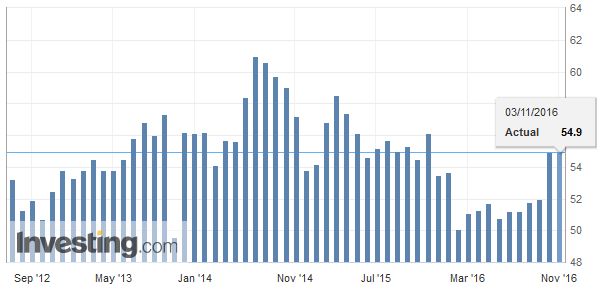

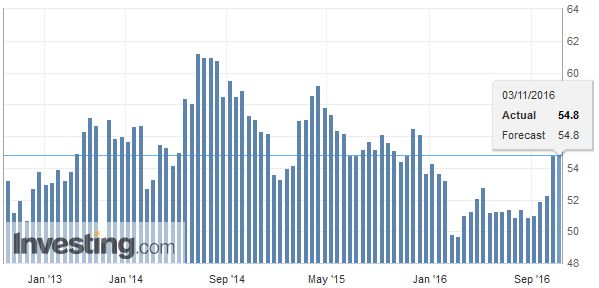

United StatesThe US economic calendar includes the new advance look at merchandise trade. The October shortfall is expected to rise to $59 bln from $56.5 bln in September. Wholesale and retail inventories for October will also be reported, but are not market moving data. Markit issues its preliminary estimate for the US services PMI and composite. Little change is expected. With yesterday’s US holiday, many will take today off as well. US bond market closes early. There is some speculation that China could announce the long-anticipated the Hong Kong-Shenzhen link later today. |

U.S. Markit Composite PMI, November 2016(see more posts on U.S. Markit Composite PMI, ) . Source: Investing.com - Click to enlarge |

U.S. Services PMI |

U.S. Services PMI, November 2016(see more posts on U.S. Services PMI, ) . Source: Investing.com - Click to enlarge |

Japan

There has been no fundamental news development that is spurring today’s modest correction. The main data has come from Japan. At the headline level, Japan’s CPI, on a year-over-year basis rose to 0.1% from -0.5%. It is the first reading above zero since February. However, it exaggerates improvement. What the BOJ calls the core rate, excludes fresh food, and on a year-over-year basis, it remained -0.4%. It has been negative for eight months, which is the longest deflation streak since 2009-2011.

What happened in October is that because of the typhoon and poor weather, fresh food prices rose by nearly 11.5%. We can be confident that the upward pressure on fresh food prices will not be sustained. At the same time, there was another encouraging sign that deflation may be ebbing. The measure of Japanese inflation that comes close to the US core rate, which excludes both food and energy rose from its lowest pace since September 2013 (of zero) to 0.2%.

Meanwhile, Japan’s Topix advance was extended for an 11th session. It has rallied for three consecutive weeks, the longest streak since May. The MSCI Asia-Pacific Index rose 0.6%, the fourth gain this week, and managed to snap a four-week losing streak with a 1.3% advance. European bourses are mostly slightly higher in a mixed session that is seeing health care and utilities post small gains, while energy, materials, and information technology sectors ease.

(The effort to finish my book, Political Economy of Tomorrow is also done. I expect to resume my normal commentary schedule next week. Thank you for your patience).

Graphs and additional information on Swiss Franc by the snbchf team.