Swiss Franc The Euro has risen by 0.19% to 1.0957 . FX Rates Overview: The prospect of not just the failure of the US and China to resolve its trade dispute but a new escalation has sapped the confidence that had lifted equity benchmarks and the greenback. Led by more than a 1% decline in Tokyo (Nikkei), Hong Kong, and Australia, all the major markets in the Asia Pacific region fell. European shares, perhaps encouraged by an upward revision to the flash composite...

Read More »Weekly Technical Analysis: 04/06/2018 – USD/CHF, EUR/JPY, GBP/USD, AUD/USD, WTI

USD/CHF The USDCHF pair managed to break 0.9850 level and closed the daily candlestick below it, which supports the continuation of our bearish overview efficiently in the upcoming period, paving the way to head towards 0.9723 level as a next station, noting that the EMA50 supports the expected decline, which will remain valid for today conditioned by the price stability below 0.9870. Expected trading range for today...

Read More »What Happened Monday?

Italian politics dominated Monday’s activity. Initially, the euro reacted positively in Asia to news that the Italian President had blocked the proposed finance minister. A technocrat government would be appointed to prepare for new elections. The euro reversed course by midday in Asia, several hours before European markets opened. The move accelerated and by midday in Europe, with London markets on holiday as well as...

Read More »Weekly Technical Analysis: 21/05/2018 – USD/JPY, EUR/USD, GBP/JPY, USD/CAD, USD/CHF

USD/CHF The USDCHF pair reaches the key support 0.9955 now, and as we mentioned in our last report, breaking this level will confirm completing the double top pattern that appears on the chart, to rally towards our negative targets that begin at 0.9900 and extend to 0.9850. Therefore, we will continue to suggest the bearish trend supported by the negative pressure formed by the EMA50, unless the price managed to rally...

Read More »Weekly Technical Analysis: 14/05/2018 – USD/JPY, EUR/USD, EUR/JPY, GBP/USD, USD/CHF

USD/CHF The USDCHF pair provided positive trading yesterday to test 1.0000 level and settles around it, and as long as the price is below this level, our bearish overview will remain valid, noting that our next target is located at 0.9900, while breaching 1.0000 followed by 1.0055 levels represent the key to regain the main bullish trend again. Expected trading range for today is between 0.9920 support and 1.0055...

Read More »Weekly Technical Analysis: 07/05/2018 – USD/JPY, EUR/USD, GBP/USD, Gold

USD/CHF The USDCHF pair’s recent trades are confined within mew minor bearish channel that we believe it forms bullish flag pattern, thus, the price needs to breach 1.0035 to activate the positive effect of this pattern followed by rallying towards our waited target at 1.0100. Therefore, we will continue to suggest the bullish trend supported by the EMA50, unless we witnessed clear break and hold below 1.0000. Expected...

Read More »Weekly Technical Analysis: 23/04/2018 – USD/JPY, EUR/USD, GBP/USD, AUD/USD, WTI oil futures

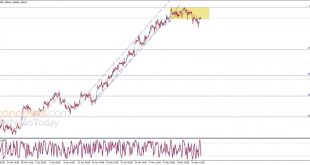

USD/CHF The USDCHF pair touched the bullish channel’s resistance that appears on the chart, and the price might be forced to show some temporary decline to test the support base formed above 0.9790 before resuming the rise again. In general, we will continue to suggest the bullish trend supported by the EMA50, depending on the organized trading inside the mentioned bullish channel, noting that our next target is...

Read More »Understanding the Latest International Reserve Figures

At the end of every quarter, the IMF publishes the most authoritative reserve data with a three-month lag. On Good Friday, the IMF published Q4 17 reserve holdings. A recent article on Bloomberg played up an economist’s forecast that euro reserves would increase by $500 bln over the next couple of years. A review of the reserve data may help us evaluate such a claim, which if true, could have important implications for...

Read More »Weekly Technical Analysis: 26/03/2018 – USD/JPY, EUR/USD, GBP/USD, AUD/JPY, GBP/JPY, USD/CHF

USD/CHF The USDCHF pair provided negative trades after 0.9488 proved its strength against the recent positive attempts, to keep the bearish trend scenario valid efficiently in the upcoming period, supported by the EMA50 that pushes negatively on the price, waiting to test 0.9373 initially. Breaking the mentioned level will extend the bearish wave to reach 0.9300 as a next station, while holding below 0.9488...

Read More »Weekly Technical Analysis: 19/03/2018 – USD/JPY, EUR/USD, GBP/USD, NZD/USD, USD/CHF

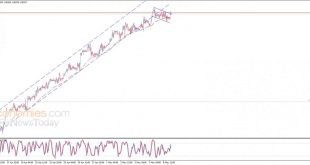

USD/CHF The USDCHF pair leaned well on 0.9488 level to resume its positive trading, on its way towards our first waited target at 0.9581, as the price moves inside bullish channel that appears on the above chart, supported by the EMA50 that protects trading inside this channel, noting that breaching the targeted level will extend the pair’s gains to reach 0.9675. Therefore, the bullish trend will remain suggested for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org