Central bank stance supports AUD in the short term, but a number of factors should weigh on currency over coming year. At its 4 October monetary policy meeting, the Reserve Bank of Australia (RBA) left monetary policy stance broadly unchanged, with the cash rate remaining at 1.50%. This was the first monetary policy meeting under the RBA’s new governor, Philip Lowe.The broadly unchanged statement the RBA released at the end of its meeting suggested that the central bank is in no hurry to lower the cash rate. As such, the demand for the high-yielding Australian dollar should remain robust in the current search-for-yield environment.In the medium and longer term, the RBA’s monetary policy will depend on the outlook for inflation, the health of the labour market and conditions in the housing market. Based on our analysis of these factors, we do not expect any significant improvement in Australian inflation. In turn, persistently low inflation could require looser monetary conditions from the RBA, especially as Australian dollar (AUD strength) could weigh on the traded sector.Overall, a persistently low domestic inflation rate (currently 1% y-o-y), a negative current account (-3.8% of GDP) and an overvalued AUD versus the US dollar (by 12.5%, based on CPI-based purchasing power parity) favour AUD weakness versus the American currency over the coming year.

Topics:

Luc Luyet considers the following as important: Australian Dollar, Australian inflation, Macroview, Reserve Bank of Australia

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Oil Shock

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Central bank stance supports AUD in the short term, but a number of factors should weigh on currency over coming year.

At its 4 October monetary policy meeting, the Reserve Bank of Australia (RBA) left monetary policy stance broadly unchanged, with the cash rate remaining at 1.50%. This was the first monetary policy meeting under the RBA’s new governor, Philip Lowe.

The broadly unchanged statement the RBA released at the end of its meeting suggested that the central bank is in no hurry to lower the cash rate. As such, the demand for the high-yielding Australian dollar should remain robust in the current search-for-yield environment.

In the medium and longer term, the RBA’s monetary policy will depend on the outlook for inflation, the health of the labour market and conditions in the housing market. Based on our analysis of these factors, we do not expect any significant improvement in Australian inflation. In turn, persistently low inflation could require looser monetary conditions from the RBA, especially as Australian dollar (AUD strength) could weigh on the traded sector.

Overall, a persistently low domestic inflation rate (currently 1% y-o-y), a negative current account (-3.8% of GDP) and an overvalued AUD versus the US dollar (by 12.5%, based on CPI-based purchasing power parity) favour AUD weakness versus the American currency over the coming year. Investor demand for Australian bonds is damped by the overvalued AUD and could be dented further if, in accordance with our scenario, the US hikes rates in December. Consequently, a lower currency could be needed to attract foreign bond investors.

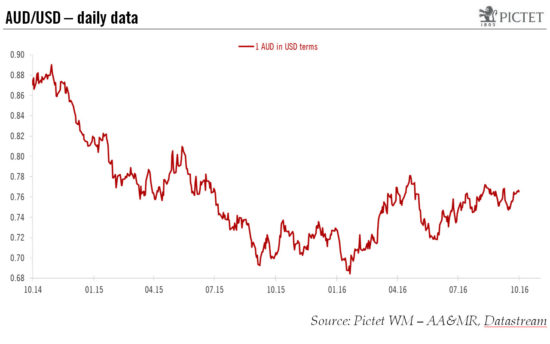

The AUD has recently been moving in a range of roughly USD0.745-USD0.775, but given the factors outlined, we believe it could move towards USD0.70 in 2017.