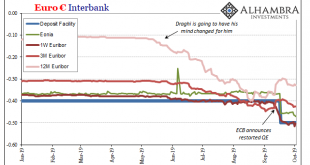

Europe’s QE, as noted this weekend, is off to a very rough start. In the bond market and in inflation expectations, the much-ballyhooed relaunch of “accommodation” is conspicuously absent. There was a minor back up in yields between when the ECB signaled its intentions back in August and the few weeks immediately following the actual announcement. Other than that, and that wasn’t much, you wouldn’t have known QE is already back on the table. It barely registered,...

Read More »FX Daily, June 22: Markets Consolidate as Table is Set for Referendum

There is a nervous calm in the capital markets today. The focus is squarely on tomorrow’s UK referendum. Brexit According to a BBC focus group, the leeave camp won the debate 39%-34%. The last polls show a contest that it too close to calls in that the results are within the margin of error. The Financial Times poll of polls has it at 45%-44% in favor of Brexit. However, the betting markets appear to be telling a...

Read More »ECB Policy meeting preview: The central bank may have no choice but to act again by the Spring

We expect the ECB to remain on hold at the 21 January meeting, but the combination of market stress, lower oil prices and renewed concerns about global growth is likely to force the Governing Council to consider easing policy again by the Spring. Two weeks into 2016, six weeks after easing policy at the December meeting, here we are again: the ECB is under pressure to do more. Investors continue to react to a number of related concerns, including the uninterrupted fall in oil prices,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org