The greater the excesses, speculative euphoria and moral hazard, the greater the reversal. A very convenient conviction is rising in the panicked financial netherworld that the Federal Reserve and its fellow dark lords will “save the market” from COVID-19 collapse. They won’t. I already explained why in The Fed Has Created a Monster Bubble It Can No Longer Control (February 16, 2020) but it bears repeating. Contrary to naive expectations, the Fed’s primary job isn’t...

Read More »Central Banking since the 2008 Financial Crisis

This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in late 2020. In chapter 5 we reviewed the textbook analysis of how a central bank buys government debt in “open market operations” to add reserves to the banking system, with which commercial banks can then advance loans to their own customers. However, in the wake of the financial crisis of 2008, the Federal Reserve and other central banks...

Read More »Mises and the “New Economics”

[This article is excerpted from a talk delivered on February 22, 2020 at the Austrian Student Scholars Conference, hosted by Grove City College in Pennsylvania.] I. Introduction What a wonderful gathering of students today, on this impressive and beautiful campus. We can see why Hans Sennholz loved this place, and why Drs. Herbener and Ritenour so enjoy living and teaching here. You are all too young to serve as the “remnant,” so we will consider you the vanguard...

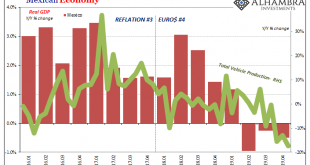

Read More »Economy: Curved Again

Earlier today, Mexico’s Instituto Nacional de Estadística y Geografía (INEGI) confirmed the country’s economy is in recession. Updating its estimate for Q4 GDP, year-over-year output declined by 0.5% rather than -0.3% as first thought. On a quarterly basis, GDP was down for the second consecutive quarter which mainstream convention treats as a technical recession. On a yearly basis, it was actually the third straight. Nothing seems to have changed as 2019 drew to...

Read More »Jeff Snider Show Reel 2020

Show Reel featuring the work of Jeff Snider.

Read More »Start of a Virus: Time to Buy Stocks?

Historically the first two months of a new global virus have been a good opportunity to buy stocks. Markets behave a bit like in a small recession. But recessions is the moment when stock investors make money. Long-Term Profits Decide One should still remember that even if short-term profits decline,only the expected long-term profits finally decide about share prices. And there the virus does not have an influence. Virus Symptoms and Symptoms of Declining...

Read More »All-Stars #94 Jeff Snider: The slowdown started before the Coronavirus hit the tape!

Please visit our website https://www.macrovoices.com to register your free account to gain access to supporting materials. Jeff Snider Chartbook: http://bit.ly/2T1IZbB

Read More »FX Daily, February 26: Dramatic Investor Adjustment Continues

Swiss Franc The Euro has fallen by 0.16% to 1.0601 EUR/CHF and USD/CHF, February 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The warning by the US Center for Disease Control and Prevention that Americans should prepare for an outbreak of Covid-19 sent the S&P 500 tumbling to an 11-week low and the 10-year Treasury yield to a record low near 1.30%. The volatility of the S&P (VIX) jumped to its...

Read More »Should rail commuter data be monetised through advertising?

Federal Railways has the personal data of some 3.7 million commuters. (SRF-SWI) Swiss Federal Railways is coming under fire for using the personal data of commuters for advertising purposes. The data commissioner and a watchdog group have sounded the alarm bell as the volume of data being harnessed grows. Thanks to the increasing digitisation of its services, the Federal Railways now has customer names, addresses, age, sex, telephone numbers, photos, details of trips...

Read More »USD/CHF registers four-day losing streak as coronavirus keeps risk-tone heavy

USD/CHF holds onto losses amid fears of coronavirus outbreak. Soft coronavirus statistics from China fail to counter widespread disease data from the rest of the globe. China’s ability to meet phase-one deal terms seem to gain a little appreciation among traders. The US New Home Sales, Swiss ZEW Survey can offer intermediate moves. USD/CHF flashes 0.03% loss while trading around 0.9760 during early Wednesday. In doing so, the quote declines for the fourth day in a...

Read More » SNB & CHF

SNB & CHF