Tiny landlocked Switzerland is a big player in the commodity trading business. The country's involvement in this industry can be traced back to the 15th century, when its ideal central location had merchants from all over Europe meeting on its city square to exchange goods. Today, commodities are shipped around the world in huge container ships, and the trading mostly happens in climatised offices, far away from the mines and ports. Giants such as Glencore, Vitol and Trafigura have their...

Read More »ISM’s Nasty Little Surprise Isn’t Actually A Surprise

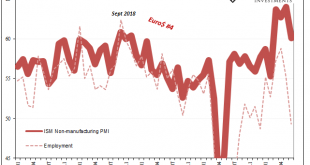

Completing the monthly cycle, the ISM released its estimates for non-manufacturing in the US during the month of June 2021. The headline index dropped nearly four points, more than expected. From 64.0 in May, at 60.1 while still quite high it’s the implication of being the lowest in four months which got so much attention. Consistent with IHS Markit’s estimates as well as the ISM’s Manufacturing PMI released last week, there are growing (confirmed) concerns that...

Read More »Nearly 40% have Long Covid after 7 months, finds Swiss study

The longer term effects of Covid-19 can take many forms and there are numerous definitions of the disease. A study undertaken by HUG and UNIGE in Geneva, published on 6 July 2021, found that 39% of a group of Covid-19 patients still had symptoms after 7 months. © Wavebreakmedia Ltd | Dreamstime.com Of the 629 participants in the study who completed the interviews, 410 completed the follow-up at 7 to 9 months after a COVID-19 diagnosis in early 2020. Of this group,...

Read More »Weekly Market Pulse (VIDEO)

[embedded content] Weekly Market Pulse interview with Joe Calhoun. [embedded content] You Might Also Like SNB Sight Deposits: Inflation Fear Decreasing, SNB Selling Euros 2021-07-05 Sight Deposits have fallen: The change is -0.5 bn. compared to last week, this means the SNB is selling euros and dollars. Weekly Market Pulse (VIDEO) 2021-06-22 Weekly Market Pulse...

Read More »FX Daily, July 06: Greenback Shows Some Resilency after Follow-Through Selling Dried up

Swiss Franc The Euro has fallen by 0.13% to 1.0921 EUR/CHF and USD/CHF, July 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Follow-through dollar selling stalled as key levels were approached, including $1.19 in the euro, $1.3900 in sterling, $0.7600 in the Australian dollar, and CAD1.2300. Sentiment is mixed after the greenback sold-off before last weekend despite the fastest jobs growth in 10-months....

Read More »A Few Things About Reinforced Concrete High-Rise Condos

There is a downside to steel reinforcing bars: they rust. The second most remarkable thing about the sudden collapse of the Florida condo building was the rush to assure everyone that this was a one-off catastrophe: all the factors fingered as causes were unique to this building, the implication being all other high-rise reinforced concrete condos without the exact same mix of causal factors were not in danger. Before we accept this conveniently feel-good conclusion,...

Read More »Swiss social spending up nearly 60 percent in 20 years

In 1999, social expenditure in Switzerland was CHF 13,370 per resident. By 2019, the same figure had reached CHF 21,300, a rise of nearly 60%. © Alexey Stiop | Dreamstime.com Over the same period, total inflation was around 11%. Applying inflation to CHF 13,370 brings the figure to CHF 14,480. Why has the cost risen beyond this and how has the extra spending been funded? One of the key drivers behind the rise in social expenditure is increased spending on pensions as...

Read More »Covid: Swiss Government sets out Autumn Scenarios and Measures

On 30 June 2021, Switzerland’s Federal Council discussed ways of preparing Switzerland for the autumn and winter months and a possible renewed rise in the number of coronavirus cases. © Silviu Matei | Dreamstime.com From the meeting ministers produced a report setting out various scenarios and response plans. The key elements are rapid identification of new variants of concern, continued progress with vaccination and a focus on ensuring sufficient capacity for...

Read More »Experts Said Ending Lockdowns Would Be Worse for the Economy than the Lockdowns Themselves. They Were Wrong.

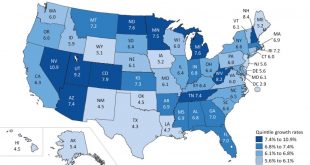

Here’s something we often heard in 2020 from experts who wanted long and draconian covid lockdowns: “Yes, these say-at-home orders are causing economic turmoil, but if you don’t lock everyone down now—and keep them locked down for a long time—your economy will be even worse off!” The reasoning was that without lockdowns, the covid-19 virus would spread out of control and that as a result, so many people would die—or become so ill—that virtually everyone would become...

Read More »Swiss to keep Sipping from Single-Use Plastics as EU Ban takes Effect

Forbidden fruit: the paper straws are OK, but the plastic cup is banned in much of Europe Westend61 / Maria Elena Pueyo Ruiz Single-use plastic items like straws and cups are no longer allowed in the 27 European Union countries. This isn’t the case in non-member Switzerland, where retailers and restaurants are taking their own approach. The EU ban on certain plastic products took effect on July 3 and covers a range of everyday items from food packaging to wet wipes....

Read More » SNB & CHF

SNB & CHF